Question: "Why can't we pay our shareholders a dividend?" shouts your new boss at Polar Opposites. "This income statement you prepared for me says we earned $5 million in our first year!" You recently prepared the financial statements below. Although net income was $5 million, cash flow from operating activities was a negative $5 million. This just didn't make any sense to your boss. Required: Prepare a memo explaining how net income could be positive and operating cash flows is negative. Include in your report the calculation of operating cash flows of negative $5 million using the indirect method.

Question: "Why can't we pay our shareholders a dividend?" shouts your new boss at Polar Opposites. "This income statement you prepared for me says we earned $5 million in our first year!" You recently prepared the financial statements below. Although net income was $5 million, cash flow from operating activities was a negative $5 million. This just didn't make any sense to your boss. Required: Prepare a memo explaining how net income could be positive and operating cash flows is negative. Include in your report the calculation of operating cash flows of negative $5 million using the indirect method.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 59BE

Related questions

Question

Question:

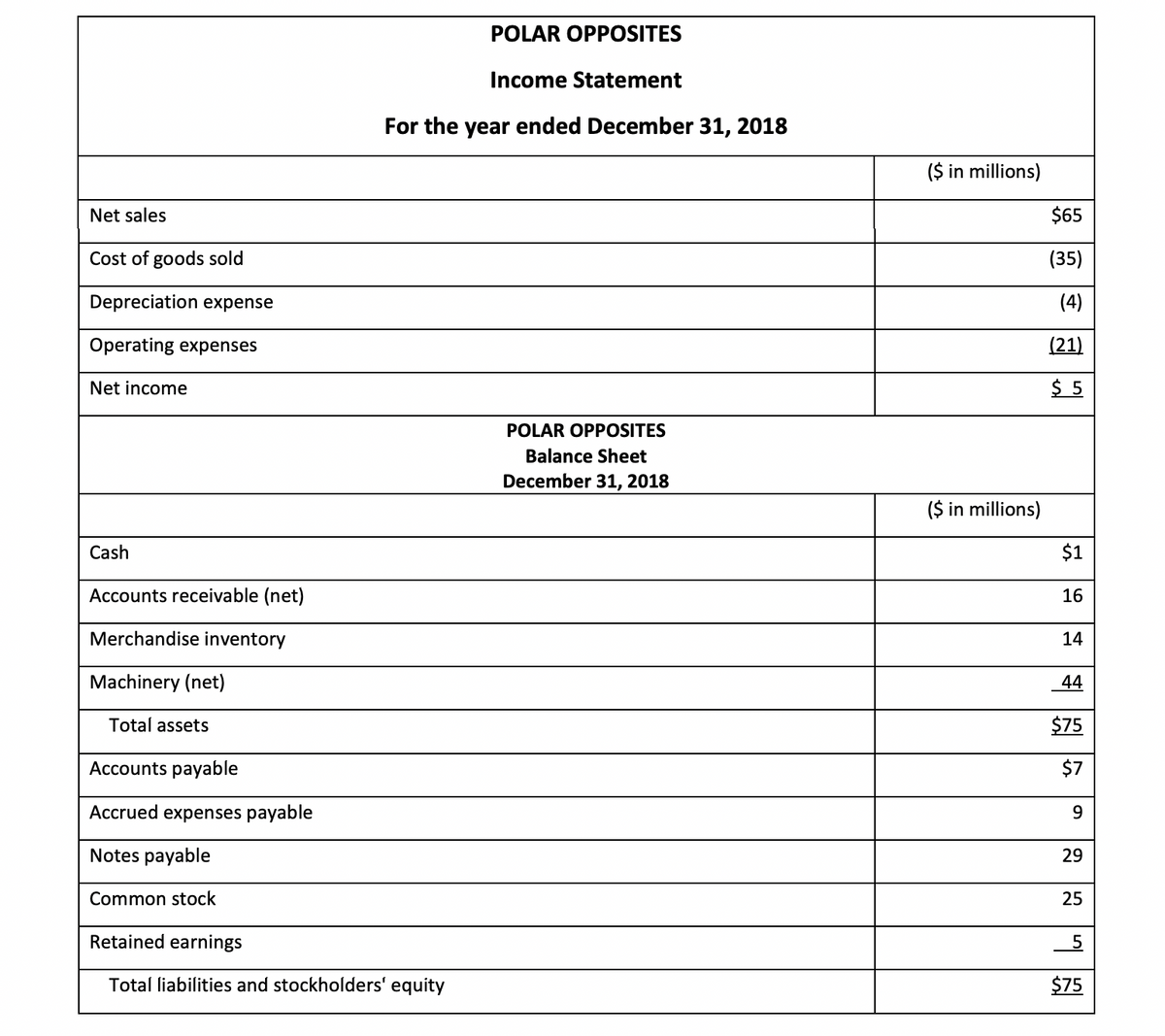

"Why can't we pay our shareholders a dividend?" shouts your new boss at Polar Opposites. "This income statement you prepared for me says we earned $5 million in our first year!" You recently prepared the financial statements below.

Although net income was $5 million, cash flow from operating activities was a negative $5 million. This just didn't make any sense to your boss. Required: Prepare a memo explaining how net income could be positive and operating cash flows is negative. Include in your report the calculation of operating cash flows of negative $5 million using the indirect method.

Transcribed Image Text:POLAR OPPOSITES

Income Statement

For the year ended December 31, 2018

($ in millions)

Net sales

$65

Cost of goods sold

(35)

Depreciation expense

(4)

Operating expenses

(21)

Net income

$ 5

POLAR OPPOSITES

Balance Sheet

December 31, 2018

($ in millions)

Cash

$1

Accounts receivable (net)

16

Merchandise inventory

14

Machinery (net)

44

Total assets

$75

Accounts payable

$7

Accrued expenses payable

9

Notes payable

29

Common stock

25

Retained earnings

Total liabilities and stockholders' equity

$75

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,