Question: Assume a Watercrest Sports outlet store began October 2020 with 47 pairs of water skis that cost the store $38 each. The sale price of these water skis was $67. During October, the store completed these inventory transactions: 2. Determine the store’s cost of goods sold for October. Also compute gross profit for October.

Question: Assume a Watercrest Sports outlet store began October 2020 with 47 pairs of water skis that cost the store $38 each. The sale price of these water skis was $67. During October, the store completed these inventory transactions: 2. Determine the store’s cost of goods sold for October. Also compute gross profit for October.

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter9: Accounting For Purchases And Cash Payments

Section9.4: Accounting For Cash Payments

Problem 4AYU

Related questions

Question

100%

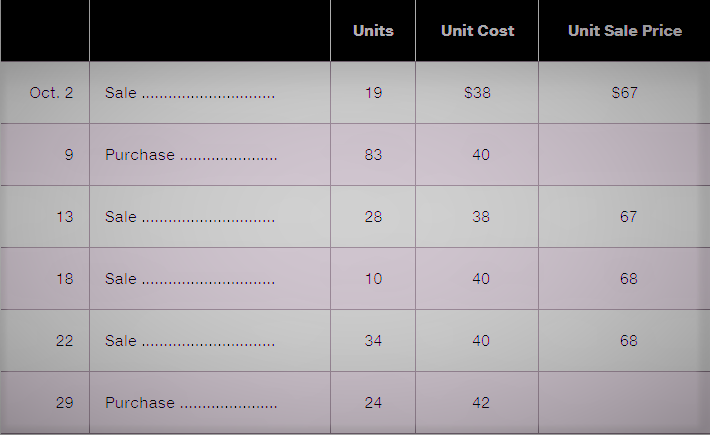

Question: Assume a Watercrest Sports outlet store began October 2020 with 47 pairs of water skis that cost the store $38 each. The sale price of these water skis was $67. During October, the store completed these inventory transactions:

2. Determine the store’s cost of goods sold for October. Also compute gross profit for October.

For the part, Sales [(47 units x $67)+(44 units x $68)] = $6,141 I don't understand what is in bolded, please explain where you get the numbers incuding the ones in dollars please.

Transcribed Image Text:Units

Unit Cost

Unit Sale Price

Oct. 2

Sale

19

$38

S67

Purchase

83

40

.........

13

Sale

28

38

67

18

Sale

10

40

68

22

Sale

34

40

68

29

Purchase

24

42

....................

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning