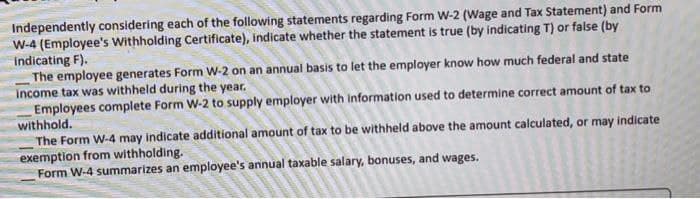

Independently considering each of the following statements regarding Form W-2 (Wage and Tax Statement) and Form W-4 (Employee's Withholding Certificate), indicate whether the statement is true (by indicating T) or false (by indicating F). The employee generates Form W-2 on an annual basis to let the employer know how much federal and state income tax was withheld during the year. Employees complete Form W-2 to supply employer with information used to determine correct amount of tax to withhold. The Form W-4 may indicate additional amount of tax to be withheld above the amount calculated, or may indicate exemption from withholding. Form W-4 summarizes an employee's annual taxable salary, bonuses, and wages.

Independently considering each of the following statements regarding Form W-2 (Wage and Tax Statement) and Form W-4 (Employee's Withholding Certificate), indicate whether the statement is true (by indicating T) or false (by indicating F). The employee generates Form W-2 on an annual basis to let the employer know how much federal and state income tax was withheld during the year. Employees complete Form W-2 to supply employer with information used to determine correct amount of tax to withhold. The Form W-4 may indicate additional amount of tax to be withheld above the amount calculated, or may indicate exemption from withholding. Form W-4 summarizes an employee's annual taxable salary, bonuses, and wages.

Chapter9: Payroll, Estimated Payments, And Retirement Plans

Section: Chapter Questions

Problem 5MCQ

Related questions

Question

Transcribed Image Text:Independently considering each of the following statements regarding Form W-2 (Wage and Tax Statement) and Form

W-4 (Employee's Withholding Certificate), indicate whether the statement is true (by indicating T) or false (by

indicating F).

The employee generates Form W-2 on an annual basis to let the employer know how much federal and state

income tax was withheld during the year.

Employees complete Form W-2 to supply employer with information used to determine correct amount of tax to

withhold.

The Form W-4 may indicate additional amount of tax to be withheld above the amount calculated, or may indicate

exemption from withholding.

Form W-4 summarizes an employee's annual taxable salary, bonuses, and wages.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage