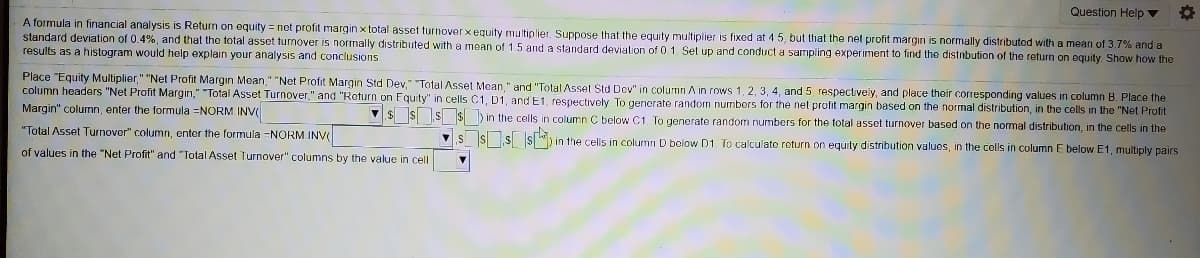

Question Help v A formula in financial analysis is Return on equity = net profit margin x total asset turnover xequity multiplier. Suppose that the equity multiplier is fixed at 45, but that the net profit margin is normally distributed with a mean of 3.7% and a standard deviation of 0.4%, and that the total asset turnover is normally distributed with a mean of 1.5 and a standard deviation of 0 1. Set up and conduct a sampling experiment to find the distnbution of the return on equity. Show how the results as a histogram would help explain your analysis and conclusions Place "Equity Multiplier," "Net Profit Margin Mean," "Net Profit Margin Std Dev," "Total Asset Mean." and "Total Asset Std Dev" in column A in rows 1, 2, 3, 4, and 5 respectively, and place their corresponding values in column B. Place the column headers "Net Profit Margin," "Total Asset Turnover," and "Roturn on Fquity" in cells C1, D1, and E1, respectively To generate random numbors for the net profit margin based on the normal distribution, in the cells in the "Net Profit V$ $S $) in the cells in column C below C1. To generate random numbers for the total asset turnover based on the normal distribution, in the cells in the Margin" columnn, enter the formula =NORM INV "Total Asset Turnover" column, enter the formula -NORM INV in the cells in column D below D1. To calculate return on equity distribution values, in the cells in column E below E1, multiply pairs of values in the "Net Profit" and "Total Asset Turnover" columns by the value in cell

Question Help v A formula in financial analysis is Return on equity = net profit margin x total asset turnover xequity multiplier. Suppose that the equity multiplier is fixed at 45, but that the net profit margin is normally distributed with a mean of 3.7% and a standard deviation of 0.4%, and that the total asset turnover is normally distributed with a mean of 1.5 and a standard deviation of 0 1. Set up and conduct a sampling experiment to find the distnbution of the return on equity. Show how the results as a histogram would help explain your analysis and conclusions Place "Equity Multiplier," "Net Profit Margin Mean," "Net Profit Margin Std Dev," "Total Asset Mean." and "Total Asset Std Dev" in column A in rows 1, 2, 3, 4, and 5 respectively, and place their corresponding values in column B. Place the column headers "Net Profit Margin," "Total Asset Turnover," and "Roturn on Fquity" in cells C1, D1, and E1, respectively To generate random numbors for the net profit margin based on the normal distribution, in the cells in the "Net Profit V$ $S $) in the cells in column C below C1. To generate random numbers for the total asset turnover based on the normal distribution, in the cells in the Margin" columnn, enter the formula =NORM INV "Total Asset Turnover" column, enter the formula -NORM INV in the cells in column D below D1. To calculate return on equity distribution values, in the cells in column E below E1, multiply pairs of values in the "Net Profit" and "Total Asset Turnover" columns by the value in cell

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter7: Analysis Of Financial Statements

Section: Chapter Questions

Problem 1Q: Define each of the following terms:

Liquidity ratios: current ratio; quick, or acid test,...

Related questions

Question

12-4 see picture to solve

Transcribed Image Text:Question Help v

A formula in financial analysis is Return on equity = net profit margin x total asset turnoverx equity multiplier. Suppose that the equity multiplier is fixed at 4 5, but that the net profit margin is normally distributod with a mean of 3.7% and a

standard deviation of 0.4%, and that the total asset turnover is normally distributed with a mean of 1.5 and a standard deviation of 0 1. Set up and conduct a sampling experiment to find the distribution of the return on equity. Show how the

results as a histogram would help explain your analysis and conclusions

Place "Equity Multiplier," "Net Profit Margin Mean," "Net Profit Margin Std Dev," "Total Asset Mean." and "Total Asset Std Dov" in column A in rows 1, 2, 3, 4, and 5 respectively, and place their corresponding values in column B. Place the

column headers "Net Profit Margin," "Total Asset Turnover," and "Return on Fquity" in cells C1, D1, and E1, respectively To generate random numbors for the net profit margin based on the normal distribution, in the cells in the "Net Profit

Margin" column, enter the formula =NORM INV

V$ $ S $ )in the cells in column C below C1, To generate random numbers for the total asset turnover based on the normal distribution, in the cells in the

"Total Asset Turnover" column, enter the formula =NORM INV

VS Ss s ") in the cells in column D bolow D1. To calculate return on equity distribution values, in the cells in column E below E1, multiply pairs

of values in the "Net Profit" and "Total Asset Turnover" columns by the value in cell

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning