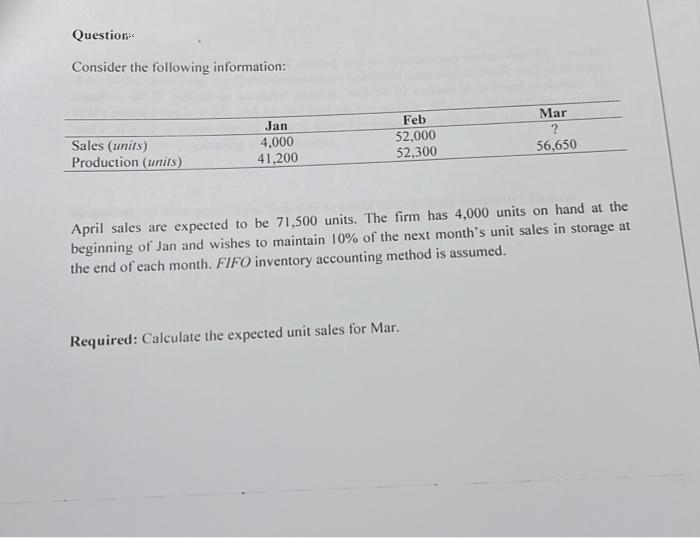

Question Consider the following information: Jan Feb Mar Sales (units) Production (units) 52,000 4,000 41,200 52,300 56,650 April sales are expected to be 71,500 units. The firm has 4,000 units on hand at the beginning of Jan and wishes to maintain 10% of the next month's unit sales in storage at the end of each month. FIFO inventory accounting method is assumed. Required: Calculate the expected unit sales for Mar.

Question Consider the following information: Jan Feb Mar Sales (units) Production (units) 52,000 4,000 41,200 52,300 56,650 April sales are expected to be 71,500 units. The firm has 4,000 units on hand at the beginning of Jan and wishes to maintain 10% of the next month's unit sales in storage at the end of each month. FIFO inventory accounting method is assumed. Required: Calculate the expected unit sales for Mar.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 16E: Dollar-Value LIFO A company adopted the LIFO method when its inventory was 1,800. One year later its...

Related questions

Question

7

Transcribed Image Text:Question

Consider the following information:

Mar

Feb

52,000

52,300

Jan

Sales (units)

Production (units)

4,000

41,200

56,650

April sales are expected to be 71,500 units. The firm has 4,000 units on hand at the

beginning of Jan and wishes to maintain 10% of the next month's unit sales in storage at

the end of each month. FIFO inventory accounting method is assumed.

Required: Calculate the expected unit sales for Mar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT