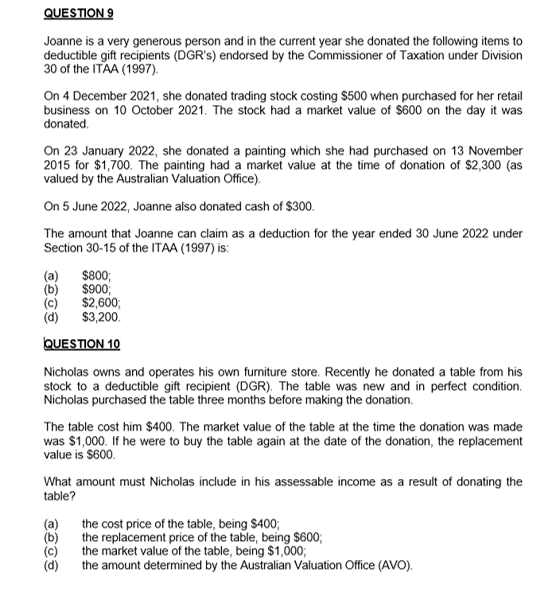

QUESTION 9 Joanne is a very generous person and in the current year she donated the following items to deductible gift recipients (DGR's) endorsed by the Commissioner of Taxation under Division 30 of the ITAA (1997). On 4 December 2021, she donated trading stock costing $500 when purchased for her retail business on 10 October 2021. The stock had a market value of $600 on the day it was donated. On 23 January 2022, she donated a painting which she had purchased on 13 November 2015 for $1,700. The painting had a market value at the time of donation of $2,300 (as valued by the Australian Valuation Office). On 5 June 2022, Joanne also donated cash of $300. The amount that Joanne can claim as a deduction for the year ended 30 June 2022 under Section 30-15 of the ITAA (1997) is: (a) (b) $800; $900; (c) $2,600; (d) $3,200.

QUESTION 9 Joanne is a very generous person and in the current year she donated the following items to deductible gift recipients (DGR's) endorsed by the Commissioner of Taxation under Division 30 of the ITAA (1997). On 4 December 2021, she donated trading stock costing $500 when purchased for her retail business on 10 October 2021. The stock had a market value of $600 on the day it was donated. On 23 January 2022, she donated a painting which she had purchased on 13 November 2015 for $1,700. The painting had a market value at the time of donation of $2,300 (as valued by the Australian Valuation Office). On 5 June 2022, Joanne also donated cash of $300. The amount that Joanne can claim as a deduction for the year ended 30 June 2022 under Section 30-15 of the ITAA (1997) is: (a) (b) $800; $900; (c) $2,600; (d) $3,200.

Chapter5: Deductions For And From Agi

Section: Chapter Questions

Problem 28P

Related questions

Question

Transcribed Image Text:QUESTION 9

Joanne is a very generous person and in the current year she donated the following items to

deductible gift recipients (DGR's) endorsed by the Commissioner of Taxation under Division

30 of the ITAA (1997).

On 4 December 2021, she donated trading stock costing $500 when purchased for her retail

business on 10 October 2021. The stock had a market value of $600 on the day it was

donated.

On 23 January 2022, she donated a painting which she had purchased on 13 November

2015 for $1,700. The painting had a market value at the time of donation of $2,300 (as

valued by the Australian Valuation Office).

On 5 June 2022, Joanne also donated cash of $300.

The amount that Joanne can claim as a deduction for the year ended 30 June 2022 under

Section 30-15 of the ITAA (1997) is:

(a) $800;

(b)

$900;

(c)

$2,600;

(d) $3,200.

QUESTION 10

Nicholas owns and operates his own furniture store. Recently he donated a table from his

stock to a deductible gift recipient (DGR). The table was new and in perfect condition.

Nicholas purchased the table three months before making the donation.

The table cost him $400. The market value of the table at the time the donation was made

was $1,000. If he were to buy the table again at the date of the donation, the replacement

value is $600.

What amount must Nicholas include in his assessable income as a result of donating the

table?

(b)

the cost price of the table, being $400;

the replacement price of the table, being $600;

the market value of the table, being $1,000;

the amount determined by the Australian Valuation Office (AVO).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT