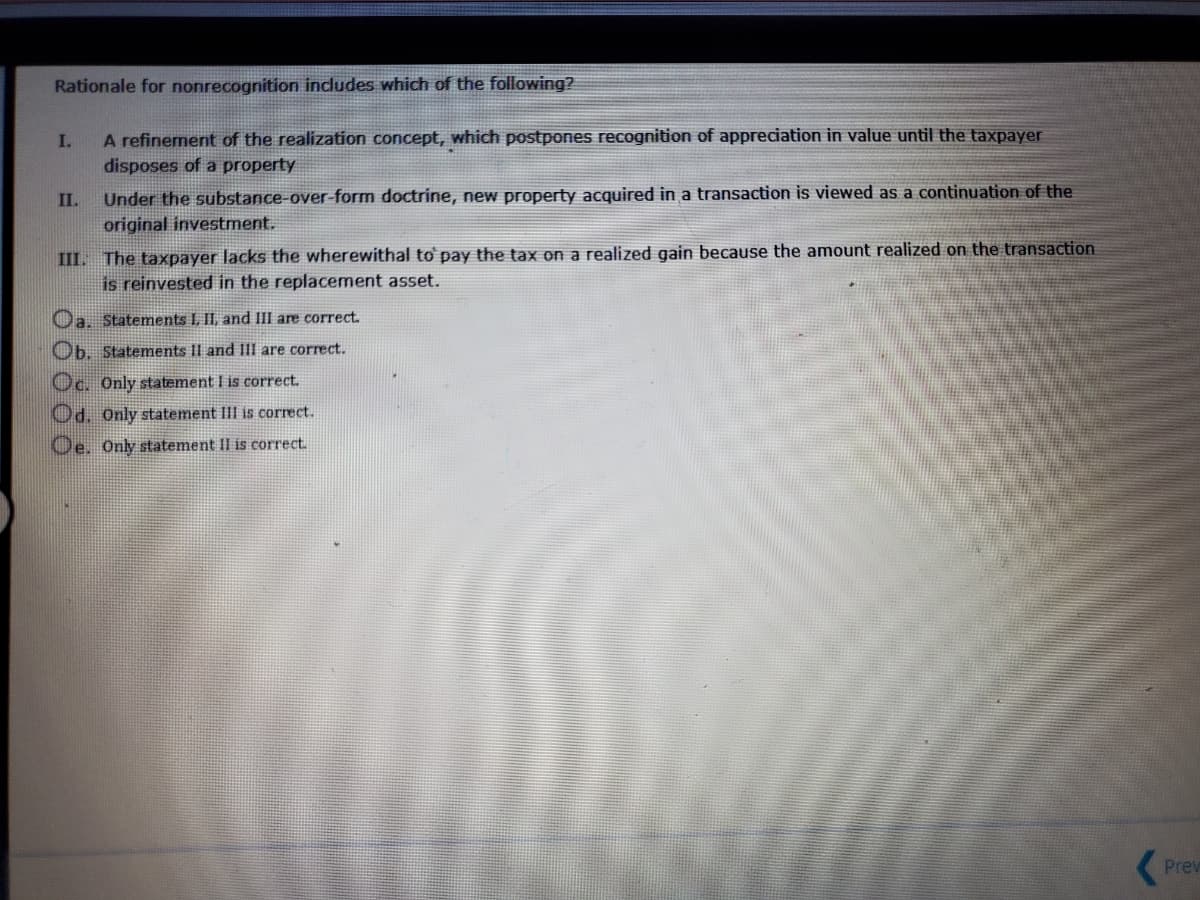

Rationale for nonrecognition includes which of the following? I. A refinement of the realization concept, which postpones recognition of appreciation in value until the taxpayer disposes of a property Under the substance-over-form doctrine, new property acquired in a transaction is viewed as a continuation of the original investment. II. III. The taxpayer lacks the wherewithal to pay the tax on a realized gain because the amount realized on the transaction is reinvested in the replacement asset. Oa, Statements I, II, and III are correct. Ob. Statements II and 111 are correct. Oc. Only statement I is correct. Od. Only statement III is correct. Oe. Only statement II is correct.

Rationale for nonrecognition includes which of the following? I. A refinement of the realization concept, which postpones recognition of appreciation in value until the taxpayer disposes of a property Under the substance-over-form doctrine, new property acquired in a transaction is viewed as a continuation of the original investment. II. III. The taxpayer lacks the wherewithal to pay the tax on a realized gain because the amount realized on the transaction is reinvested in the replacement asset. Oa, Statements I, II, and III are correct. Ob. Statements II and 111 are correct. Oc. Only statement I is correct. Od. Only statement III is correct. Oe. Only statement II is correct.

Chapter11: Investor Losses

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

Transcribed Image Text:Rationale for nonrecognition includes which of the following?

I.

A refinement of the realization concept, which postpones recognition of appreciation in value until the taxpayer

disposes of a property

Under the substance-over-form doctrine, new property acquired in a transaction is viewed as a continuation of the

original investment.

II.

III. The taxpayer lacks the wherewithal to pay the tax on a realized gain because the amount realized on the transaction

is reinvested in the replacement asset.

Oa. Statements L, II, and III are correct.

Ob. Statements II and III are correct.

Oc. Only statement I is correct.

Od. Only statement III is correct.

Oe. Only statement II is correct.

Prev

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT