o Leni and Isko are partners of Lenko Partnership which is currently liquidating. The firm's financial information is as follows: Cash 20,000 Accounts Payable 30,000 Accounts Receivable 60,000 Payable to Isko 20,000 Receivable from Leni 10,000 Leni, Capital – 60% 250,000 Inventory 120,000 Isko, Capital – 40% 200,000 Equipment, net 290,000 ТОTAL 500,000 ТОTAL 500,000

o Leni and Isko are partners of Lenko Partnership which is currently liquidating. The firm's financial information is as follows: Cash 20,000 Accounts Payable 30,000 Accounts Receivable 60,000 Payable to Isko 20,000 Receivable from Leni 10,000 Leni, Capital – 60% 250,000 Inventory 120,000 Isko, Capital – 40% 200,000 Equipment, net 290,000 ТОTAL 500,000 ТОTAL 500,000

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

The first image is the only requirement. The second image was the given and other guide to answer the question if needed (Optional). This is under

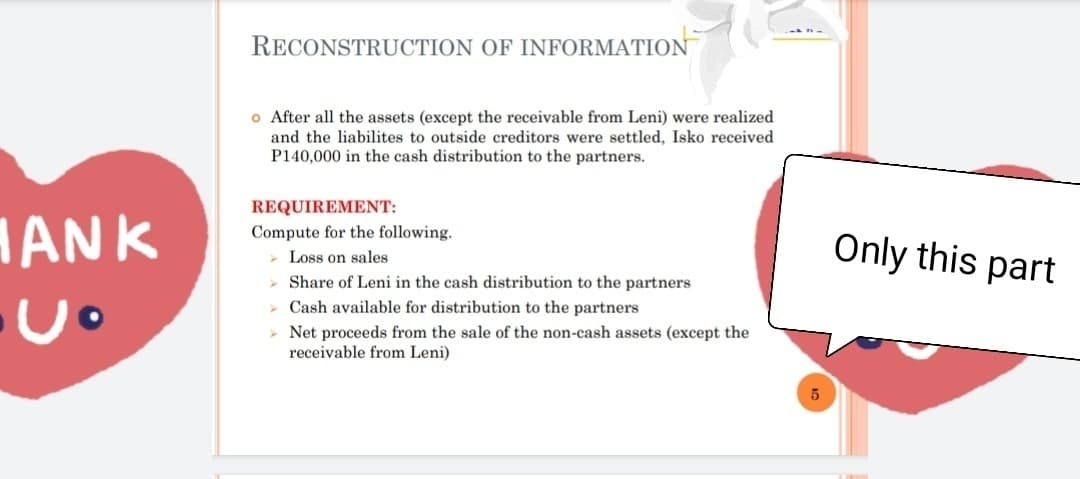

Transcribed Image Text:RECONSTRUCTION OF INFORMATION

o After all the assets (except the receivable from Leni) were realized

and the liabilites to outside creditors were settled, Isko received

P140,000 in the cash distribution to the partners.

REQUIREMENT:

ANK

Compute for the following.

Only this part

Loss on sales

> Share of Leni in the cash distribution to the partners

> Cash available for distribution to the partners

> Net proceeds from the sale of the non-cash assets (except the

receivable from Leni)

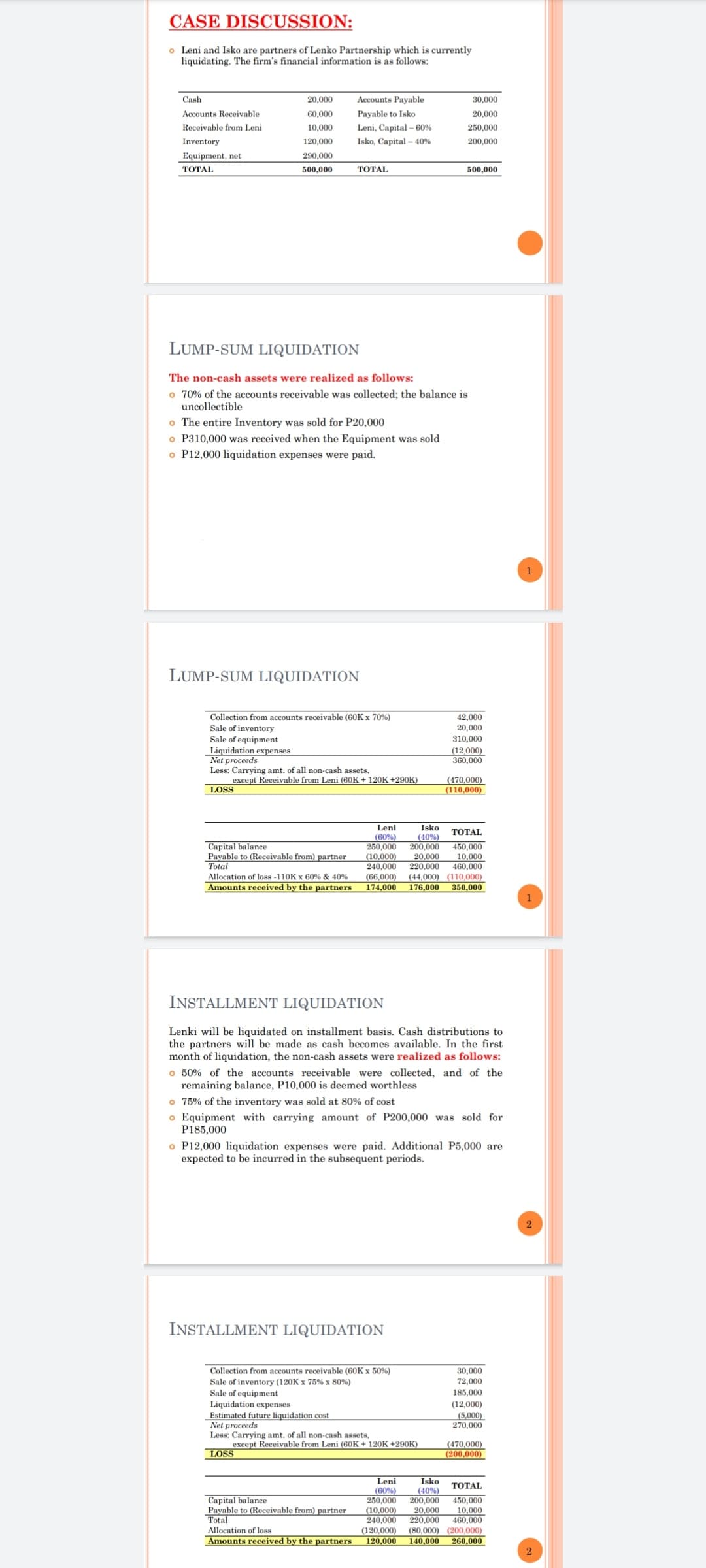

Transcribed Image Text:CASE DISCUSSION:

o Leni and Isko are partners of Lenko Partnership which is currently

liquidating. The firm's financial information is as follows:

Cash

20,000

Accounts Payable

30,000

Accounts Receivable

60,000

Payable to Isko

20,000

Receivable from Leni

10,000

Leni, Capital – 60%

250,000

Inventory

120,000

Isko, Capital – 40%

200,000

Equipment, net

290,000

ТОTAL

500,000

ТОTAL

500,000

LUMP-SUM LIQUIDATION

The non-cash assets were realized as follows:

o 70% of the accounts receivable was collected; the balance is

uncollectible

o The entire Inventory was sold for P20,000

o P310,000 was received when the Equipment was sold

o P12,000 liquidation expenses were paid.

LUMP-SUM LIQUIDATION

Collection from accounts receivable (60K x 70%)

Sale of inventory

Sale of equipment

Liquidation expenses

Net proceeds

Less: Carrying amt. of all non-cash assets,

except Receivable from Leni (60K + 120K +290K)

42,000

20,000

310,000

(12,000)

360.000

(470,000)

(110,000)

LOSS

Leni

(60%)

250.000

Isko

(40%)

ТОTAL

Capital balance

Pavable to (Receivable from) partner

Total

450,000

200,000

20,000

220,000

(44.000) (110,000)

176,000

(10,000)

240,000

10,000

460,000

Allocation of loss -110K x 60% & 40%

(66,000)

Amounts received by the partners

174,000

350.000

1

INSTALLMENT LIQUIDATION

Lenki will be liquidated on installment basis. Cash distributions to

the partners will be made as cash becomes available. In the first

month of liquidation, the non-cash assets were realized as follows:

o 50% of the accounts receivable were collected, and of the

remaining balance, P10,000 is deemed worthless

o 75% of the inventory was sold at 80% of cost

o Equipment with carrying amount of P200,000 was sold for

P185,000

o P12,000 liquidation expenses were paid. Additional P5,000 are

expected to be incurred in the subsequent periods.

INSTALLMENT LIQUIDATION

30,000

72,000

Collection from accounts receivable (60K x 50%)

Sale of inventory (120K x 75% x 80%)

Sale of equipment

Liquidation expenses

Estimated future liquidation cost

Net proceeds

Less: Carrying amt. of all non-cash assets,

except Receivable from Leni (60K + 120K +290K)

185,000

(12,000)

(5,000)

270,000

(470,000)

(200,000)

LOSS

Leni

(60%)

250.000

(10,000)

240.000

Isko

(40%)

200,000

20,000

220,000

ΤΟTAL

Capital balance

Payable to (Receivable from) partner

Total

450,000

10,000

460,000

Allocation of loss

(120,000)

(80,000) (200,000)

Amounts received by the partners

120,000

140,000

260,000

2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education