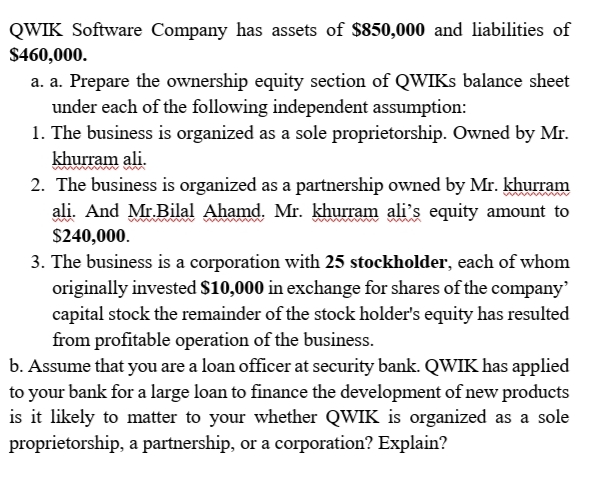

QWIK Software Company has assets of $850,000 and liabilities of $460,000. a. a. Prepare the ownership equity section of QWIKS balance sheet under each of the following independent assumption: 1. The business is organized as a sole proprietorship. Owned by Mr. khurram ali. 2. The business is organized as a partnership owned by Mr. khurram ali. And Mr.Bilal Ahamd. Mr. khurram ali's equity amount to $240,000. 3. The business is a corporation with 25 stockholder, each of whom originally invested $10,000 in exchange for shares of the company capital stock the remainder of the stock holder's equity has resulted from profitable operation of the business. b. Assume that you are a loan officer at security bank. QWIK has applied to your bank for a large loan to finance the development of new products is it likely to matter to your whether QWIK is organized as a sole proprietorship, a partnership, or a corporation? Explain?

QWIK Software Company has assets of $850,000 and liabilities of $460,000. a. a. Prepare the ownership equity section of QWIKS balance sheet under each of the following independent assumption: 1. The business is organized as a sole proprietorship. Owned by Mr. khurram ali. 2. The business is organized as a partnership owned by Mr. khurram ali. And Mr.Bilal Ahamd. Mr. khurram ali's equity amount to $240,000. 3. The business is a corporation with 25 stockholder, each of whom originally invested $10,000 in exchange for shares of the company capital stock the remainder of the stock holder's equity has resulted from profitable operation of the business. b. Assume that you are a loan officer at security bank. QWIK has applied to your bank for a large loan to finance the development of new products is it likely to matter to your whether QWIK is organized as a sole proprietorship, a partnership, or a corporation? Explain?

Chapter13: Choice Of Business Entity—general Tax And Nontax Factors/formation

Section: Chapter Questions

Problem 55P

Related questions

Question

100%

Transcribed Image Text:QWIK Software Company has assets of $850,000 and liabilities of

$460,000.

a. a. Prepare the ownership equity section of QWIKS balance sheet

under each of the following independent assumption:

1. The business is organized as a sole proprietorship. Owned by Mr.

khurram ali.

2. The business is organized as a partnership owned by Mr. khurram

ali. And Mr.Bilal Ahamd. Mr. khurram ali's equity amount to

$240,000.

3. The business is a corporation with 25 stockholder, each of whom

originally invested $10,000 in exchange for shares of the company

capital stock the remainder of the stock holder's equity has resulted

from profitable operation of the business.

b. Assume that you are a loan officer at security bank. QWIK has applied

to your bank for a large loan to finance the development of new products

is it likely to matter to your whether QWIK is organized as a sole

proprietorship, a partnership, or a corporation? Explain?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you