1. What is the primary purpose of taxation? 2. What are the secondary purposes of taxation and briefly explain each? 3. What are the principles of a sound tax system? Briefly explain each.

1. What is the primary purpose of taxation? 2. What are the secondary purposes of taxation and briefly explain each? 3. What are the principles of a sound tax system? Briefly explain each.

Chapter8: Consolidated Tax Returns

Section: Chapter Questions

Problem 3DQ

Related questions

Question

Pls answer number 1-10

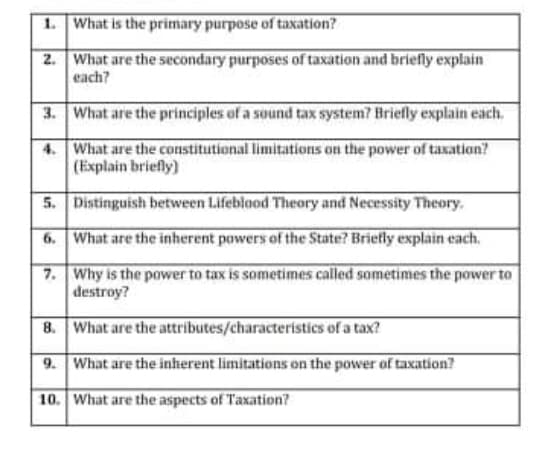

Transcribed Image Text:1. What is the primary purpose of taxation?

2. What are the secondary purposes of taxation and briefly explain

each?

3. What are the priinciples of a sound tax system? Briefly explain each.

4. What are the constitutional limitations on the power of taxation?

(Explain briefly)

5. Distinguish between Lifeblood Theory and Necessity Theory,

6. What are the inherent powers of the State? Briefly explain each.

7. Why is the power to tax is sometimes called sometimes the power to

destroy?

8. What are the attributes/characteristics of a tax?

9. What are the inherent limitations on the power of taxation?

10. What are the aspects of Taxation?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT