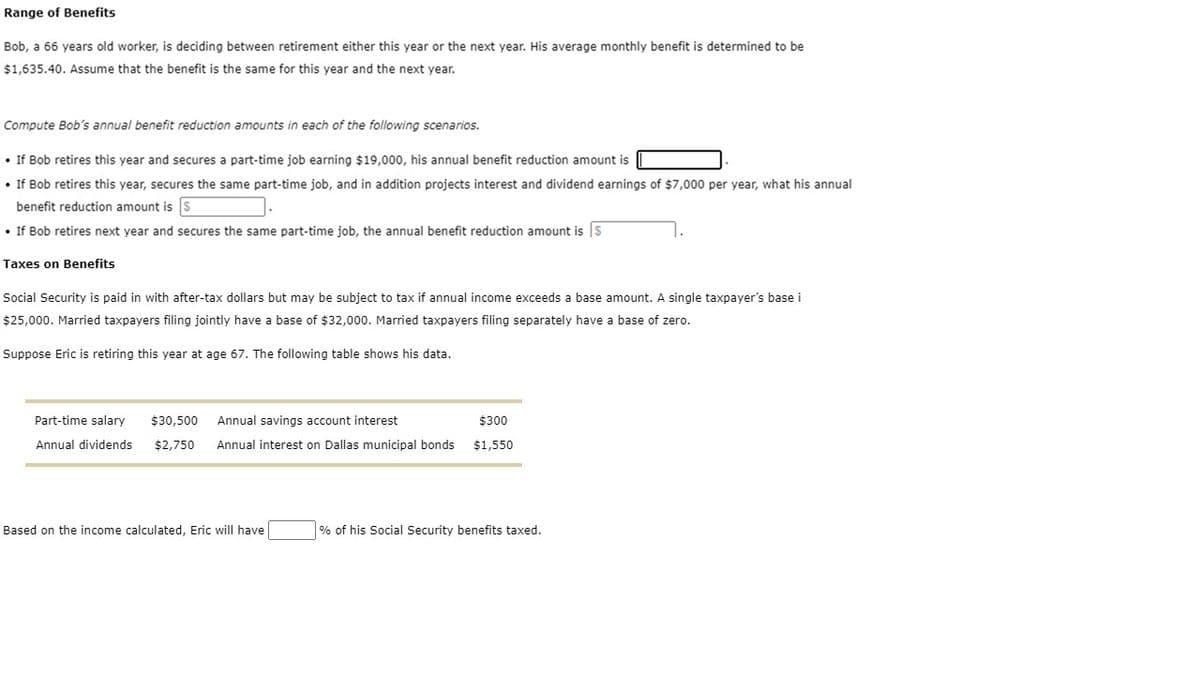

Range of Benefits Bob, a 66 years old worker, is deciding between retirement either this year or the next year. His average monthly benefit is determined to be $1,635.40. Assume that the benefit is the same for this year and the next year. Compute Bob's annual benefit reduction amounts in each of the following scenarios. • If Bob retires this year and secures a part-time job earning $19,000, his annual benefit reduction amount is • If Bob retires this year, secures the same part-time job, and in addition projects interest and dividend earnings of $7,000 per year, what his annual benefit reduction amount is S • If Bob retires next year and secures the same part-time job, the annual benefit reduction amount is S Taxes on Benefits

Range of Benefits Bob, a 66 years old worker, is deciding between retirement either this year or the next year. His average monthly benefit is determined to be $1,635.40. Assume that the benefit is the same for this year and the next year. Compute Bob's annual benefit reduction amounts in each of the following scenarios. • If Bob retires this year and secures a part-time job earning $19,000, his annual benefit reduction amount is • If Bob retires this year, secures the same part-time job, and in addition projects interest and dividend earnings of $7,000 per year, what his annual benefit reduction amount is S • If Bob retires next year and secures the same part-time job, the annual benefit reduction amount is S Taxes on Benefits

Chapter6: Business Expenses

Section: Chapter Questions

Problem 58P

Related questions

Question

Transcribed Image Text:Range of Benefits

Bob, a 66 years old worker, is deciding between retirement either this year or the next year. His average monthly benefit is determined to be

$1,635.40. Assume that the benefit is the same for this year and the next year.

Compute Bob's annual benefit reduction amounts in each of the following scenarios.

• If Bob retires this year and secures a part-time job earning $19,000, his annual benefit reduction amount is

• If Bob retires this year, secures the same part-time job, and in addition projects interest and dividend earnings of $7,000 per year, what his annual

benefit reduction amount is $

• If Bob retires next year and secures the same part-time job, the annual benefit reduction amount is S

Taxes on Benefits

Social Security is paid in with after-tax dollars but may be subject to tax if annual income exceeds a base amount. A single taxpayer's base i

$25,000. Married taxpayers filing jointly have a base of $32,000. Married taxpayers filing separately have a base of zero.

Suppose Eric is retiring this year at age 67. The following table shows his data.

Part-time salary $30,500

Annual savings account interest

$300

Annual dividends $2,750 Annual interest on Dallas municipal bonds $1,550

Based on the income calculated, Eric will have

% of his Social Security benefits taxed.

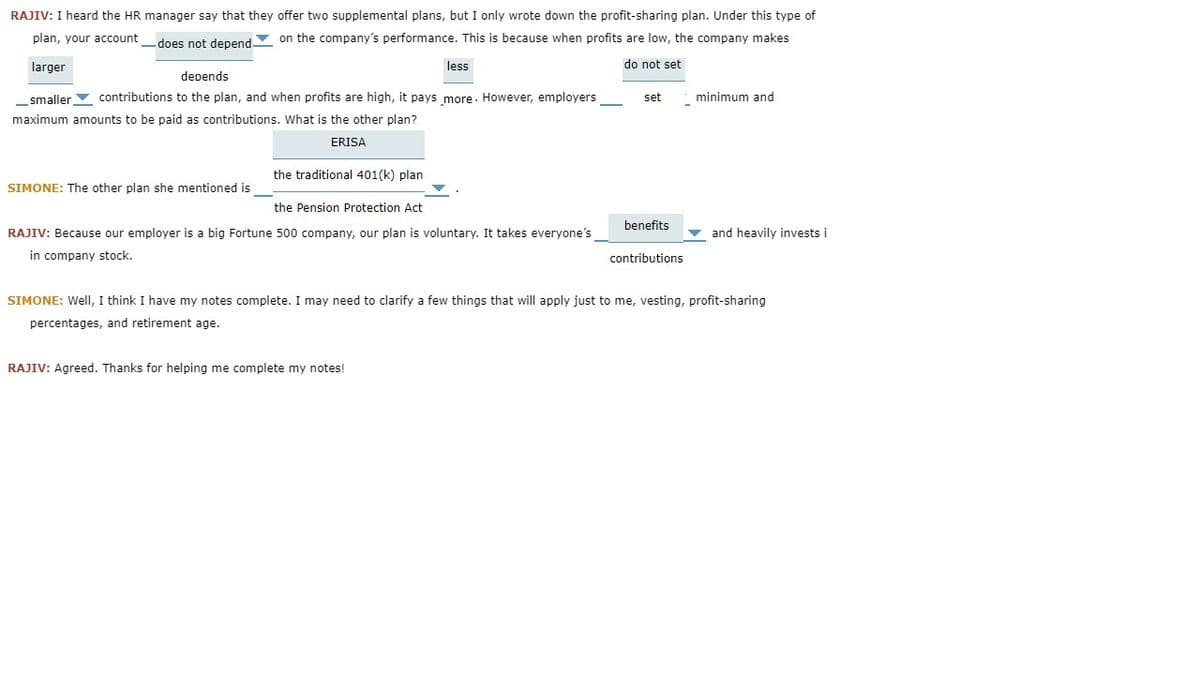

Transcribed Image Text:RAJIV: I heard the HR manager say that they offer two supplemental plans, but I only wrote down the profit-sharing plan. Under this type of

plan, your account does not depend on the company's performance. This is because when profits are low, the company makes

larger

less

do not set

depends

_smaller contributions to the plan, and when profits are high, it pays more. However, employers

maximum amounts to be paid as contributions. What is the other plan?

ERISA

SIMONE: The other plan she mentioned is

the traditional 401(k) plan

the Pension Protection Act

RAJIV: Because our employer is a big Fortune 500 company, our plan is voluntary. It takes everyone's

in company stock.

set

RAJIV: Agreed. Thanks for helping me complete my notes!

benefits

contributions

minimum and

and heavily invests i

SIMONE: Well, I think I have my notes complete. I may need to clarify a few things that will apply just to me, vesting, profit-sharing

percentages, and retirement age.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage