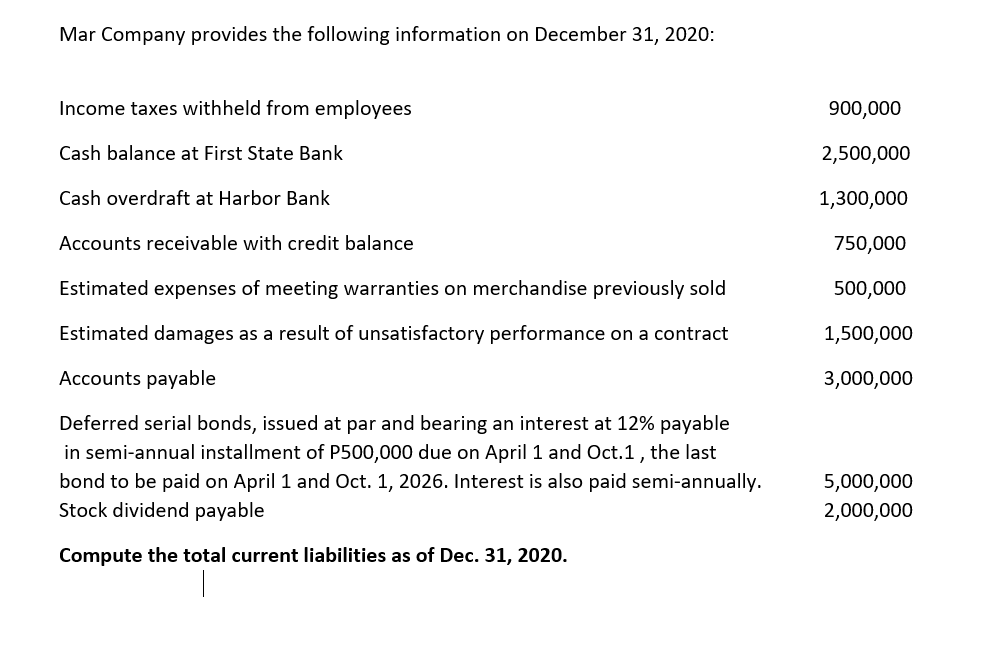

Mar Company provides the following information on December 31, 2020: Income taxes withheld from employees Cash balance at First State Bank Cash overdraft at Harbor Bank Accounts receivable with credit balance Estimated expenses of meeting warranties on merchandise previously sold Estimated damages as a result of unsatisfactory performance on a contract Accounts payable Deferred serial bonds, issued at par and bearing an interest at 12% payable in semi-annual installment of P500,000 due on April 1 and Oct.1, the last bond to be paid on April 1 and Oct. 1, 2026. Interest is also paid semi-annually. Stock dividend payable Compute the total current liabilities as of Dec. 31, 2020. 900,000 2,500,000 1,300,000 750,000 500,000 1,500,000 3,000,000 5,000,000 2,000,000

Mar Company provides the following information on December 31, 2020: Income taxes withheld from employees Cash balance at First State Bank Cash overdraft at Harbor Bank Accounts receivable with credit balance Estimated expenses of meeting warranties on merchandise previously sold Estimated damages as a result of unsatisfactory performance on a contract Accounts payable Deferred serial bonds, issued at par and bearing an interest at 12% payable in semi-annual installment of P500,000 due on April 1 and Oct.1, the last bond to be paid on April 1 and Oct. 1, 2026. Interest is also paid semi-annually. Stock dividend payable Compute the total current liabilities as of Dec. 31, 2020. 900,000 2,500,000 1,300,000 750,000 500,000 1,500,000 3,000,000 5,000,000 2,000,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 28E: On January 1, 2019, Northfield Corporation becomes delinquent on a 100,000, 14% note to First...

Related questions

Question

Transcribed Image Text:Mar Company provides the following information on December 31, 2020:

Income taxes withheld from employees

Cash balance at First State Bank

Cash overdraft at Harbor Bank

Accounts receivable with credit balance

Estimated expenses of meeting warranties on merchandise previously sold

Estimated damages as a result of unsatisfactory performance on a contract

Accounts payable

Deferred serial bonds, issued at par and bearing an interest at 12% payable

in semi-annual installment of P500,000 due on April 1 and Oct.1, the last

bond to be paid on April 1 and Oct. 1, 2026. Interest is also paid semi-annually.

Stock dividend payable

Compute the total current liabilities as of Dec. 31, 2020.

900,000

2,500,000

1,300,000

750,000

500,000

1,500,000

3,000,000

5,000,000

2,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub