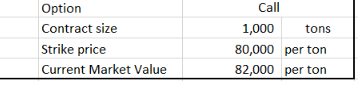

The option is currently A. In-the-money B. At-the-money C. Out-the-money 2. Determine the In/At/Out- the money by _____ 3. Determine the Intrinsic Value

Q: Find the future value of $1 000 at 7.8% p.a. simple interest over 14 months.

A: Simple interest does not consider the effect of compounding of interest over the period of time. The…

Q: Use the data below to construct the advance/decline line and Arms ratio for the market. Volume is in…

A: ARMS index is used by traders to understand the market sentiment by measuring the market supply and…

Q: The present value of a 7 year lease that requires payments of $650 at the beginning of every quarter…

A: Solution:- When an equal payment is made each period at beginning of the period, it is called…

Q: a-1. EPS a-2. PE b. Synergy value

A: Earning per share refers to the amount that shows the company’s profit per outstanding share…

Q: ants to make a few deposits so that she can withdraw $5000 per year at the end of each year for the…

A: The present value of future cash flow is the equivalent value of money today considering the…

Q: Suppose the term structure of annualized interest rate is flat at 5%. Consider the following three…

A: Bonds can be defined as investment securities in which the investor lends capital or money to an…

Q: Finance . Zinc has beginning equity of $295,000, total revenues of $95,000, and total expenses of…

A: Ending equity means total shareholders equity at the end of the year. Ending equity can be…

Q: A price level adjusted mortgage (PLAM) is made with the following terms: Amount = $96,600…

A: Annual effective rate Annual effective rate is calculated as shown below. Annual effective…

Q: ou are preparing to produce some goods for sale. You will sell them in one year and you will incur…

A: Initial Cost = $76,000. Cost of Capital = 7%

Q: How much should he invest in each account to make enough interest while minimizing his risk?

A: Interest Amount: It is the amount earned on an investment account or the monetary charge on the…

Q: Insteadofbuyingamotorcyclethisyear,youdecidedtopostponeitforanother3yearsanddeposityour money worth…

A: Inflation is the general loss of the value of money over time. It happens because of demand for…

Q: Assume you have $1600 to invest in a 4 year CD with an APR 2.8% compounded daily. When the CD…

A: Certificate of deposit (CD) A certificate of deposit (CD) is a type of savings account where the…

Q: How much should Bianca have in a savings account that is earning 2.50% compounded monthly, if she…

A: Solution:- When an equal amount is withdrawan each period at end of the period, it is called…

Q: uestion 11 Find the monthly house payment necessary to amortize the following loan. In order to…

A: Data given: Loan amount= $70000 Rate= 12% N=15 year Formula to be used for calculating monthly…

Q: Assume us government's issues 170,000,000 treasury bill for settlement of citizen's claims. So which…

A: Here the government issues 170000000 treasury bills to settle the claim, so we have to decide which…

Q: The average inflation rate in Canada is 3% per year. It means that purchasing power of $1 decreases…

A: the total decrease in the purchasing power of money in 10 years when in n years the decrease is…

Q: .Intrinsic valuation and relative valuation

A: Preference shares refer to the shares that enable the shareholders for receiving dividend that is…

Q: Kraft Heinz stock sells for $40.95 per share. It has 1.22 billion shares outstanding. It has bonds…

A: Weighted average cost of capital is that cost which was borne by the company for using the funds…

Q: If P250,000 is invested at 6% compounded semiannually, how much interest is earned in 10 years?…

A: Simple interest is computed on the principle component of a loan or the first deposit into a savings…

Q: The market premium, E(RM)−rfis estimated to be 8% per annum, while the risk-free return (rf) is…

A: This question can be solved with the help of CAPM model Ke=Rf+β(Km-Rf) Ke=Expected return Rf=Risk…

Q: State Dep Rec Norm Boom Prob 0.1 0.3 0.4 0.2 Stock A Return A -0.25 0.12 0.33 0.42 Stock B Return B…

A: Portfolio Return is that when the investor will invest the amount in more than one stock of…

Q: Please answer the following, based on the information provided for the firm ABC: the company…

A: Current Selling price is $980 Par Value of Bond is $1000 Coupon rate is 6% To Find: Pre tax Cost of…

Q: I have a question how does the value of i (interest rate) is 0.075 in the example eventhough it said…

A: From the solution, n = 20, i = 7.5% = 0.075 P = 100000 Present value of annuity is =…

Q: Imagine that Hazim Islamic bank, has the following asset and financial details:…

A: Tier 1 Capital Paid up ordinary shares = RM 30 million Share Premium = RM 5 million…

Q: (ADLA), Maria is a divorce attorney who practices law in San Francisco. She wants to join the…

A: Given: Annuity due Annual payment “PMT” = $500 Annual interest rate “r” = 8.5% Cost of lifetime…

Q: Review the CFLO from operations for Q1 2022 for GE (link below) and answer the following: Make…

A: The link has been provided for accessing the cash flow, we can check from the statement provided in…

Q: The shareholders of ABC Corporation would like to know the valuation of their ownership in the…

A:

Q: b-1. What was the arithmetic average risk premium over this period? (A negative answer should be…

A: Standard Deviation: It is a statistical measure used to measure the dispersion of a set of data…

Q: Solve for the unknown interest rate in each of the following: (Do not round intermediate…

A: Future value is a value of an investment on a specific date in the future. It is calculated as:…

Q: At age 25, you start work for a company and are offered two retirement options. Retirement option 1:…

A: Compound Interest: It is the interest earned on interest. It is calculated depend on initial…

Q: Determine the payback period for each investment alternative and identify the alternative Stuart…

A: Payback period (PBP) refers to the period or duration within which the company is able to recover…

Q: Calculate Hasbro's and UHS's ROE for each fiscal year. Verify if the answers below are correct if…

A: Solution:- In the given sum, financial statements of only Hasbro Company are given. So, the…

Q: Development costs of a new product are estimated to be $100,000 per year for five years. Annual…

A: Net Present value : It is the net of the present value of cash inflows and cash outflows. Formula to…

Q: 1.1) For $20,000, you can purchase a five-year annuity that will pay $5000 per year for five years.…

A: Here, Details of 1.1 Present Value (PV) is $20,000 Annuity Payment (PMT) is $5,000 Time Period…

Q: AlendingcompanyoffersaloanworthPhP24,000withasimpleannualinterestrateof10%foratermof 6 months and to…

A: APR is a company's rate of return based on the amount of interest it accrues by borrowing or…

Q: Calculate the company's WACC. Note: Do not round intermediate calculations and enter your answer as…

A: Weighted Average Cost of Capital: It refers to the company's cost of the capital where each source…

Q: A contractionary monetary policy decreases interest rates in order to slow the growth of the money…

A: A country's central bank can use a variety of measures known as monetary policy to encourage stable…

Q: At a discount rate of 8% the Net Present Value (NPV) of a project is 65 million. At a discount rate…

A: Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only one…

Q: compute each investment payback period.

A: Payback Period: It is a method used in capital budgeting to determine the time it will take for the…

Q: Dr. Magneto is evaluating whether to open a private MRI clinic in leased office space in a local…

A: After tax salvage value of machine After tax salvage value of machine is calculated as shown below.…

Q: (e) both (c) and (d) 11

A: Prepayment penalty refers to the charges charged by the lenders if all or some part of the…

Q: The exact interest on a loan of P3728 at 7.4% annual simple interest for 95 days is Round your…

A: The rate at which you borrow or lend money is called simple interest. If a borrower takes money from…

Q: Alpha Corporation issued serial preference shares that has a total par value of P2,000,000, a term…

A: Given: Particulars Amount Par value (FV) 2,000,000 Years(NPER) 5 Coupon rate 15%…

Q: The value of an investment can be defined in numerous ways. Which is FALSE? a. It is the value…

A: There are many different types valuation method of the investment some depends on the cash flow or…

Q: Which of the followings are not considered as principles of Islamic banking?* A. Shared…

A: The principles of Islamic banking are based on Sharia Law. There are some principles that are…

Q: You are choosing between two projects. The cash flows for the projects are given in the following…

A: NPV is a Capital budgeting techniques which help in decision making that the Project is viable or…

Q: Use the information provided to answer the questions. Use the information provided below to…

A: NPV is technique in capital budgeting which help in decision making on the basis of future cash flow…

Q: Question 2: National bank is an all-equity firm with an after-tax operating income of $350 million…

A:

Q: A payday lender might lend you $350 now, and you'll be asked to pay them back when your paycheck…

A: A payday loan is a high-risk loan given for a short period of time on the promise that it will be…

Q: You have just been hired as a financial manager for BEE Inc. Management has provided you with the…

A: Please note that as per the guidelines, we are required to answer only the first three questions.…

1. The option is currently

A. In-the-money

B. At-the-money

C. Out-the-money

2. Determine the In/At/Out- the money by _____

3. Determine the Intrinsic Value

Step by step

Solved in 2 steps

- Assume the following: LC Exposure = 10,000; Spot Rate = $1.00/LC1.00; 1 Year Forward = $0.98/LC1.00; 1 Year Strike Price = $0.975; Premium = $0.005; and WACC = 8.0% p.a. Please calculate the cost of the forward contract and the option.How long do the following options have before they expire?Call Price = $5Put Price = $9Stock Price = $65Exercise Price = $70Risk-free rate = 3% per annum4d) Price the European call having strike 60 GBP. Use the two-periods binomial model with u = 1.1, d = 0.9 and ∆t = 1. Assume that the risk free rate is 5%, and the current price of the underlying asset is 50 GBP.

- Graph the value of Call European option (K=80, T=1year, S0=80, r = 5%, volatility=10%) over a) a range of underlying prices (40 to 150) b)a range of maturities ( 2 years to maturities) c) a range of volatilities (1% to 100%)Consider the following data for a certain share. Current Price = S0 = Rs. 80 Exercise Price = E = Rs. 90 Standard deviation of continuously compounded annual return = \sigma = 0.5 Expiration period of the call option = 3 months Risk – free interest rate per annum = 6 percent a. What is the value of the call option? Use the normal distribution table. b. What is the value of a put option?The stock index future contract involves buying and selling the stock index for a specified price at a specified date. How much will a contract price be if it involves the S&P SmallCap index with a current value of P200 times the index for 1700 points?* a. P340,000 b. P314,000 c. P8,500 d. P342,000

- (Capital Asset Pricing Model) The expected return for the general market is 10.5 percent, and the risk premium in the market is 6.8 percent. Tasaco, LBM, and Exxos have betas of 0.809, 0.677, and 0.578, respectively. What are the appropriate expected rates of return for the three securities? Question content area bottom Part 1 The appropriate expected return of Tasaco is enter your response here%. (Round to two decimal places.) Part 2 The appropriate expected return of LBM is enter your response here%. (Round to two decimal places.) Part 3 The appropriate expected return of Exxos is enter your response here%. (Round to two decimal places.)What is the price of an American CALL option that is expected to pay a dividend of $2 in three months with the following parameters? s0 = $40d = $2 in 3 monthsk = $43 r = 10%sigma = 20%T = 0.5 years (required precision 0.01 +/- 0.01)Consider a stock worth K12.50 that can go up or down by 15% per period. Assume aperiod process of one. The risk-free rate is 10%. Find the value of the call optiontoday, with the strike price of K11.50.

- Inputs Annual Coupon Rate 3.70% Number of Years 6 Face Value (PAR) $1,000 Price $1,100.27 In Excel: a. What is the YTM? b. Calculate Macaulay’s duration and co c. Plot the price-yield relationship using Excel. Hint: (Calculate prices for different yields, e.g., yields from 0.5% to 23.5%; then your x axis is yields and y axis prices. The plot should show an inverse relationship .A. Consider a stock worth K12.50 that can go up or down by 15% per period. Assume aperiod process of one. The risk-free rate is 10%. Find the value of the call optiontoday, with the strike price of K11.50. B. What is the price of a European put option on a non-dividend paying stock when thestock price is K69, the strike price is K70, the risk-free rate is 5% per annum, thevolatility is 35% per annum, and the time to maturity is 6 months?Q1 A long forward contract on a commodity that was negotiated some time ago will expire in 1 months and has a delivery price of $70. The current spot price of the commodity is $59. The risk-free interest rate (with continuous compounding) is 0.09. What is the value of the long forward contract? Q2 A short forward contract on an investment asset that yields 0.08 and was negotiated some time ago will expire in 4 months and has a delivery price of $50. The current spot price of the commodity is $48. The risk-free interest rate (with continuous compounding) is 0.02. What is the value of the short forward contract? Q3 A long forward contract on a commodity that was negotiated some time ago will expire in 2 months and has a delivery price of $76. The current spot price of the commodity is $66. The risk-free interest rate (with continuous compounding) is 2.2%. What is the value of the long forward contract?