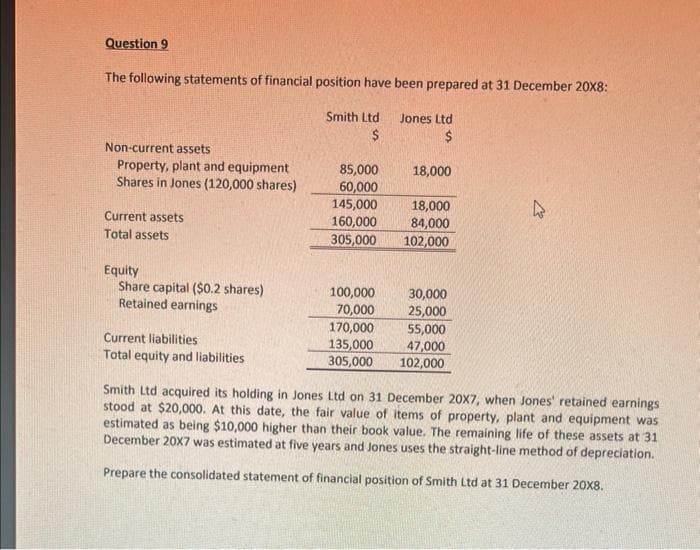

Question 9 The following statements of financial position have been prepared at 31 December 2008: Smith Ltd Jones Ltd $ $ Non-current assets Property, plant and equipment Shares in Jones (120,000 shares) Current assets Total assets Equity Share capital ($0.2 shares) Retained earnings Current liabilities Total equity and liabilities 85,000 60,000 145,000 160,000 305,000 100,000 70,000 170,000 135,000 305,000 18,000 18,000 84,000 102,000 30,000 25,000 55,000 47,000 102,000 4 Smith Ltd acquired its holding in Jones Ltd on 31 December 20X7, when Jones' retained earnings stood at $20,000. At this date, the fair value of items of property, plant and equipment was estimated as being $10,000 higher than their book value. The remaining life of these assets at 31 December 20X7 was estimated at five years and Jones uses the straight-line method of depreciation. Prepare the consolidated statement of financial position of Smith Ltd at 31 December 20x8.

Question 9 The following statements of financial position have been prepared at 31 December 2008: Smith Ltd Jones Ltd $ $ Non-current assets Property, plant and equipment Shares in Jones (120,000 shares) Current assets Total assets Equity Share capital ($0.2 shares) Retained earnings Current liabilities Total equity and liabilities 85,000 60,000 145,000 160,000 305,000 100,000 70,000 170,000 135,000 305,000 18,000 18,000 84,000 102,000 30,000 25,000 55,000 47,000 102,000 4 Smith Ltd acquired its holding in Jones Ltd on 31 December 20X7, when Jones' retained earnings stood at $20,000. At this date, the fair value of items of property, plant and equipment was estimated as being $10,000 higher than their book value. The remaining life of these assets at 31 December 20X7 was estimated at five years and Jones uses the straight-line method of depreciation. Prepare the consolidated statement of financial position of Smith Ltd at 31 December 20x8.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 23E

Related questions

Question

Transcribed Image Text:Question 9

The following statements of financial position have been prepared at 31 December 20X8:

Smith Ltd

$

Non-current assets

Property, plant and equipment

Shares in Jones (120,000 shares)

Current assets

Total assets

Equity

Share capital ($0.2 shares)

Retained earnings

Current liabilities

Total equity and liabilities

85,000

60,000

145,000

160,000

305,000

100,000

70,000

170,000

135,000

305,000

Jones Ltd

$

18,000

18,000

84,000

102,000

30,000

25,000

55,000

47,000

102,000

4

Smith Ltd acquired its holding in Jones Ltd on 31 December 20X7, when Jones' retained earnings

stood at $20,000. At this date, the fair value of items of property, plant and equipment was

estimated as being $10,000 higher than their book value. The remaining life of these assets at 31

December 20X7 was estimated at five years and Jones uses the straight-line method of depreciation.

Prepare the consolidated statement of financial position of Smith Ltd at 31 December 20X8.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning