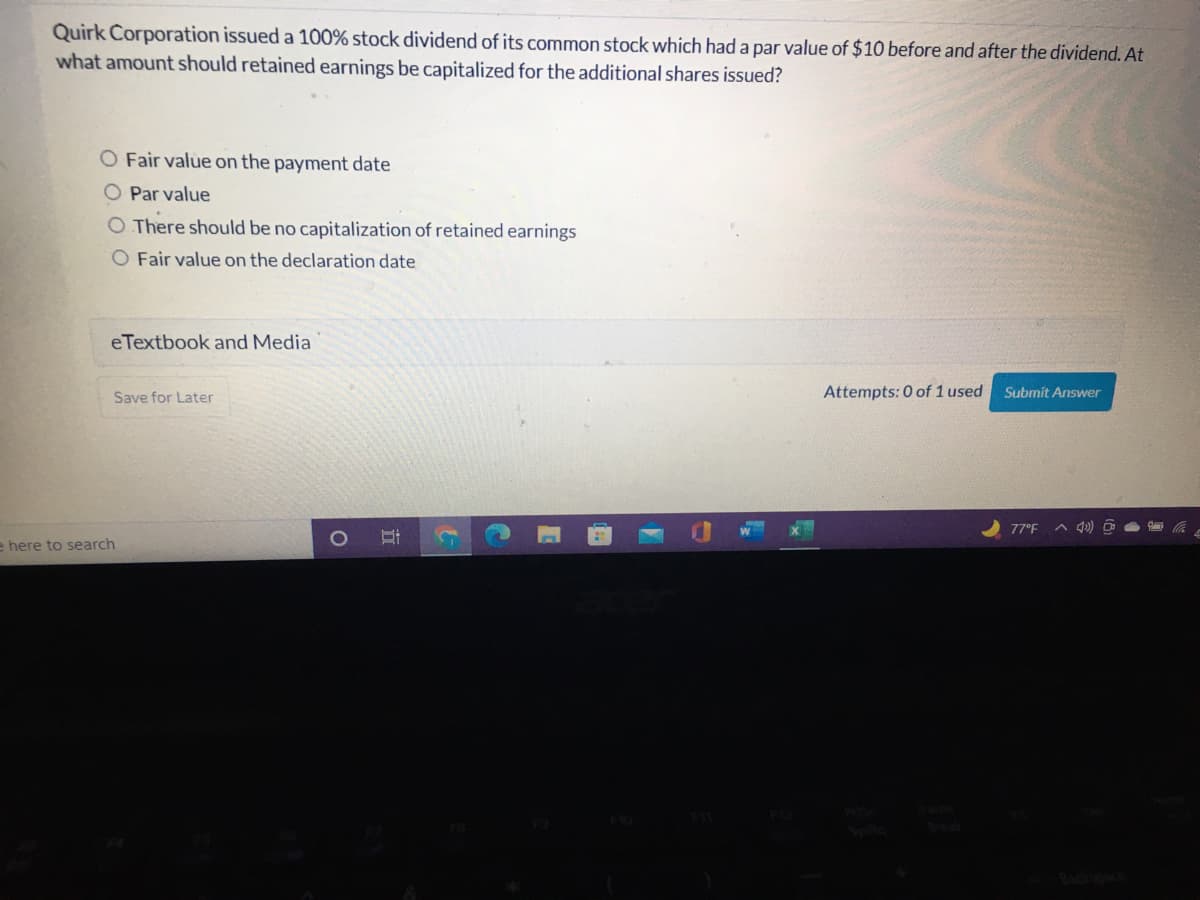

Quirk Corporation issued a 100% stock dividend of its common stock which had a par value of $10 before and after the dividend. At what amount should retained earnings be capitalized for the additional shares issued? O Fair value on the payment date Par value O There should be no capitalization of retained earnings O Fair value on the declaration date eTextbook and Media Save for Later Attempts: 0 of 1 used Submit Answer 77°F

Quirk Corporation issued a 100% stock dividend of its common stock which had a par value of $10 before and after the dividend. At what amount should retained earnings be capitalized for the additional shares issued? O Fair value on the payment date Par value O There should be no capitalization of retained earnings O Fair value on the declaration date eTextbook and Media Save for Later Attempts: 0 of 1 used Submit Answer 77°F

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 3RE

Related questions

Question

Transcribed Image Text:Quirk Corporation issued a 100% stock dividend of its common stock which had a par value of $10 before and after the dividend. At

what amount should retained earnings be capitalized for the additional shares issued?

O Fair value on the payment date

Par value

O There should be no capitalization of retained earnings

O Fair value on the declaration date

eTextbook and Media

Save for Later

Attempts: 0 of 1 used

Submit Answer

77°F ^ Q)

e here to search

1O

行

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning