Question: Do you think there is an ideal mix of debt and equity across corporations? Elaborate your answer.

Q: The following data pertain to Dakota Division's most recent year of operations. Income $ 16,000,000 ...

A: Income = $16,000,000 Average invested capital = $185,000,000 Return on invested capital = 14%

Q: Golden Gate Construction Associates, a real estate developer and building contractor in San Francisc...

A: EVA as a residual income measure of financial performance is simply the operating profit after tax ...

Q: Bramble Inc. reports the following incomes (losses) for both book and tax purposes (assume the carry...

A: Income before tax means the earnings from which the tax is yet to be deducted.

Q: ) On 30th of Sentember 2020 Bobby delivered the October

A: As per standard accounting principles a revenue is recognised not w...

Q: Define the concepts of Dept capacity and Unused debt capacity? and if unused debt capacity was negat...

A: Debt Capacity: In general terms, it is the amount of debt that a business can incur and repay it as ...

Q: Acquisition of Cats Rule: On January 1, 2019, Buddy Dog Food Company acquired Cats Rule Food Company...

A: Consideration paid is the amount of cash or other assets exchanged in the event of one company acqui...

Q: of your answer on the space provided before each item. 1.On finding good strategies A. "Never discou...

A: Match 1. M 2. A 3 F 4 C 5 K 6 D 7 B 8 E 9 H 10 I 11 F 12 G 13 J 14 ...

Q: On August 31, 2022, Firewall Co. licensed its $9,600 application that will protect a customer's comp...

A: Performance obligation is the mandatory actionable on the part of service provider for each service ...

Q: Adams Corporation is considering four averagerisk projects with the following costs and rates of ret...

A: Here given the details of the calculation of weighted average cost of capital which can determine th...

Q: Lady G, has a beauty shop located in SM Cebu. For the year, 2021, Lady’s beauty shop collected P2,5...

A: Accrual basis: Under accrual basis accounting, revenue and expenses are recognized when they are inc...

Q: On February 20, 2022, ABC Construction Company entered into a fixed-price contract to construct a co...

A: Calculation of total Amount of Contract Costs charged to Profit and Loss in 2022::: Total Estimated ...

Q: Required information [The following information applies to the questions displayed below.] Clyde is ...

A: Gross income is the amount of money that represents the earnings of a person.

Q: ADDITIONAL FUNDS NEEDED Morrissey Technologies Inc.’s 2016 financial statements areshown here. Suppo...

A: a)

Q: Required information [The following information applies to the questions displayed below.] Louis fil...

A: A taxpayer is sometimes required to pay taxes in advance which is paid on estimation basis without k...

Q: Require (a): Your business issued a 14%, $300,000, one-year, note payable on April 1, 20x1. Both the...

A: Journal entries are the backbone of financial accounting and book keeping and are the primary entrie...

Q: Susan Wilson earned a salary of $440 for the last week of October. She will be paid on November 1. T...

A: Adjusting entries are those entries that are prepared at the end of an accounting period to adjust t...

Q: 45.5A Developing Ltd has an authorised capital of 50,000, 10% preference shares of £1 each following...

A: Working notes 1) Developing Ltd. Statement of changes in equity for 2013 Particulars Amount EUR A...

Q: Required: 1. Use appropriate Excel formulas to perform vertical analysis and complete the "Percent" ...

A: Vertical analysis is done to determine the change in line items with respect to the other line item....

Q: Require (a): Your business issued a 14%, $300,000, one-year, note payable on April 1, 20x1. Both the...

A: Lets understand the basics. Adjusting entry is entry which is passed to make sure that income and ex...

Q: Zachary Lee has a personal automobile policy (PAP) with coverage of $25,000/$50,000 for bodily injur...

A: Bodily injury liability is a liability that occurs when you are at fault in a car accident, medical ...

Q: 4. As production takes place, all manufacturing costs are added to the: a. Work-in-Process Inventory...

A: Lets understand the basics. Work in progress inventory account is a account which shows that, how mu...

Q: On January 1, 2022, AA Company received cash of P1,000,000 and a 4-year, oninterest bearing note to ...

A: Solution Given Life of note 4 years Amount to be collected every year 600000 Effecti...

Q: im Young, M.D., keeps his accounting records on the cash basis. During 2021, Dr. Young collected P46...

A: Calculation of Dr. Young's patient service revenue for 2021 (accrual basis) Cash Collecte...

Q: AA and BB have been partners for a decade. As of January 1, 2022, the capital balances of AA and BB ...

A: Partnership is one of the form of business organisation, under which two or more than two persons in...

Q: Tamarisk Corporation issued 20-year, $10,500,000 face value, 9% convertible debentures on January 1,...

A: The question is based on the concept of Financial Accounting.

Q: Wildhorse Company has accounts receivable of $101,200 at March 31, 2022. Credit terms are 2/10, n/30...

A: Allowance for doubtful accounts is considered as a contra asset account. The bad debts expenses are ...

Q: quivalent Units: Weighted Average Method The following data are for four independent process-costin...

A: Department A Department B Department C Department D Beginning inventory 8,000 6,000 46,000 (...

Q: George and Amal file a joint return in 2019 and have AGI of $39,800. They each make a $1,600 contrib...

A: Answer: George and Amal file joint return AGI= $39,800 Contribution to IRA= $1600 each Saver credit=...

Q: Inflation AdjustmentsThe Rodriguez Company is considering an average-risk investment in amineral wat...

A: Net Present Value=(Present Value of Cash Inflows-Present Value of Cash Outflows)

Q: Problem 1: On January 1, 2020, Pond Co. acquired 40% of the outstanding voting common shares of Ramp...

A: When a company invest in another company, then it has to record some entries in its books of account...

Q: Problem 3. The books of Marikit’s Service, Inc. disclosed a cash balance of P687,570 on December 31,...

A: Bank Reconciliation Statement Cash Book Balance P687,570 Add: a. Check number 748 for P30,000...

Q: The Solomon Company uses a job costing system at its Dover, Delaware plant. The plant has a machinin...

A: Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for yo...

Q: he Moto Hotel opened for business on May 1, 2017. Here is its trial balance before adjustment on May...

A: Solution Working note Adjusted trial balance Debit Credit Cash 2263 Supplies...

Q: Journalize the entry on July 1 and the adjusting entry on December 31 for Wildhorse Co. Wildhorse us...

A: Solution:- Preparation of the entry on July 1 and the adjusting entry on December 31 for Wildhorse C...

Q: AP 21-1 (Turnover Tax vs. GST) You have been appointed tax policy advisor to a country that has neve...

A: Here given the alternatives to implement the taxation into the government sector in Canada by the wa...

Q: noni and nino are partners who share profit or loss in the ration of 6:4 they have capital balance o...

A: Let's understand the basics A partnership is an arrangement between two or more people to oversee bu...

Q: 58. The following information is related to ABC Corporation, which is undergoing liquidation: ...

A: Liquidation of partnership means cessation or end of the partnership, under which all assets are bei...

Q: Colt Company owns a machine that can produce two specialized products. Production time for Product T...

A: Lets understand the basics. When there is any constrain to fulfill the needs of customer then manage...

Q: The December bank statement, which has a beginning balance of P96,800, is reproduced below: Robinson...

A: Thanks for the Question: Bartleby's Guideline “Since you have posted a question with multiple sub-pa...

Q: On January 1, 2022, AA Company sold an equipment costing P5,000,000 and accumulated depreciation of ...

A: INITIAL RECOGNITION AS ON 1 JANUARY,2022 (PART OF WORKING) CASH FLOWS (I) PVF @8% (II) I * II ...

Q: When a partner's capital balance becomes a deficit, O The deficit will be considered as a partnershi...

A: Partners Capital: When we say Partnership Capital, we're referring to the aggregate amount of the Pa...

Q: PROBLEM 7. In your year end audit of A. Bonifacio Corporation, the Cashier showed a cash accountabil...

A: 17. Opening cash accountability P240,000 Less: Disbursements for cost and expense (P15,000,000)...

Q: The Product: The Company’s only product is soft cookies, of which it makes over 50 varieties. Larg...

A: The company's goal is to provide a pristine, no-preservation product while employing all cost-effect...

Q: he business type of this company is food services industry. Give me an analyzation or interpretatio...

A: Finished goods turnover is obtained by dividing cost of goods sold by the average amount of finished...

Q: The following information is available for Ace Company for 2021: Disbursements fo...

A: COGS termed as Cost of goods sold means the cost which is directly related to the producing goods an...

Q: On July 1, 2022, Sandhill Co. pays $23,000 to Blossom Company for a 1-year insurance contract. Both ...

A: In the books of sandbill company

Q: Slies to the questions displayed below.] Illinois Metallurgy Corporation has two divisions. The Fabr...

A: Note: As per general rule, in the case of sufficient capacity available, the minimum transfer price ...

Q: b. Issued 4,000 shares of $80 par preferred 5% stock at $100, receiving cash. Description Debit Cred...

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in...

Q: Problem 6-18 The Nanny Tax (LO 6.7) Ann hires a nanny to watch her two children while she works at a...

A: Calculation of employer and nanny's portion of social, and medicare tax are as follows

Q: Required: 1. Prepare a segmented income statement for Countywide Cable Services, Inc. SEGMENTED INCO...

A: Solution:- Preparation of Income statement as follows under:- Notes:- Contribution margin = Sales - ...

Step by step

Solved in 2 steps

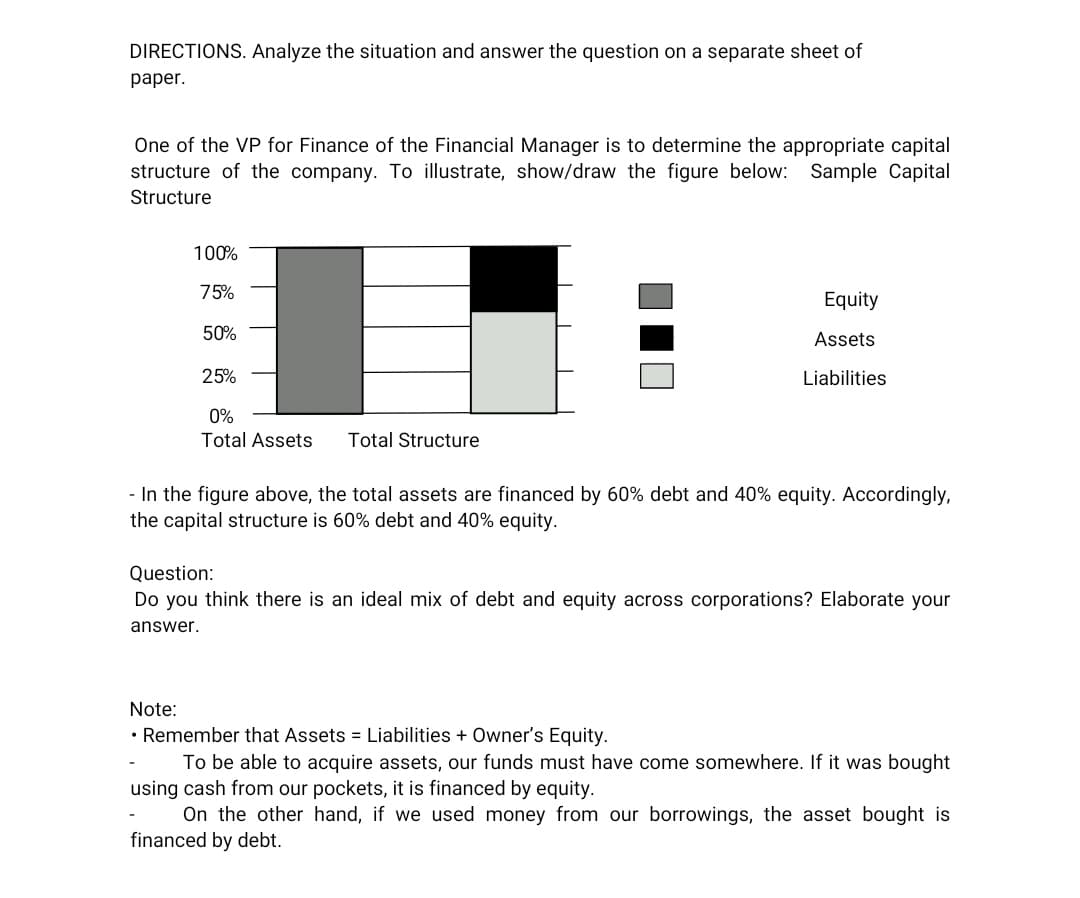

- To get an overall picture of each companys capital structure, it is helpful to look at a chart that summarizes the companys capital structure over the past decade. To obtain this chart, choose a company to start with and select FINANCIALS. Next, select MORE THOMSON REPORTS CHARTSCAPITAL STRICTURE. This should generate a chart that plots the companys total long-term debt, total common equity, and total current liabilities over the past decade. What, if any, are the major trends that emerge when youre looking at these charts? Do these companies tend to have relatively high or relatively low levels of debt? Do these companies have significant levels of current liabilities? Have their capital structures changed over time?CALCULATING 3Ms COST OF CAPITAL In this chapter, we described how to estimate a companys WACC, which is the weighted average of its costs of debt, preferred stock, and common equity. Most of the data we need to do this can be found from various data sources on the Internet. Here we walk through the steps used to calculate Minnesota Mining Manufacturings (MMM) WACC. 3. Next, we need to calculate MMMs cost of debt. We can use different approaches to estimate it. One approach is to take the companys interest expense and divide it by total debt (which is the sum of short-term debt and long-term debt). This approach only works if the historical cost of debt equals the yield to maturity in todays market (i.e., if MMMs outstanding bonds are trading at close to par). This approach may produce misleading estimates in years in which MMM issues a significant amount of new debt. For example, if a company issues a great deal of debt at the end of the year, the full amount of debt will appear on the year-end balance sheet, yet we still may not see a sharp increase in annual interest expense because the debt was outstanding for only a small portion of the entire year. When this situation occurs, the estimated cost of debt will likely understate the true cost of debt. Another approach is to try to find this number in the notes to the companys annual report by accessing the companys home page and its Investor Relations section. Alternatively, you can go to other external sources, such as bondsonline.com, for corporate bond spreads, which can be used to find estimates of the cost of debt. Remember that you need the after-tax cost of debt to calculate a firms WACC, so you will need MMMs tax rate (which has averaged around 30% in recent years). What is your estimate of MMMs after-tax cost of debt?As a first step, we need to estimate what percentage of MMMs capital comes from debt, preferred stock, and common equity. This information can be found on the firms latest annual balance sheet. (As of year end 2014, MMM had no preferred stock.) Total debt includes all interest-bearing debt and is the sum of short-term debt and long-term debt. a. Recall that the weights used in the WACC are based on the companys target capital structure. If we assume that the company wants to maintain the same mix of capital that it currently has on its balance sheet, what weights should you use to estimate the WACC for MMM? b. Find MMMs market capitalization, which is the market value of its common equity. Using the sum of its short-term debt and long-term debt from the balance sheet (we assume that the market value of its debt equals its book value) and its market capitalization, recalculate the firms debt and common equity weights to be used in the WACC equation. These weights are approximations of market-value weights. Be sure not to include accruals in the debt calculation.

- You are given the following information concerning a firm:Assets required for operation: $5,600,000Revenues: $8,700,000Operating expenses: $7,900,000Income tax rate: 40%. Management faces three possible combinations of financing: 100% equity financing 35% debt financing with a 8% interest rate 70% debt financing with a 8% interest rate What is the net income for each combination of debt and equity financing? Round your answers to the nearest dollar. 1 2 3 Net income $ $ $ What is the return on equity for each combination of debt and equity financing? Round your answers to one decimal place. 1 2 3 Return on equity % % % If the interest rate had been 16 percent instead of 8 percent, what would be the return on equity for each combination of debt and equity financing? Round your answers to one decimal place. 1 2 3 Return on equity % % % What is the implication of the use of financial leverage…You are given the following information concerning a firm: (please show work) Assets required for operation: $5,000,000 Revenues: $8,400,000 Operating expenses: $7,900,000 Income tax rate: 40%. Management faces three possible combinations of financing: 100% equity financing 30% debt financing with a 6% interest rate 60% debt financing with a 6% interest rate a) What is the net income for each combination of debt and equity financing? b) What is the return on equity for each combination of debt and equity financing? c) If the interest rate had been 12 percent instead of 6 percent, what would be the return on equity for each combination of debt and equity financing?An accountant for Stability Inc. must calculate the weighted average cost of capital of the corporation using the following information. Interest Rate Accounts payable $35,000,000 0 Long-term debt 10,000,000 8% Common stock 10,000,000 15% Retained earnings 5,000,000 18% What is the weighted average cost of capital of Stability? Select one: a. 10.25% b. 6.88% c. 12.80% d. 8.00%

- The financial manager of a firm determines the following schedules of cost of debt and cost of equity for various combinations of debt financing: Debt/Assets After-Tax Cost of Debt Cost of Equity 0 % 4 % 7 % 10 4 7 20 4 7 30 4 9 40 5 10 50 5 12 60 8 13 70 8 15 Find the optimal capital structure (that is, optimal combination of debt and equity financing). Round your answers for the capital structure to the nearest whole number and for the cost of capital to one decimal place. The optimal capital structure: % debt and % equity with a cost of capital of % Why does the cost of capital initially decline as the firm substitutes debt for equity financing? The cost of capital initially declines because the firm cost of debt is than the cost of equity. Why will the cost of funds eventually rise as the firm becomes more financially leveraged? As the firm becomes more financially leveraged and riskier, the cost of debt…Based on the following numbers, calculate the firm’s WACC, explaining in detail each step in your calculations and the formulas that you are using. You may find it useful to complete this task in Excel and include the Excel table in your response. Cost of debt (averaging over all the forms of debt used): 12%. Risk-free rate on Treasury Bonds: 5%. Expected return on the domestic portfolio: 9%. Effective tax rate: 20%. Share of debt in optimal capital structure: 65%. Share of equity in optimal capital structure: 35%. Beta: 1.2Hello. I need help with the following question please. Taylor Company has a target capital structure that consists of $3.3 million of debt capital, $2.5 million of preferred stock financing, and $2.8 million of common equity. The corresponding weights of its debt, preferred stock, and common equity financing that should be used to compute its weighted cost of capital (rounded to the nearest wo decimal places) are: 38.37%, 29.07%, and 32.56%, respectively 32.04%, 34.53%, and 33.43%, respectively 29.07%, 32.56%, and 38.37%, respectively 34.53%, 33.43%, and 32.04%, respectively Consider the following case: Mason Limited, a key competitor of Taylor Company in the construction field, has a capital structure consisting of 45% debt, 5% preferred stock, and 50% common equity. Concerned that its cost of capital may put it at a competitive disadvantage vis-a-vis the Taylor Company, a Mason analyst has been tasked with computing and comparing the weighted costs…

- You are the new CFO of Risk SurfingLtd, whichhas current assets of $7,920, net fixed assets of $17,700, current liabilities of $4,580 and long-termdebts of $5,890. Required:a.What are the three important questions of corporate financeyou will need to address? Please briefly explain them and indicate how they are related to the areas in the balance sheet of a company.b.Calculate owners’ equity and build a balance sheet for the company? c.How much is net working capital of the company? d.Calculatethe return on assets of the company giventhat Return on Equity is 30%?e.What is the PE of the company total number of ordinary share outstanding of the companies is 2,000 and market price of each share is $12?Kellogg’s CFO is in the process of determining the firm’s WACC and needs to figure out the weights of the various types of capital sources. Accordingly, she starts by collecting information from the balance sheet and the capital markets, and makes up the table shown below: Component Balance Sheet Value Number Outstanding Current Market Price Market Value Debt $150,000,000 150,000 $1,075 Preferred Stock $ 45,000,000 1,500,000 $40 Common Stock $180,000,000 4,500,000 $45.57 Corporate tax rate = 30% is Tc Before tax cost of debt = 7.6% Rd Cost of Equity = 11.36% Re Based upon the above information, calculate the firm’s weighted average cost of capital.You are given the following data: EBIT : OMR 500,000 Shareholders funds : OMR 1200,000 Non current liabilities : OMR 800,000 Then return on capital employed is