QUESTION 8. For a recent year L'Oreal reported operating profit of $3,110 (in millions) for its Cosmetics division. Total assets were $11,314 at the beginning of the year and $12,988 (in millions) at the end of the year. Required: Compute return on investment (ROI) for the year. State your answer as a percent.

QUESTION 8. For a recent year L'Oreal reported operating profit of $3,110 (in millions) for its Cosmetics division. Total assets were $11,314 at the beginning of the year and $12,988 (in millions) at the end of the year. Required: Compute return on investment (ROI) for the year. State your answer as a percent.

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter7: Employee Earnings And Deductions

Section: Chapter Questions

Problem 1E

Related questions

Question

Help me do excercise 8. Thanks you

Transcribed Image Text:Doment s

Reion

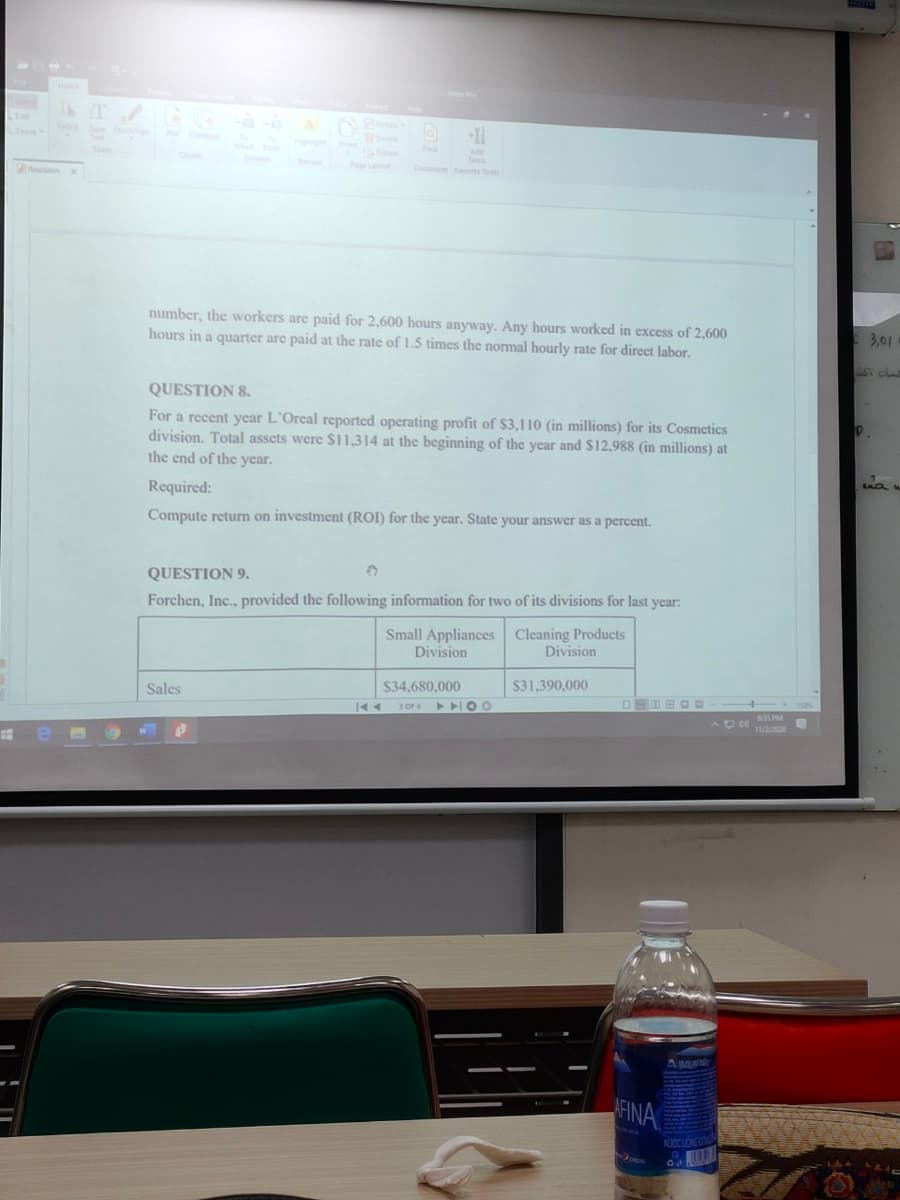

number, the workers are paid for 2,600 hours anyway. Any hours worked in excess of 2,600

hours in a quarter are paid at the rate of 1.5 times the normal hourly rate for direct labor.

3,01

QUESTION 8.

For a recent year L'Oreal reported operating profit of $3,110 (in millions) for its Cosmetics

division. Total assets were $11,314 at the beginning of the year and $12,988 (in millions) at

the end of the year.

Required:

Compute return on investment (ROI) for the year. State your answer as a percent.

QUESTION 9.

Forchen, Inc., provided the following information for two of its divisions for last year:

Small Appliances Cleaning Products

Division

Division

$34,680,000

$31,390,000

Sales

口回四田ロロ

Oe SPM

FINA

pos

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub