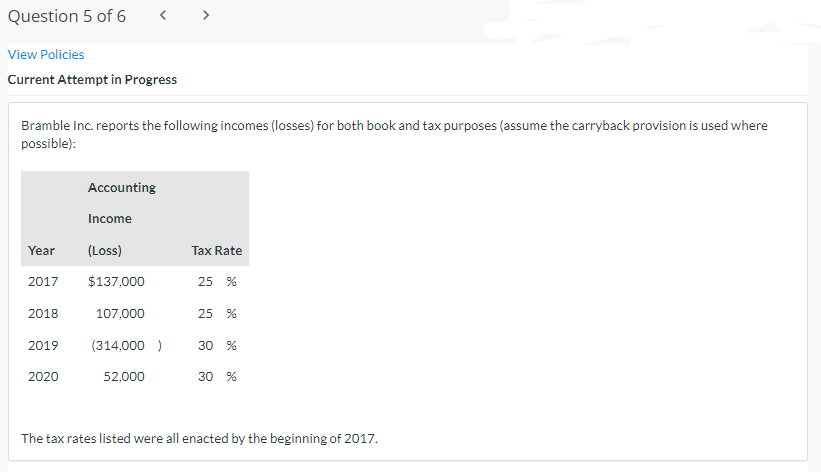

Bramble Inc. reports the following incomes (losses) for both book and tax purposes (assume the carryback provision is used where possible): Accounting Income Year (Loss) Tax Rate 2017 $137,000 25 % 2018 107,000 25 % 2019 (314,000 ) 30 % 2020 52,000 30 % The tax rates listed were all enacted by the beginning of 2017.

Bramble Inc. reports the following incomes (losses) for both book and tax purposes (assume the carryback provision is used where possible): Accounting Income Year (Loss) Tax Rate 2017 $137,000 25 % 2018 107,000 25 % 2019 (314,000 ) 30 % 2020 52,000 30 % The tax rates listed were all enacted by the beginning of 2017.

Chapter3: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 56P

Related questions

Question

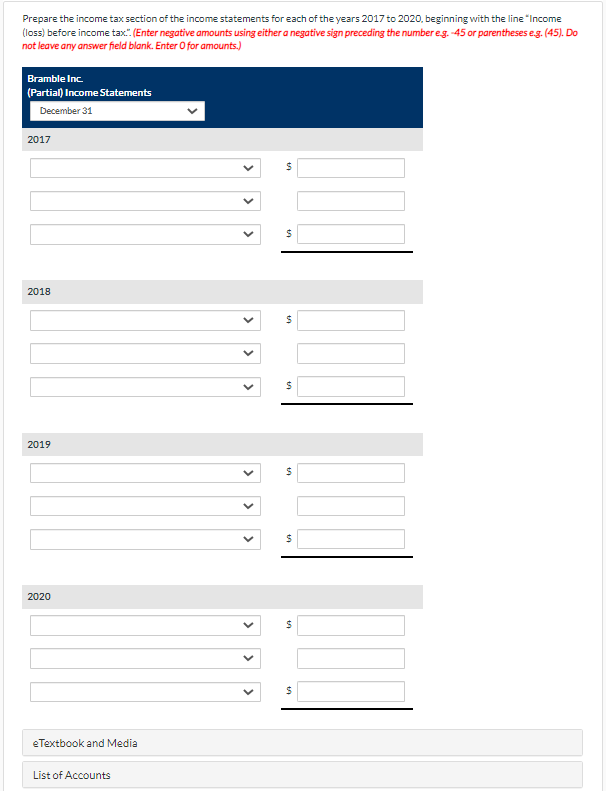

Transcribed Image Text:Prepare the income tax section of the income statements for each of the years 2017 to 2020, beginning with the line "Income

(loss) before income tax.". (Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses eg. (45). Do

not leave any answer field blank. Enter O for amounts.)

Bramble Inc.

(Partial) Income Statements

December 31

2017

2018

2019

2020

eTextbook and Media

List of Accounts

>

>

Transcribed Image Text:Question 5 of 6

< >

View Policies

Current Attempt in Progress

Bramble Inc. reports the following incomes (losses) for both book and tax purposes (assume the carryback provision is used where

possible):

Accounting

Income

Year

(Loss)

Tax Rate

2017

$137,000

25 %

2018

107,000

25 %

2019

(314,000 )

30 %

2020

52,000

30 %

The tax rates listed were all enacted by the beginning of 2017.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT