Question What type of policy should James and Joanne consider covering the diamond wedding ring?

Q: Crestview Estates purchased a tractor on January 1, 2018, for $65,000. The tractor's useful life is…

A: Depreciation: Depreciation means the reduction in an asset's value over the asset's life due to the…

Q: irections: 1. please assist with journalize each of the following transactions for October 2020.…

A: Journal entries recording is the first step of accounting cycle process, under this atleast one…

Q: nance For a bank, what is the tradeoff between having high vs. low capital reserve?

A: Maintaining the reserve capital is mandatory for banks as per guidelines of the federal bank and…

Q: Question 2 Tasty Biscuit prepares its financial statements on every 31 December and incurred the…

A: Depreciation - Depreciation is charged to income statement for the assets used in the business. It…

Q: Determine the flexible budget amount for equipment depreciation in September?

A: In budgeting we make master budgets which essentially are planned budgets. These budgets are…

Q: USE GOOGLE SHEET Use the template below and create your own invoice for purchased products of a…

A: An invoice seems to be a document that is used as proof to indicate the transaction that occurred…

Q: Badour Inc. is a job-order manufacturer. The company uses a predetermined overhead rate based on…

A: Underapplied Overhead: When a company does not allocate a sufficient amount of its budget to cover…

Q: If each standard computer and portable computer contributes a profit of $220, and $150 respectively,…

A:

Q: Redlands Inc. sells one product for $5. The variable cost per item is $3, and the fixed costs for…

A: The differential analysis is performed to analyse the different alternatives available to the…

Q: Bridgeport AG unda €175.000, 4-year 95% note at face value to Flint Hills Bank on January 1, 2022,…

A: A note payable can be described as a written commitment which is paid by promissory to the lender of…

Q: Prepare the shar (b) financial position at Decen to shareholders' equity 1. The following…

A: Comment - Multiple Questions Asked. Shares- The business's financial resources are its shares.…

Q: Lawyers estimate that there is a 10% chance of losing the case. Susan Ltd incurred $8,000 in costs…

A: Acquisition analysis is prepared considering the fair value of assets and liabilities of the…

Q: Blue Company sold a car to a customer at a price of P400,000 with a production cost of P300,000 on…

A:

Q: On January 1, 2019, Sunshine Company sells office furniture. The office furniture originally cost…

A: a) Date Account Debit Credit 01 Jan 2019 Cash $15,000…

Q: Compute the annual income tax due if Nicanor will opt for graduated tax rate

A: It has been given in the question that the Nicanor (Taxpayer) has opted to use the graduated tax…

Q: White purchased 10% of an investee’s 100,000 outstanding ordinary shares on January 1, 2022 for…

A: Investment - An investment is a type of asset created by an investor using his or her own money and…

Q: Requirement 2. Journalize in summary form the requisition of direct materials and the assignment of…

A: Under job order costing journal entries required for labor, material, overhead. At the end of…

Q: Question 4.4…

A: Introduction: A life-cycle revenue calculates the number of sales and profits by calculating the…

Q: If a company plans to sell 40000 units of product but sells 60000 units, the most appropriate…

A: All the budget was made on the planned unit sales of 40000. Actual units sold are 60000. Comparison…

Q: Wendell’s Donut Shoppe is investigating the purchase of a new $40,000 donut-making machine. The new…

A: Answer : Internal rate of return = 16.99%

Q: What is the firm's cash flow from operations,financing and investing

A: Working note 1- calculation of net profit of current year Net profit= Sales - COGS- depreciation -…

Q: Financial Accounting Project: 1. The owner, Josef Miguel, invested Php250,000 cash in the business.…

A: Income Statement The purpose of preparing the income statement is to know the net income which are…

Q: Provide the mandatory information to be included in a tax invoice under the Sales Tax Act 2018.…

A: Introduction: A sales tax is a consumption tax imposed by the government on the sale of goods and…

Q: Milano Gallery purchases the copyright on a painting for $510,000 on January 1. The copyright is…

A: Introduction: A journal entry is used to document a business transaction in the accounting records…

Q: What is the consequence of the sale to the highest bidder? Group of answer choices D shall own 400…

A: The par value of the shares means the value of each share means the value of the share at which…

Q: Based on the following information, what was the 2018 taxable income for Jin Co. assuming that its…

A: Lets understand the basics. When there is temporary taxable difference arise between the book profit…

Q: 14 4

A: "Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the…

A: We can calculate the depreciation expense using the Double Declining Balance method as follows:-…

Q: Steve Ankenbrandt, president of Beeb Corporation, has been discussing the company’s internal…

A: Internal audit function includes: Monitoring internal controls Assessing Governance Managing risks…

Q: Monthly Payment of Interest-Bearing Note Payable A business issued, and recorded, a 5-year Note…

A: Note payable : When a business borrows money then it issue a note payable as a promise to pay the…

Q: The Gourmand Cooking School runs short cooking courses at its small campus. Management has…

A: The flexible budget performance report is prepared to evaluate the difference between actual…

Q: Haughton Company uses a job costing system for its production costs and a predetermined factory…

A: "Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: The treasurer is solely responsible for the petty cash fund. A) True B) False

A: Petty cash funds are those funds which are established for small petty expenses of the business.…

Q: sales mix and break-even sales?

A: Given in the question: Fixed Costs $3,30,330.00 Combined Contribution Margin…

Q: What is the difference between job order costing and process costing? What types of companies use…

A: Costing is the Process of Computing cost of Manufacturing of goods or provision of services. Costing…

Q: In a consolidated statement of financial position, the non-controlling interest is shown: Group of…

A: Statement of financial position is one of the financial statement of the business, which shows all…

Q: Crane Company manufactures a product with a standard direct labor cost of two hours at $17 per hour.…

A: Variance is difference between actual and standard revenue or expenses. If actual expenses higher…

Q: Change in Sales Mix and Contribution Margin Head Pops Inc. manufactures two models of solar-powered,…

A: Lets understand the basics. When there is excess capacity available then management may decide to…

Q: Cute Company operates a branch in Baguio City. Selected balances taken from the books of Home Office…

A: Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: A household has the following statistics related to Balance Sheet and annual Cash Flow: Balance…

A: Total operating percentage of a household indicates how much of total income is spent over its…

Q: Vaughn Manufacturing uses flexible budgets. At normal capacity of 22000 units, budgeted…

A: The difference between the budgeted and actual overheads is usually known as variance. In this,…

Q: 1(a). Prepare journal entries to record the issuance of Frenza bonds on January 1, Year 1. 1(b).…

A: Requirement 1 a) :— Statement Showing Journal entry to record the issuance of Frenza bonds on…

Q: Exercise 8-7 Cash Budget [LO8-8] Garden Depot is a retailer that is preparing its budget for the…

A: Cash Budget :— It is the budget made by company to estimate the flow of cash & cash equivalents…

Q: The 2021 income statement of Adrian Express reports sales of $15,642,000, cost of goods sold of…

A:

Q: What amount should be capitalized as the cost of the new equipment?

A: As per the relevant IFRS "PPE", all the costs incurred by the Business Entity, to bring the Asset…

Q: What are all the entries relating to the equipment in the general journals of Peter’s financial…

A: Assets are depreciated every year due to their wear and tear during the year. Depreciation represent…

Q: Carbon Company provides the following information about resources. Unused Resources Capacity…

A: Income statement is a financial statement that records all the expenses and income of the company…

Q: Root Technology Co. manufactures DVDs for computer software and entertainment companies. Root uses…

A: Total material cost is the amount spend in purchasing or producing the material for the final…

Q: roblem 8-3A Establishing, reimbursing, and increasing petty cash LO P2 Nakashima Gallery had the…

A: Introduction: A journal entry is used to record a business transaction in the accounting system of a…

Q: How much is the gain on debt restructuring?

A: Meaning Of Debt restructuring Debt Restructuring is opted to avoid risk of defaulting payment of…

Step by step

Solved in 2 steps

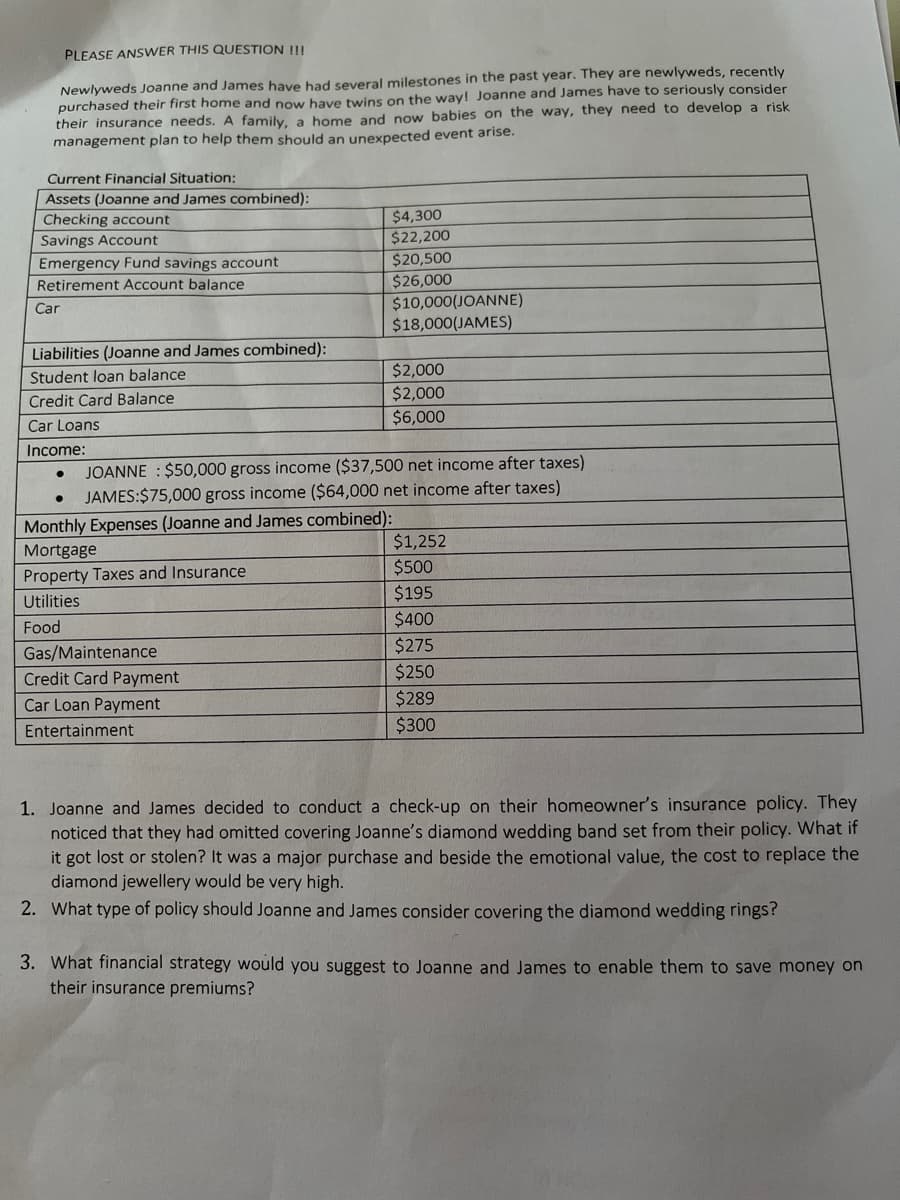

- Home and Automobile Insurance Newlyweds Joanne and James have had several milestones in the past year. They are newlyweds, recently purchased their first home and now have twins on the way! Joanne and James have to seriously consider their insurance needs. A family, a home and now babies on the way, they need to develop a risk management plan to help them should an unexpected event arise. Current Financial Situation: Assets (Joanne and James combined): Checking account $4,300 Savings Account $22,200 Emergency Fund savings account $20,500 Retirement Account balance $26,000 Car $10,000(JOANNE) $18,000(JAMES) Liabilities (Joanne and James combined): Student loan balance $0 Credit Card Balance $2,000 Car Loans $6,000 Income: · JOANNE : $50,000 gross income ($37,500 net income after taxes) · JAMES:$75,000 gross income ($64,000 net income after taxes) Monthly Expenses (Joanne and James combined):…Home and Automobile Insurance Newlyweds Jamie Lee and Ross have had several milestones in the past year. They are newlyweds, recently purchased their first home and now have twins on the way! Jamie Lee and Ross have to seriously consider their insurance needs. A family, a home and now babies on the way, they need to develop a risk management plan to help them should an unexpected event arise. Current Financial Situation: Assets (Jamie Lee and Ross combined): Checking account: $6,300 Savings Account: $23,200 Emergency Fund savings account: $30,500 IRA balance: $36,000 Car: $10,000 (Jamie Lee) and $18,000 (Ross) Liabilities (Jamie Lee and Ross combined): Student loan balance: $0 Credit Card Balance: $4,000 Car Loans: $8,000 Income: Jamie Lee: $50,000 gross income ($37,500 net income after taxes) Ross: $75,000 gross income ($64,000 net income after taxes) Monthly Expenses (combined): Mortgage: $1,252 Property Taxes and Insurance: $500 Utilities: $195 Food: $600…Home and Automobile Insurance Newlyweds Jamie Lee and Ross have had several milestones in the past year. They are newlyweds, recently purchased their first home and now have twins on the way! Jamie Lee and Ross have to seriously consider their insurance needs. A family, a home and now babies on the way, they need to develop a risk management plan to help them should an unexpected event arise. Current Financial Situation: Assets (Jamie Lee and Ross combined): Checking account: $6,300 Savings Account: $23,200 Emergency Fund savings account: $30,500 IRA balance: $36,000 Car: $10,000 (Jamie Lee) and $18,000 (Ross) Liabilities (Jamie Lee and Ross combined): Student loan balance: $0 Credit Card Balance: $4,000 Car Loans: $8,000 Income: Jamie Lee: $50,000 gross income ($37,500 net income after taxes) Ross: $75,000 gross income ($64,000 net income after taxes) Monthly Expenses (combined): Mortgage: $1,252 Property Taxes and Insurance: $500 Utilities: $195 Food: $600…

- Home and Automobile Insurance Newlyweds Jamie Lee and Ross have had several milestones in the past year. They are newlyweds, recently purchased their first home and now have twins on the way! Jamie Lee and Ross have to seriously consider their insurance needs. A family, a home and now babies on the way, they need to develop a risk management plan to help them should an unexpected event arise. Current Financial Situation: Assets (Jamie Lee and Ross combined): Checking account: $6,300 Savings Account: $23,200 Emergency Fund savings account: $30,500 IRA balance: $36,000 Car: $10,000 (Jamie Lee) and $18,000 (Ross) Liabilities (Jamie Lee and Ross combined): Student loan balance: $0 Credit Card Balance: $4,000 Car Loans: $8,000 Income: Jamie Lee: $50,000 gross income ($37,500 net income after taxes) Ross: $75,000 gross income ($64,000 net income after taxes) Monthly Expenses (combined): Mortgage: $1,252 Property Taxes and Insurance: $500 Utilities: $195 Food: $600…Home and Automobile Insurance Newlyweds Jamie Lee and Ross have had several milestones in the past year. They are newlyweds, recently purchased their first home and now have twins on the way! Jamie Lee and Ross have to seriously consider their insurance needs. A family, a home and now babies on the way, they need to develop a risk management plan to help them should an unexpected event arise. Current Financial Situation: Assets (Jamie Lee and Ross combined): Checking account: $6,300 Savings Account: $23,200 Emergency Fund savings account: $30,500 IRA balance: $36,000 Car: $10,000 (Jamie Lee) and $18,000 (Ross) Liabilities (Jamie Lee and Ross combined): Student loan balance: $0 Credit Card Balance: $4,000 Car Loans: $8,000 Income: Jamie Lee: $50,000 gross income ($37,500 net income after taxes) Ross: $75,000 gross income ($64,000 net income after taxes) Monthly Expenses (combined): Mortgage: $1,252 Property Taxes and Insurance: $500 Utilities: $195 Food: $600…The Jeffersons want to establish a trust to provide for their children in case of their premature deaths. Which of the following is most appropriate for the Jeffersons' overall situation and objectives (objectives are Capital accumulation is a primary concern in this stage of their lives. The protection of principal, income production, and reduction of taxes are of minor importance)? They have a net worth of $725,000 Provide a rationale for your answer. Choose one of the following an irrevocable life insurance trust granting Crummey powers to the children a grantor retained income trust (GRIT) with their children, Ashanti and Blake named as beneficiaries a revocable living trust naming a third party as successor trustee, with Avery and Jaylen as the primary beneficiaries while living and the children listed as remainder beneficiaries an irrevocable living trust naming the children as beneficiaries and Jaylen and Avery as the trustees

- Here is the word problem that I attempted: Jamie Lee and Ross were stunned to find that their family of two has grown to a family of five! They were expecting twins, but when the babies were born, they discovered that they were actually the parents of triplets! Ross immediately had worries of being able to provide for the growing family: diapers, formula, college expenses times three! What if something happened to him or Jamie Lee? How would the surviving parent be able to provide for such a large family? Jamie Lee and Ross decided to purchase life insurance for Ross because his is the higher income at this time and because it would be more devastating if his income was lost due to his death. They have allowed $9,600 for funeral costs. Calculate their living expenses for 6 months to include all monthly expenses, excluding credit card debt and entertainment. Note that Ross's mother lives close and will be providing childcare to their triplets once Jamie Lee goes back to work at the…3. How much life insurance do you need? Calculating resources- Part 2 Dmitri and Frances Ivanov have completed Step 1 of their needs analysis worksheet and determined that they need $2,418,000 to maintain the projected lifestyle of Frances (age 41) and their two children (ages 7 and 11) in the event of Dmitri’s (the primary earner’s) death. The Ivanovs also have certain financial resources available after Dmitri’s death, however, so their life insurance needs are lower than this amount. If Dmitri dies, Frances will be eligible to receive Social Security survivors’ benefits—approximately $3,500 a month ($42,000 a year) until the youngest child graduates from high school in 9 years. After the children leave home, Frances will be able to work full-time and earn an estimated $52,000 a year (after taxes) until she retires at age 65. After Frances turns 65, she’ll receive approximately $3,100 a month ($37,200 a year) from her own Social Security and retirement benefits. The life…Help wanted! With the triplets now in high school, Jamie Lee and Ross have made good decisions so far concerning their financial and investment strategies. They budgeted throughout the years and are right on track to reaching their long-term investment goals of paying the triplets’ college tuition and accumulating enough to purchase a beach house to enjoy when Jamie Lee and Ross retire. The pair are still researching where to best invest the $50,000 that Ross had recently inherited from his uncle’s estate. Ross and Jamie Lee would like to invest in several varieties of stocks, bonds, or other investment instruments to supplement their retirement income goals. Jamie Lee and Ross have been researching stock investment opportunities that my offer lucrative returns, but they know there is plenty of risk involved. They are aware that they must develop a firm plan to assess the risk of the various investment types so they may have the proper balance between high, moderate, and low risk…

- Jamie Lee and Ross were stunned to find that their family of two has grown to a family of five! They were expecting twins, but when the babies were born, they discovered that they were actually the parents of triplets! Ross immediately had worries of being able to provide for the growing family: diapers, formula, college expenses times three! What if something happened to him or Jamie Lee? How would the surviving parent be able to provide for such a large family? Jamie Lee and Ross decided to purchase life insurance for Ross because his is the higher income at this time and because it would be more devastating if his income was lost due to his death. They have allowed $9,600 for funeral costs. I really need help in calculate their living expenses for 6 months to include all monthly expenses, excluding credit card debt and entertainment. Note that Ross's mother lives close and will be providing childcare to their triplets once Jamie Lee goes back to work at the bakery for half…Suppose you are 28 and married. You and your spouse file for income taxes jointly. You are in the 25% tax bracket. You are considering a few personal investment issues. Suppose you expect a significant career or family change in three years, which requires substantial initial capital commitment (e.g., starting your own business, relocating abroad, buying a house, children going to college, etc.). Which of the following seems to be the most appropriate investment strategy? a.Take a loan to buy an investment condo. b.Use your savings to buy a small number of stocks that you believe to rise in price. c.Use your savings to buy well-diversified stock mutual fund shares. d.Use your savings to buy well-diversified bond mutual fund shares.Tom and Tina are updating their financial plan and are concerned that they might not have enough life insurance coverage for their family, which includes two children, ages 4 and 10. They have determined that their annual income is $70,000 and their net worth is now $150,000. What is the amount of life insurance they should carry using the easy method?