Question Giant Ltd acquired 80 percent share capital of Expert Ltd. On 1 July 2018 for a cost of $1,600,000. As at the date of acquisition, all assets and liabilities of Expert Ltd were fairly valued except a land that has a carrying value $150,000 less than the fair value. The recorded balance of equity of Expert Ltd as at 1 July 2018 were as: Share capital Retained earnings $800,000 $200,000 $400,000 $1,400,000 General Reserve Total Additional information: The management of Giant Ltd values non-controlling interest at the proportionate share of Expert Ltd identifiable net assets. • Expert Ltd has a profit after tax of $200,000 for the year ended 30 June 2019. • During the financial year to 30 June 2019, Expert Ltd sold inventory to Giant Ltd for a price of $120,000. The inventory costs Expert Ltd $60,000 to produce. 25 percent of the inventory are still on the hand of Giant Ltd as at 30 June 2019. • During the year Expert Ltd paid $60,000 in consultancy fees to Giant Ltd. • On 1 July 2018, Expert Ltd sold an item of plant to Giant Ltd $80000. The equipment had a carrying value of $60,000 (Cost $100,000, accumulated depreciation $40,000). At the date of sale, it was expected that the equipment had a remaining life of 4 years and no residual value. • The tax rate is 30 percent. Required: a) Based on the above information, calculate the non-controlling interest as at 30 June 2019. b) Prepare the necessary journal entries to recognise the non-controlling interest as at 30 June 2019.

Question Giant Ltd acquired 80 percent share capital of Expert Ltd. On 1 July 2018 for a cost of $1,600,000. As at the date of acquisition, all assets and liabilities of Expert Ltd were fairly valued except a land that has a carrying value $150,000 less than the fair value. The recorded balance of equity of Expert Ltd as at 1 July 2018 were as: Share capital Retained earnings $800,000 $200,000 $400,000 $1,400,000 General Reserve Total Additional information: The management of Giant Ltd values non-controlling interest at the proportionate share of Expert Ltd identifiable net assets. • Expert Ltd has a profit after tax of $200,000 for the year ended 30 June 2019. • During the financial year to 30 June 2019, Expert Ltd sold inventory to Giant Ltd for a price of $120,000. The inventory costs Expert Ltd $60,000 to produce. 25 percent of the inventory are still on the hand of Giant Ltd as at 30 June 2019. • During the year Expert Ltd paid $60,000 in consultancy fees to Giant Ltd. • On 1 July 2018, Expert Ltd sold an item of plant to Giant Ltd $80000. The equipment had a carrying value of $60,000 (Cost $100,000, accumulated depreciation $40,000). At the date of sale, it was expected that the equipment had a remaining life of 4 years and no residual value. • The tax rate is 30 percent. Required: a) Based on the above information, calculate the non-controlling interest as at 30 June 2019. b) Prepare the necessary journal entries to recognise the non-controlling interest as at 30 June 2019.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 19E

Related questions

Question

Transcribed Image Text:Question

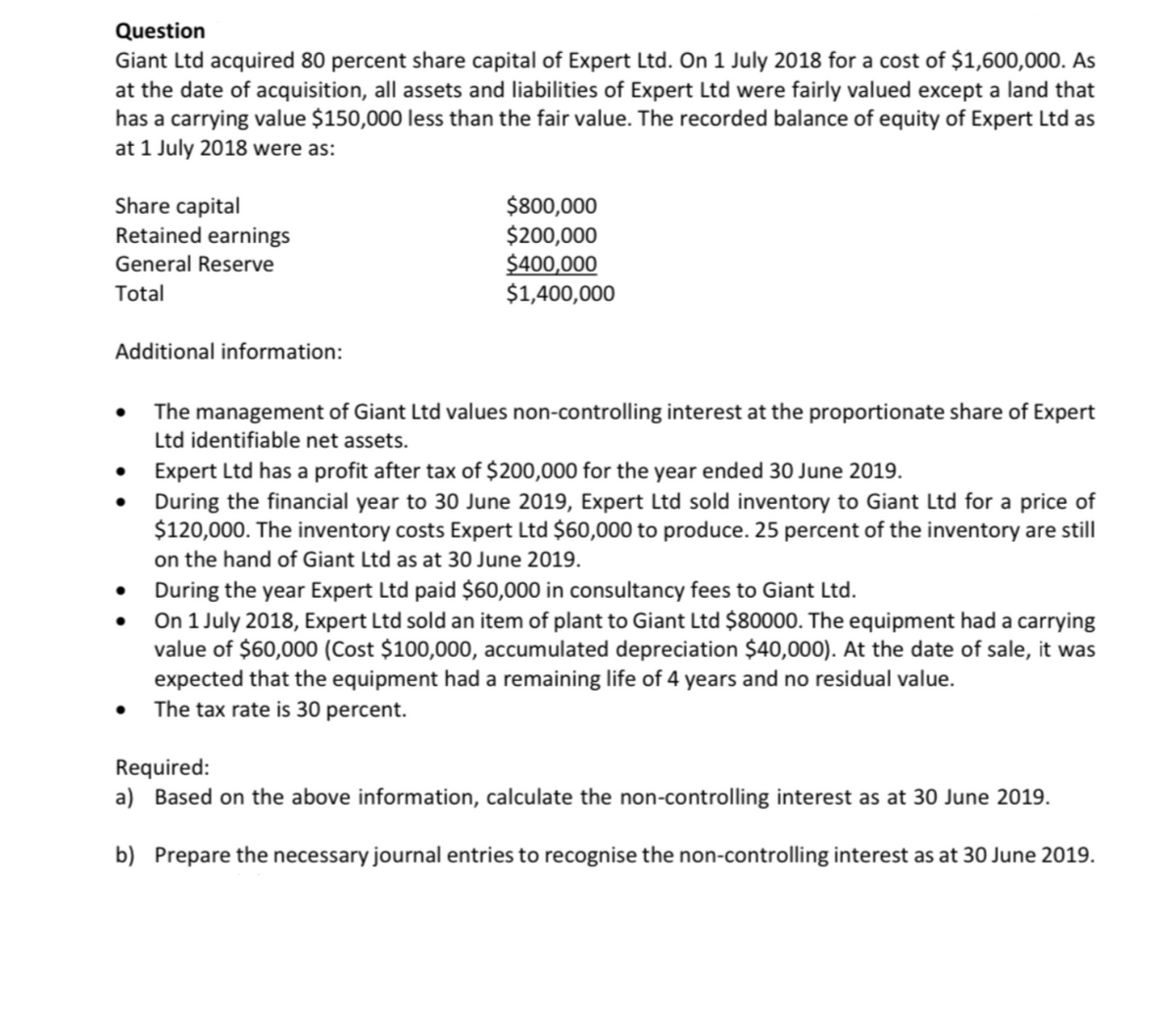

Giant Ltd acquired 80 percent share capital of Expert Ltd. On 1 July 2018 for a cost of $1,600,000. As

at the date of acquisition, all assets and liabilities of Expert Ltd were fairly valued except a land that

has a carrying value $150,000 less than the fair value. The recorded balance of equity of Expert Ltd as

at 1 July 2018 were as:

Share capital

Retained earnings

$800,000

$200,000

$400,000

$1,400,000

General Reserve

Total

Additional information:

The management of Giant Ltd values non-controlling interest at the proportionate share of Expert

Ltd identifiable net assets.

• Expert Ltd has a profit after tax of $200,000 for the year ended 30 June 2019.

• During the financial year to 30 June 2019, Expert Ltd sold inventory to Giant Ltd for a price of

$120,000. The inventory costs Expert Ltd $60,000 to produce. 25 percent of the inventory are still

on the hand of Giant Ltd as at 30 June 2019.

• During the year Expert Ltd paid $60,000 in consultancy fees to Giant Ltd.

• On 1 July 2018, Expert Ltd sold an item of plant to Giant Ltd $80000. The equipment had a carrying

value of $60,000 (Cost $100,000, accumulated depreciation $40,000). At the date of sale, it was

expected that the equipment had a remaining life of 4 years and no residual value.

• The tax rate is 30 percent.

Required:

a) Based on the above information, calculate the non-controlling interest as at 30 June 2019.

b) Prepare the necessary journal entries to recognise the non-controlling interest as at 30 June 2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 6 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub