Rates of return (annualized) in two investment portfolios are compared over the last 12 quarters. They are considered similar in safety. but portfolio Bis advertised as being "less volatile." (a) At a = .025, does the sample show that portfolio A has significantly greater variance in rates of return than portfolio ? (b) At a = .025, is there a significant difference in the means? Portfolio B 9.10 Portfolio A 5.27 18.83 8.69 12.47 7.70 4.10 6.58 5.66 7.54 8.66 7.13 7.70 7.65 9.72 7.66 9.66 8.73 4.82 8.95 11.56 7.73 11.46 9.97 Dpicture Click here for the Excel Data File (a-1) Choose the appropriate hypotheses. Assume o,2 is the variance of the Portfolio A and og? is the variance of the Portfolio B. Ho: 0Aiog2s1 versus H: OA2ior?>1 Ho: OA2I0B2 = 1 versus H: OA2iog? 1

Rates of return (annualized) in two investment portfolios are compared over the last 12 quarters. They are considered similar in safety. but portfolio Bis advertised as being "less volatile." (a) At a = .025, does the sample show that portfolio A has significantly greater variance in rates of return than portfolio ? (b) At a = .025, is there a significant difference in the means? Portfolio B 9.10 Portfolio A 5.27 18.83 8.69 12.47 7.70 4.10 6.58 5.66 7.54 8.66 7.13 7.70 7.65 9.72 7.66 9.66 8.73 4.82 8.95 11.56 7.73 11.46 9.97 Dpicture Click here for the Excel Data File (a-1) Choose the appropriate hypotheses. Assume o,2 is the variance of the Portfolio A and og? is the variance of the Portfolio B. Ho: 0Aiog2s1 versus H: OA2ior?>1 Ho: OA2I0B2 = 1 versus H: OA2iog? 1

MATLAB: An Introduction with Applications

6th Edition

ISBN:9781119256830

Author:Amos Gilat

Publisher:Amos Gilat

Chapter1: Starting With Matlab

Section: Chapter Questions

Problem 1P

Related questions

Question

100%

Please help

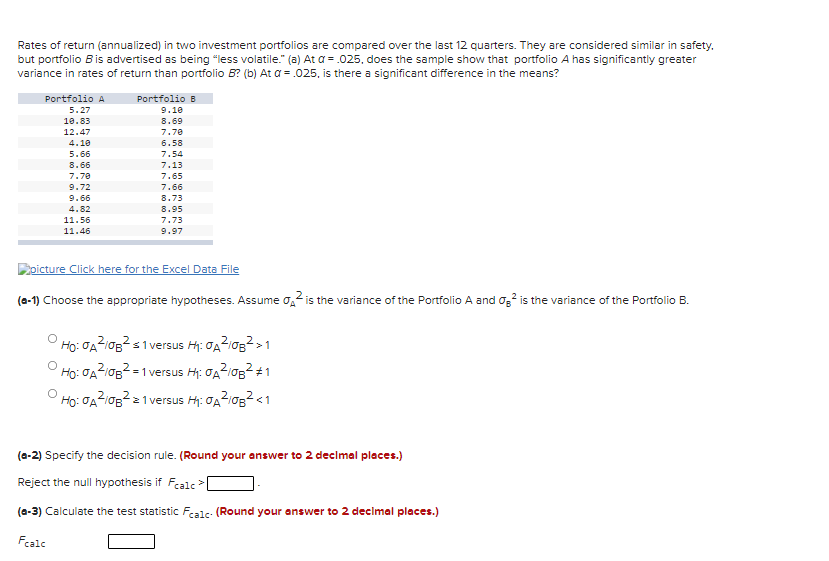

Transcribed Image Text:Rates of return (annualized) in two investment portfolios are compared over the last 12 quarters. They are considered similar in safety.

but portfolio B is advertised as being "less volatile." (a) At a = .025, does the sample show that portfolio A has significantly greater

variance in rates of return than portfolio B? (b) At a = .025, is there a significant difference in the means?

Portfolio A

Portfolio B

5.27

9.10

8.69

7.70

10.83

12.47

4.10

6.58

5.66

7.54

8.66

7.13

7.70

7.65

9.72

7.66

9.66

8.73

4.82

8.95

11.56

7.73

11.46

9.97

picture Click here for the Excel Data File

(a-1) Choose the appropriate hypotheses. Assume o,2 is the variance of the Portfolio A and og is the variance of the Portfolio B.

Ho: TA2i0g2 s1 versus H: 0A2i0g2>1

Ho: TA-i0B = 1 versus H: OA2/0B2 #1

Ho: TA-I0B21 versus H: OA2iog?<1

(0-2) Specify the decision rule. (Round your answer to 2 declmal places.)

Reject the null hypothesis if Fcale >

(a-3) Calculate the test statistic Fealc- (Round your answer to 2 decimal places.)

Feale

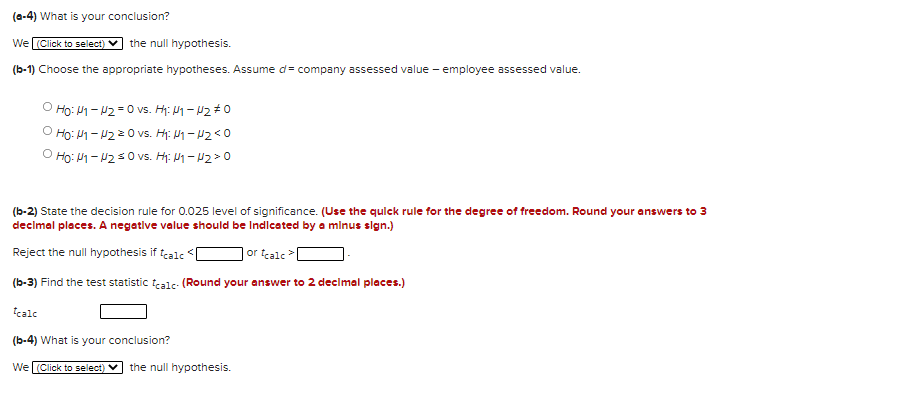

Transcribed Image Text:(a-4) What is your conclusion?

We (Click to select)

the null hypothesis.

(b-1) Choose the appropriate hypotheses. Assume d= company assessed value - employee assessed value.

Ho: M1 - 2 =0 vs. H: 1 – P2#0

Ho: M1- U220 vs. Hi: My – H2<0

O Ho: 1 - 2 s0 vs. H: M1 - 12>0

(b-2) State the decision rule for 0.025 level of significance. (Use the qulck rule for the degree of freedom. Round your answers to 3

decimal places. A negative value should be Indicated by a minus sign.)

Reject the null hypothesis if tcale

| or tcalc>[

(b-3) Find the test statistic tealc- (Round your answer to 2 declmal places.)

tcale

(b-4) What is your conclusion?

WeL(Click to select) V

the null hypothesis.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

Elementary Statistics: Picturing the World (7th E…

Statistics

ISBN:

9780134683416

Author:

Ron Larson, Betsy Farber

Publisher:

PEARSON

The Basic Practice of Statistics

Statistics

ISBN:

9781319042578

Author:

David S. Moore, William I. Notz, Michael A. Fligner

Publisher:

W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:

9781319013387

Author:

David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:

W. H. Freeman