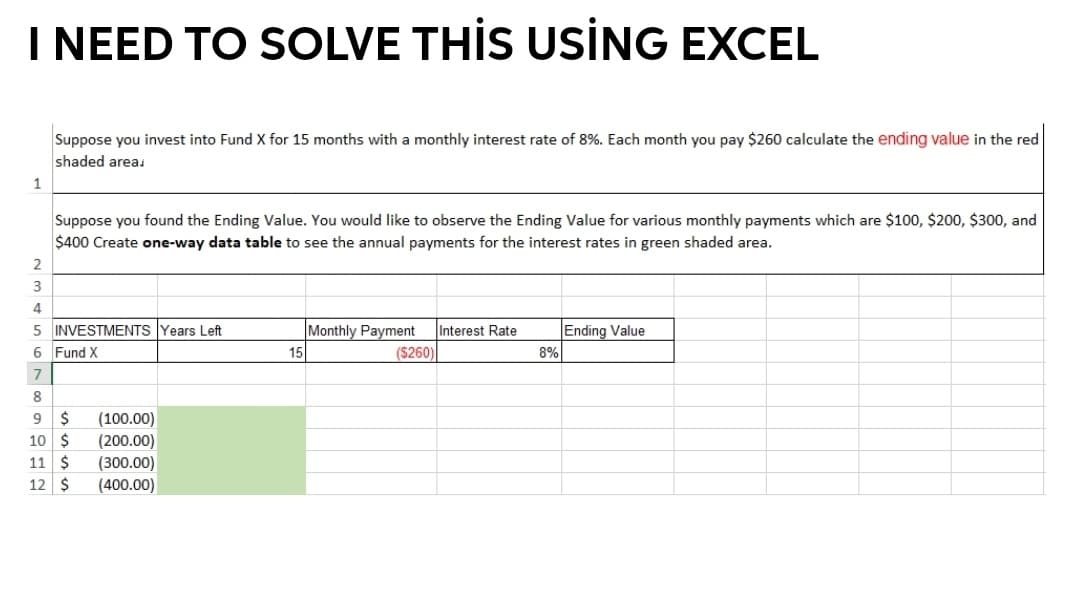

Suppose you invest into Fund X for 15 months with a monthly interest rate of 8%. Each month you pay $260 calculate the ending value in the red shaded area. 1 Suppose you found the Ending Value. You would like to observe the Ending Value for various monthly payments which are $100, $200, $300, and $400 Create one-way data table to see the annual payments for the interest rates in green shaded area. 2 4. 5 INVESTMENTS Years Left 6 Fund X Monthly Payment 15 Ending Value 8% Interest Rate (S260) 7 8 10 $ 11 $ 12 $ (100.00) (200.00) (300.00) (400.00)

Suppose you invest into Fund X for 15 months with a monthly interest rate of 8%. Each month you pay $260 calculate the ending value in the red shaded area. 1 Suppose you found the Ending Value. You would like to observe the Ending Value for various monthly payments which are $100, $200, $300, and $400 Create one-way data table to see the annual payments for the interest rates in green shaded area. 2 4. 5 INVESTMENTS Years Left 6 Fund X Monthly Payment 15 Ending Value 8% Interest Rate (S260) 7 8 10 $ 11 $ 12 $ (100.00) (200.00) (300.00) (400.00)

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 13EB: Conestoga Plumbing plans to invest in a new pump that is anticipated to provide annual savings for...

Related questions

Question

Transcribed Image Text:I NEED TO SOLVE THİS USIİNG EXCEL

Suppose you invest into Fund X for 15 months with a monthly interest rate of 8%. Each month you pay $260 calculate the ending value in the red

shaded area.

1

Suppose you found the Ending Value. You would like to observe the Ending Value for various monthly payments which are $100, $200, $300, and

$400 Create one-way data table to see the annual payments for the interest rates in green shaded area.

2

4

5 INVESTMENTS Years Left

6 Fund X

Monthly Payment

($260)

Interest Rate

Ending Value

15

8%

7

8

(100.00)

(200.00)

(300.00)

(400.00)

10 $

11 $

12 $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning