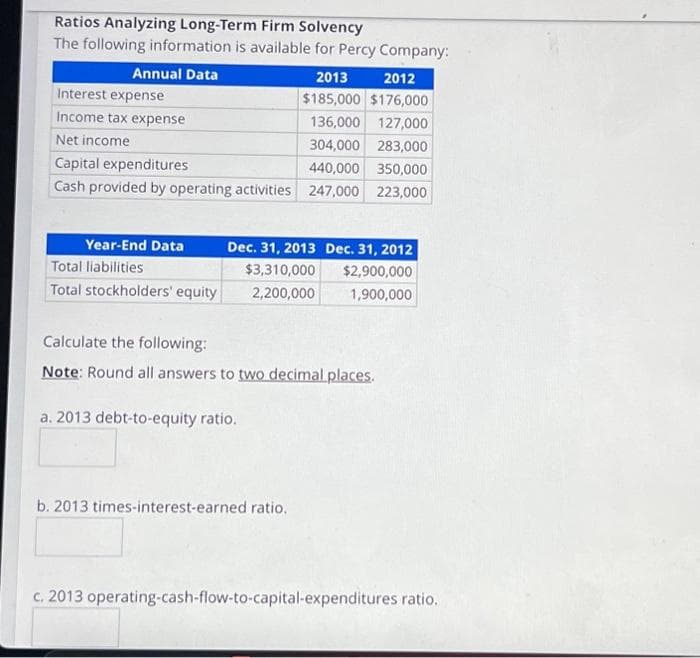

Ratios Analyzing Long-Term Firm Solvency The following information is available for Percy Company: Annual Data 2013 Interest expense 2012 $185,000 $176,000 136,000 127,000 Income tax expense Net income 304,000 283,000 Capital expenditures 440,000 350,000 Cash provided by operating activities 247,000 223,000 Year-End Data Dec. 31, 2013 Dec. 31, 2012 $3,310,000 $2,900,000 1,900,000 Total liabilities Total stockholders' equity 2,200,000 Calculate the following: Note: Round all answers to two decimal places. a. 2013 debt-to-equity ratio. b. 2013 times-interest-earned ratio. c. 2013 operating-cash-flow-to-capital-expenditures ratio.

Ratios Analyzing Long-Term Firm Solvency The following information is available for Percy Company: Annual Data 2013 Interest expense 2012 $185,000 $176,000 136,000 127,000 Income tax expense Net income 304,000 283,000 Capital expenditures 440,000 350,000 Cash provided by operating activities 247,000 223,000 Year-End Data Dec. 31, 2013 Dec. 31, 2012 $3,310,000 $2,900,000 1,900,000 Total liabilities Total stockholders' equity 2,200,000 Calculate the following: Note: Round all answers to two decimal places. a. 2013 debt-to-equity ratio. b. 2013 times-interest-earned ratio. c. 2013 operating-cash-flow-to-capital-expenditures ratio.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter13: Financial Statement Analysis

Section: Chapter Questions

Problem 13.8E

Related questions

Question

ssubject :-Accounting

Transcribed Image Text:Ratios Analyzing Long-Term Firm Solvency

The following information is available for Percy Company:

Annual Data

2013

Interest expense

2012

$185,000 $176,000

136,000 127,000

Income tax expense

Net income

304,000 283,000

Capital expenditures

440,000 350,000

Cash provided by operating activities 247,000 223,000

Year-End Data

Dec. 31, 2013 Dec. 31, 2012

Total liabilities

$3,310,000

$2,900,000

Total stockholders' equity 2,200,000

1,900,000

Calculate the following:

Note: Round all answers to two decimal places.

a. 2013 debt-to-equity ratio.

b. 2013 times-interest-earned ratio.

c. 2013 operating-cash-flow-to-capital-expenditures ratio.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning