QUESTION Part A) On January 1, 2023 its issue date, Diogenes Inc. purchased a 9%, $200,000, 10-year bond. Interest is paid annually on December 31. Diogenes uses the amortized cost model and the effective interest method for amortizing premium or discount. The current market rate was 10% and as a result Diogenes paid $187,711 for the bonds. On December 31, 2023, the bonds have a market value of $185,000. Diogenes applies IFRS. Instructions Record the receipt of interest for 2023.

QUESTION Part A) On January 1, 2023 its issue date, Diogenes Inc. purchased a 9%, $200,000, 10-year bond. Interest is paid annually on December 31. Diogenes uses the amortized cost model and the effective interest method for amortizing premium or discount. The current market rate was 10% and as a result Diogenes paid $187,711 for the bonds. On December 31, 2023, the bonds have a market value of $185,000. Diogenes applies IFRS. Instructions Record the receipt of interest for 2023.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 5P

Related questions

Question

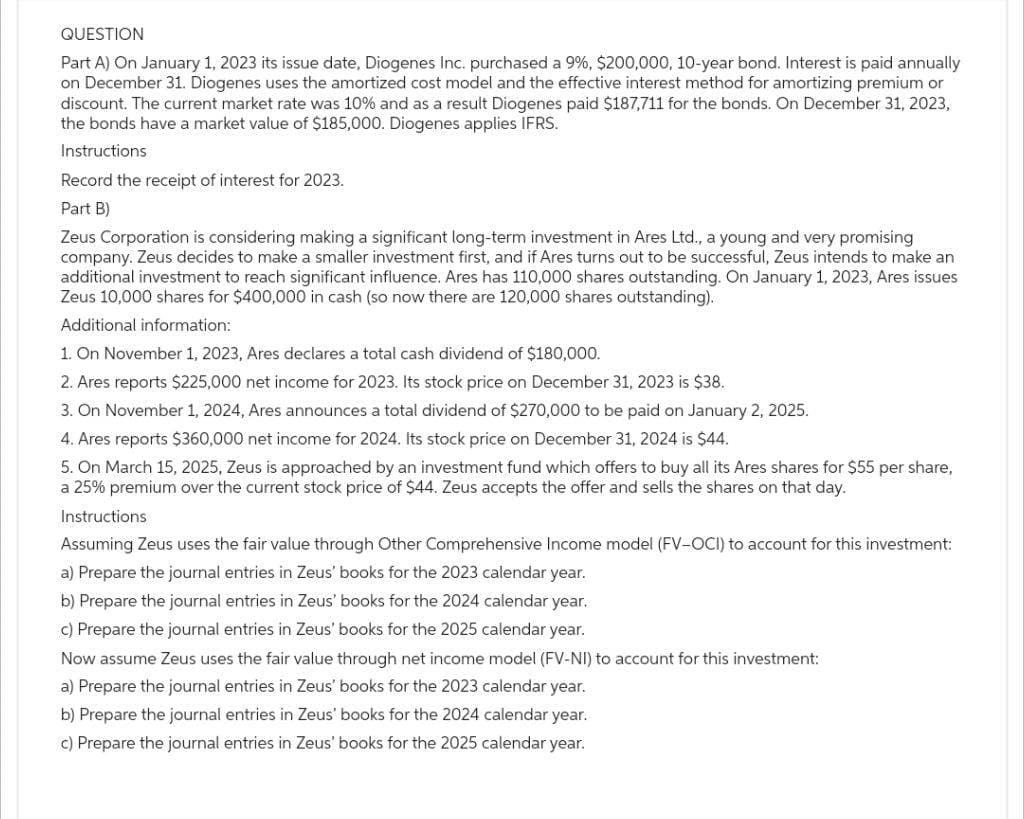

Transcribed Image Text:QUESTION

Part A) On January 1, 2023 its issue date, Diogenes Inc. purchased a 9%, $200,000, 10-year bond. Interest is paid annually

on December 31. Diogenes uses the amortized cost model and the effective interest method for amortizing premium or

discount. The current market rate was 10% and as a result Diogenes paid $187,711 for the bonds. On December 31, 2023,

the bonds have a market value of $185,000. Diogenes applies IFRS.

Instructions

Record the receipt of interest for 2023.

Part B)

Zeus Corporation is considering making a significant long-term investment in Ares Ltd., a young and very promising

company. Zeus decides to make a smaller investment first, and if Ares turns out to be successful, Zeus intends to make an

additional investment to reach significant influence. Ares has 110,000 shares outstanding. On January 1, 2023, Ares issues

Zeus 10,000 shares for $400,000 in cash (so now there are 120,000 shares outstanding).

Additional information:

1. On November 1, 2023, Ares declares a total cash dividend of $180,000.

2. Ares reports $225,000 net income for 2023. Its stock price on December 31, 2023 is $38.

3. On November 1, 2024, Ares announces a total dividend of $270,000 to be paid on January 2, 2025.

4. Ares reports $360,000 net income for 2024. Its stock price on December 31, 2024 is $44.

5. On March 15, 2025, Zeus is approached by an investment fund which offers to buy all its Ares shares for $55 per share,

a 25% premium over the current stock price of $44. Zeus accepts the offer and sells the shares on that day.

Instructions

Assuming Zeus uses the fair value through Other Comprehensive Income model (FV-OCI) to account for this investment:

a) Prepare the journal entries in Zeus' books for the 2023 calendar year.

b) Prepare the journal entries in Zeus' books for the 2024 calendar year.

c) Prepare the journal entries in Zeus' books for the 2025 calendar year.

Now assume Zeus uses the fair value through net income model (FV-NI) to account for this investment:

a) Prepare the journal entries in Zeus' books for the 2023 calendar year.

b) Prepare the journal entries in Zeus' books for the 2024 calendar year.

c) Prepare the journal entries in Zeus' books for the 2025 calendar year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT