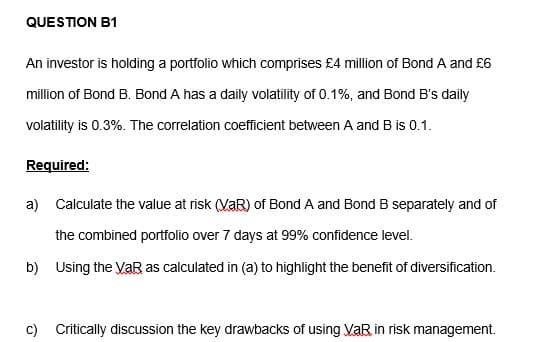

QUESTION B1 An investor is holding a portfolio which comprises £4 million of Bond A and £6 million of Bond B. Bond A has a daily volatility of 0.1%, and Bond B's daily volatility is 0.3%. The correlation coefficient between A and B is 0.1. Required: a) Calculate the value at risk (VaR) of Bond A and Bond B separately and of the combined portfolio over 7 days at 99% confidence level. b) Using the VaR as calculated in (a) to highlight the benefit of diversification.

Q: mind map’

A: The preparation and use of the most important requirements and equipment to protect passengers and…

Q: Income Statement for the year ended December 31, 2021 Net sales $65,117 Gain on disposal of fixed…

A: A statement of cash flows is prepared to know the cash inflows and cash outflows of the company…

Q: On October 31, Year 1, Trailer Homes Company (THC) determines that it will need to buy 175,000 lbs…

A: With the strike price (X) and the market spot price (S) at forward date when trading take place. Net…

Q: True/false An option is a financial contract that gives the owner the right to buy or sell some…

A:

Q: The amount a person would have to deposit today (present value) at a 5 percent interest rate to have…

A: Information Provided: Interest rate = 5% Future value = $1000 Period of deposit = 5 years

Q: The manufacture of folic acid is a competitive business. A new plant costs $100,000 and lasts for…

A: The company evaluates the projects based on cost and benefits. When a company has several options…

Q: ETM Co is considering investing in machinery costing K150,000 payable at the start of first year.…

A: NPV It is a capital budgeting tool. As per NPV rule, the project should be accepted by the company…

Q: In order to accumulate enough money for a down payment on a house, a couple deposits $551 per month…

A: Given, Amount of deposit is $551 every month Interest rate is 3% compounded monthly Term is 5 years

Q: Caleb Clark Ventures invests $2 million in convertible preferred stock in a company with an $8…

A: The preferred stock is a hybrid of equity and debt instrument that provides the holder with…

Q: How many months does it take to pay off the card, and what is the total amount paid including…

A: APR is the annual interest rate. It's like the annual fee for your borrowing. exist In other words,…

Q: Make three observations in each section - Assets, Liabilities and Net Worth, and Selected Financial…

A: Observations are used to bring significant issues to the attention of audit managers. While…

Q: Find the present worth of a future payment of P200,000 to be made in 15 years with an interest of…

A: Future worth of a present value With present worth (PW), effective annual rate (r) and time (n), the…

Q: OPTIMAL CAPITAL STRUCTURE Terrell Trucking Company is in the process of setting its target capital…

A: Optimal capital structure is referred to as that perfect mix of debt and equity that maximizes a…

Q: Suppose that the price of an asset equals its fundamental value. What behavioral features might then…

A:

Q: Determine if a fixed or a floating debt rate should be used during a recession.

A: A fixed debt rate is the interest rate that remains the same over the lifetime of the debt…

Q: Find the future value of the following annuity due. Payments of $900 for 2 years at 4% compounded…

A: Annuity Due Periodic Payment = 900 N = 2 Nominal Rate of return = 4% Compounding periods = 2

Q: What is the expected capital gains yield for each bond? What is the expected total return for each…

A: Given: Particulars Amount Coupon rate 9% Face value(FV) $1,000 Years 8 Current value(PV)…

Q: Gabby's Garage issued a bond with a 10-year maturity, a $1,000 par value, a 10 percent coupon rate,…

A: The coupon rate is the interest rate of a bond that is used to determine the interest payment, the…

Q: An offering of shares to institutional investors at a discount to the current market price is known…

A: There are several ways in which a company can raise its equity capital funding. All the ways involve…

Q: 2-7 SCENARIO ANALYSIS Huang Industries is considering a proposed project whose estimated NPV is $12…

A: As per the given information: Economic Scenario Probability of Outcome NPV Recession 0.05 ($70…

Q: 1. What is the future worth of a series of equal yearly deposits of Php 100,000 for 8 years in a…

A:

Q: [Determination of Selling Price] Question 18: The following data are obtained from the records of a…

A: I solved four parts in step 2 As per bartleby guidelines we are allowed 3 parts only I answered…

Q: A new antitheft system incorporating MEMS technology is being separately evaluated economically by…

A: Initial Investment $ 85,000.00 MARR 8% Time Period Years 6 Salvage Value $…

Q: 5. Find the present worth of a future payment of 100,000 to be made in 10 years with an interest of…

A: The present value: The value of a sum of money to be received or paid at some point time in the…

Q: With an annual inflation rate of 1.57%, how much did an item that now costs $5700 cost 4 years…

A: Inflation rate is 1.57% Current Cost of Item is $5700 Time period is 4 years To Find: Cost of an…

Q: what is the value of $100

A: The future value of money is determined by compounding the original amount with interest. It…

Q: PLEASE DO THE SOLUTIONS MANUALLY. NOT THRU EXCEL.

A: NPV=[Cash Flow/(1+i)^t]-initial investment i=discount rate t=number of time periods

Q: 4. Thom J.A.M. Company has P80,000 to invest and is considering two different projects, Vlogging and…

A: The company evaluates two alternatives by comparing the net present value of projects. The company…

Q: Given the following information: Exchange rate - Canadian dollar 0.665 per DM (spot) 1 Canadian…

A: Arbitrage is a strategy that uses the difference in the price of the same commodity in different…

Q: Determine the Cost of Capital (k) Using NPV and IRR method, give your recommendation if the company…

A: Net Present Value: It is a method of capital budgeting used by project managers to measure a…

Q: Under your six-year savings plan, you deposit P1,000 now and P1,000 at the end of the fourth year,…

A: Future value is a value of an investment or asset on a specific date in the future. Compound…

Q: Find the compound amount and the amount of interest earned by the following deposit. $4,000 at 7.87%…

A: An interest is referred as an amount from the borrower or the deposit taking banks or the financial…

Q: What does Working Capital Mean?

A: The excess of Current Assets over Current Liabilities is known as Working Capital current assets…

Q: Barry has an annual salary of $85,000 and he plans on working He is concerned that should he die…

A: Present value of annuity Annuity is a series of equal payment at equal interval over a specified…

Q: 1. A FICO score: A. Is a common credit rating system B. Is only issued through banks C. Is a type…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: The following information is extracted from Pinnacle Bank's balance sheet (all numbers are in…

A: Liquidity Coverage Ratio The ratio that indicates the ability of a financial institution to keep…

Q: The two main approaches to equity analysis are the relative valuation models and…

A: ANSWER: Option C ;The discounted cash-flow models.

Q: Given the following information: Exchange rate - Canadian dollar 0.665 per DM (spot) Canadian dollar…

A: Final answer Arbitrage profit =can $2.6

Q: The following spot rates are observed in the market t (years) is (%) 1 6.50 2 6.68 3 6.84 4 6.95 5…

A: An interest rate swap is a derivative where two parties agree to exchange the net of interest…

Q: 3.1 REQUIRED Calculate the following for both projects from the information provided below: 3.1.1…

A: Payback period The time that a project undertakes to recover the funds invested in a project is…

Q: A newborn child receives a $9,000 gift toward a college education from her grandparents. How much…

A: As per the given information: Principal amount or amount of money deposited (P) - $9,000 Time period…

Q: Mosaic is evaluating a manufacturing plant that has the potential to generate revenue of $2 million…

A: The value of the firm can be determined on the basis of expected cash flows. The expected cash flows…

Q: j. Find the PV and the FV of an investment that makes the following end-of-year payments. The…

A: Information provided: Interest rate = 10% Year 1 Payment = $100 Year 2 Payment = $300 Year 3…

Q: You deposit $10,000 into an investment account. You believe that you can reasonably expect a…

A: A future value formula can be used to calculate the value of investment (FV) after 30 years. The…

Q: why is ESG important for genera

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: An industrial organization studying the relative desirability of two diesel engines proposed for…

A: Relative Desirability : Based on the quantity of investment in one asset in an organization, how…

Q: The Australian Financial System consists of the following 3 components: Select one: a.…

A: A financial system can be defined as that system in a country which facilitates the exchange of…

Q: . [Put-Call Parity Condition] At date t, there is a European call option on the dollar with a strike…

A: Put call parity With call price (c), put price (p), stock price (s), exercise price (k), risk free…

Q: What will be the accumulated amount in an investment account

A: As per the concept of the Time value of money, today’s money value has more valuable than tomorrow.…

Q: Q1- What is a probability impact matrix? Q2- how to make a risk assessment matrix? Q3- how to use…

A: Probability impact matrix is 2 dimensional graphic risk assessment tool based on chances on…

Step by step

Solved in 6 steps with 2 images

- Question 3: You are an active investor in the securities market and you have established an investment portfolio of two stock A and B five years ago. Required: a) If your portfolio has provided you with returns of 9.7%, -6.2%, 12.1%, 11.5% and 13.3% over the past five years, respectively. Calculate the geometric average return of the portfolio for this period?b) AssumethatexpectedreturnofthestockAinyourportfoliois14.6%.The risk premium on the stocks of the same industry are 5.8%, the risk-free rate of return is 5.9% and the inflation rate was 2.7. Calculate beta of this stock using Capital Asset Pricing Model (CAPM)? D) Assume that the following data available for the portfolio, calculate the expected return, variance and standard deviation of the portfolio given stock A accounts for 45% and stock B accounts for 55% of your portfolio?AB 12.5% 18.5%Expected returnStandard Deviation of return Correlation of coefficient (p) 0.415% 20%Question 4 You are a financial investor who actively buys and sells in the securities market. Now you have a portfolio, including four shares: $7,500 of Share A, $4,800 of Share B, $5,700 of Share C, and $2,500 of Share D. Required: A)Compute the weights of the assets in your portfolio? B)If your portfolio has provided you with returns of 7.7%, 10.5%, - 8.7% and 14.2% over the past four years, respectively. Calculate the geometric average return of the portfolio for this period? C)Assume that expected return of the stock A in your portfolio is 13.2%. The risk premium on the stocks of the same industry are 6.8%, beta of this stock is 1.3. Calculate the risk-free rate of return using Capital market pricing model (CAPM). ? D)You have another portfolio that comprises of two shares only: $500 Tesla shares and $700 Eagle shares. Below is the data of your portfolio: Tesla Eagle Expected…A portfolio consists of two bonds. The probability of joint default of the two bonds is 1.27%, and the default correlation is 30%. The bond value, default probability, and recovery rate are USD 1,000,000,3%, and 60% for one bond, and USD 600,000,5%, and 40% for the other. Q1: What is the expected credit loss (ECL) of the portfolio? Q2: What is the best estimate of the unexpected credit loss (away from the ECL) at a confidence level of 98% over a one-year horizon for this portfolio?

- Quantitative Problem: You are holding a portfolio with the following investments and betas: Stock Dollar investment Beta A $300,000 1.2 B 200,000 1.6 C 400,000 0.75 D 100,000 -0.35 Total investment $1,000,000 The market's required return is 11% and the risk-free rate is 4%. What is the portfolio's required return? Do not round intermediate calculations. Round your answer to three decimal places.D4) Finance Consider a portfolio composed of shares AAA and BBB as shown in the following table. At 95% confidence level, select the correct statement AAA BBB Value 2,470,000 785,750 % investment 76% 24% Volatilities 2.32 % 2.69 % Correlation for both assets 0.65 Portfolio Value for both assets 3,255,750 a) The Component VaR of the Asset AAA is 92,223 and the component VaR of the Asset BBB is 27955.69 b) The contribution to the VaR of the Asset AAA is 77% and the one of the Asset 2 is 23% c) Both answers are correctQUESTION 7 An investor wishes to construct a portfolio consisting of a 70 percent allocation to a stock index and a 30 percent allocation to a risk-free asset. The return on the risk-free asset is 4.5 percent, and the expected return on the stock index is 12 percent. Calculate the expected return on the portfolio. a. 16.50 percent b. 17.50 percent c. 14.38 percent d. 9.75 percent e. 8.25 percent

- Quantitative Problem: You are holding a portfolio with the following investments and betas: Stock Dollar investment Beta A $300,000 1.3 B 200,000 1.6 C 500,000 0.75 D 0 -0.15 Total investment 1,000,000 The market's required return is 11% and the risk-free rate is 3%. What is the portfolio's required return? Round your answer to 3 decimal places. Do not round intermediate calculations.%Question 4 You are an experienced investor in the securities market and you have established an investment portfolio of two blue chips five years ago: Diamond shares with current market value of $235,000 and Platinum shares with current market value of $355,000. Required: a) If your portfolio has provided you with returns of 10.5%, 12.6%, - 11.5%, 14.5% and 15.2% over the past five years, respectively. Calculate geometric average return of the portfolio for this period. b) Assume that data in the table below is available for your portfolio performance, calculate the expected return, variance and standard deviation of the portfolio? Diamond Platinum Expected return 16.5% 23.5% Standard Deviation of return 7% 11% Correlation of coefficient (p) 0.45 c) Assume that beta of the Diamond shares in your portfolio is 1.5. The market portfolio expected…You invest $1,028 portfolio holding a risky asset and a Treasury bill. You expect the portfolio to reach a value of $1,105 in 1 year. Expected Return of Risky Asset: 27% Standard Deviation of Risky Assets: 11% Expected Return of Treasury Bill: 3% This is only possible if the weight of the risky asset is ____________________________. *Please round to the nearest two decimals. *Please state your answer as percentage and not as decimal (i.e. 40 and not 0.40) *Please do not use the symbol %

- Question 3 Peter is a financial investor who actively buys and sells in the securities market. Peter has a portfolio which provided the returns of 13.7%, 10.5%, - 11.7%, 25.5% and 19.2% over the past five years, respectively. Required: Calculate the arithmetic and geometric average returns of Peter’s portfolio for this five-year period. Assume that the expected return of the share A in Peter’s portfolio is 15.4%. The market risk premium is 6.8%, Government Bond rate of return is 7.2%. Calculate the beta co-efficient of this share using the Capital Asset Pricing Model (CAPM). Peter has just set up another portfolio that comprises of two shares only: $3,500 Blue shares and $4,700 Red shares. Below is the data of this portfolio: Blue Red Expected return 17% 23% Standard Deviation of return 22% 39% Correlation of coefficient (p) - 0.45…QUESTION 10 An investor wishes to construct a portfolio by borrowing 35 percent of his original wealth and investing all the money in a stock index. The return on the risk-free asset is 4.0 percent, and the expected return on the stock index is 15 percent. Calculate the expected return on the portfolio. a. 9.50 percent b. 18.25 percent c. 11.15 percent d. 15.00 percent e. 18.85 percent2. Mr. Morgan is planning to invest £20m in one of two following portfolios. Both portfolios consist of four securities from various industries. The correlation between the returns of the individual securities is thought to be close to zero. Portfolio A investments Equity beta Expected return (%) Amount invested (£m) 1 1.6 18 4 2 0.2 5 6 3 0.6 7 7 4 1 10 3 Portfolio B investments Equity beta Expected return (%) Amount invested (£m) 1 1.4 11 3 2 0.8 10 5 3 0 4.5 7 4 0.4 6 5 QUESTION: (a) Mr. Morgan decides to use the capital asset pricing model (CAPM) to compare the portfolios. The current market return is estimated to be 10 per cent and the rate on Treasury bills is 4.5 per cent. Using the information provided, recommend which one should be selected.