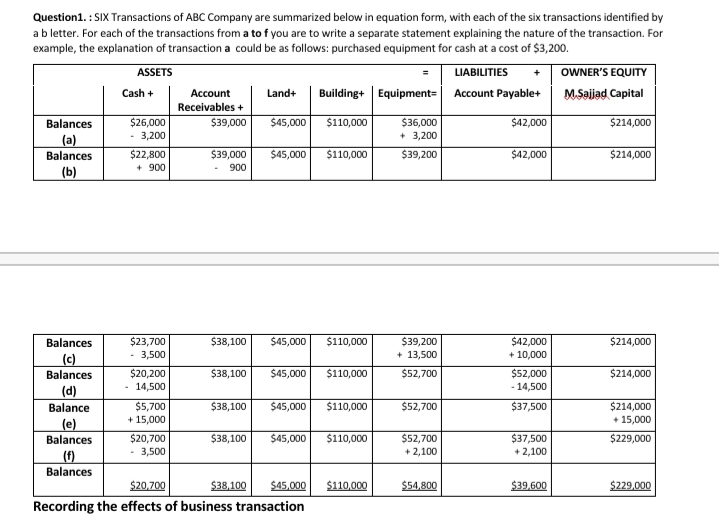

Question1. : SIX Transactions of ABC Company are summarized below in equation form, with each of the six transactions identified by abletter. For each of the transactions from a to f you are to write a separate statement explaining the nature of the transaction. For example, the explanation of transaction a could be as follows: purchased equipment for cash at a cost of $3,200. ASSETS LIABILITIES OWNER'S EQUITY Cash + Account Land+ Building+ Equipment= Account Payable+ M.Saljad Capital Receivables + $39,000 $110,000 Balances (a) Balances $26,000 - 3,200 $45,000 $42,000 $214,000 $36,000 + 3,200 $39,200 $22,800 + 900 $39,000 $42,000 $214,000 $45,000 $110,000 900 (b) Balances $214,000 $23,700 - 3,500 $20,200 $38,100 $45,000 $110,000 $39,200 + 13,500 $42,000 + 10,000 (c) Balances $214,000 $38,100 $45,000 $110,000 $52,700 $52,000 - 14,500 14,500 (d) Balance $37,500 $5,700 + 15,000 $38,100 $45,000 $110,000 $52,700 (e) Balances $214,000 + 15,000 $229,000 $45,000 $20,700 3,500 $52,700 + 2,100 $37,500 + 2,100 $38,100 $110,000 (1) Balances $20,700 $38,100 $45.000 $110,000 $54,800 $39.600 $229.000 Recording the effects of business transaction

Question1. : SIX Transactions of ABC Company are summarized below in equation form, with each of the six transactions identified by abletter. For each of the transactions from a to f you are to write a separate statement explaining the nature of the transaction. For example, the explanation of transaction a could be as follows: purchased equipment for cash at a cost of $3,200. ASSETS LIABILITIES OWNER'S EQUITY Cash + Account Land+ Building+ Equipment= Account Payable+ M.Saljad Capital Receivables + $39,000 $110,000 Balances (a) Balances $26,000 - 3,200 $45,000 $42,000 $214,000 $36,000 + 3,200 $39,200 $22,800 + 900 $39,000 $42,000 $214,000 $45,000 $110,000 900 (b) Balances $214,000 $23,700 - 3,500 $20,200 $38,100 $45,000 $110,000 $39,200 + 13,500 $42,000 + 10,000 (c) Balances $214,000 $38,100 $45,000 $110,000 $52,700 $52,000 - 14,500 14,500 (d) Balance $37,500 $5,700 + 15,000 $38,100 $45,000 $110,000 $52,700 (e) Balances $214,000 + 15,000 $229,000 $45,000 $20,700 3,500 $52,700 + 2,100 $37,500 + 2,100 $38,100 $110,000 (1) Balances $20,700 $38,100 $45.000 $110,000 $54,800 $39.600 $229.000 Recording the effects of business transaction

Chapter16: Statement Of Cash Flows

Section: Chapter Questions

Problem 5MC: Which of these transactions would be part of the operating section? A. land purchased, with note...

Related questions

Topic Video

Question

In this question interpret the effects of business transaction. You are to write a separate statement explaining the nature of the transaction from a to f.

Transcribed Image Text:Question1. : SIX Transactions of ABC Company are summarized below in equation form, with each of the six transactions identified by

ab letter. For each of the transactions from a to f you are to write a separate statement explaining the nature of the transaction. For

example, the explanation of transaction a could be as follows: purchased equipment for cash at a cost of $3,200.

ASSETS

LIABILITIES

OWNER'S EQUITY

Account

Receivables +

Building+ Equipment=

Cash +

Land+

Account Payable+

M.Sajad Capital

Balances

$26,000

$39,000

$45,000

$110,000

$36,000

$42,000

$214,000

3,200

+ 3,200

(a)

Balances

$22,800

$39,000

$45,000

$110,000

$39,200

$42,000

$214,000

(b)

+ 900

900

Balances

$23,700

$38,100

$45,000

$110,000

$214,000

$39,200

+ 13,500

$42,000

+ 10,000

- 3,500

(c)

Balances

$20,200

14,500

$38,100

$45,000

$110,000

$52,700

$214,000

$52,000

- 14,500

(d)

$5,700

$38,100

$45,000

$110,000

$52,700

$37,500

$214,000

+ 15,000

Balance

+ 15,000

(e)

Balances

$20,700

$38,100

$45,000

$110,000

$52,700

$37,500

$229,000

3,500

+ 2,100

+ 2,100

(f)

Balances

$20,700

$38,100

$45,000

$110,000

$54,800

$39,600

$229,000

Recording the effects of business transaction

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning