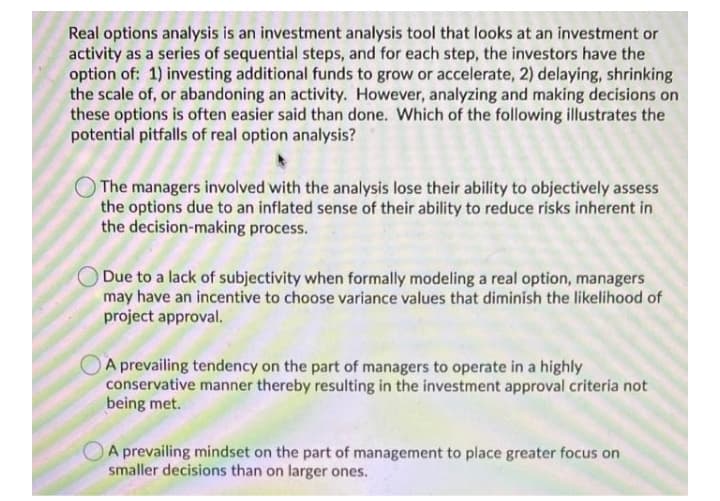

Real options analysis is an investment analysis tool that looks at an investment or activity as a series of sequential steps, and for each step, the investors have the option of: 1) investing additional funds to grow or accelerate, 2) delaying, shrinking the scale of, or abandoning an activity. However, analyzing and making decisions on these options is often easier said than done. Which of the following illustrates the potential pitfalls of real option analysis? The managers involved with the analysis lose their ability to objectively assess the options due to an inflated sense of their ability to reduce risks inherent in the decision-making process. Due to a lack of subjectivity when formally modeling a real option, managers may have an incentive to choose variance values that diminish the likelihood of project approval. A prevailing tendency on the part of managers to operate in a highly conservative manner thereby resulting in the investment approval criteria not being met. A prevailing mindset on the part of management to place greater focus on smaller decisions than on larger ones.

Real options analysis is an investment analysis tool that looks at an investment or activity as a series of sequential steps, and for each step, the investors have the option of: 1) investing additional funds to grow or accelerate, 2) delaying, shrinking the scale of, or abandoning an activity. However, analyzing and making decisions on these options is often easier said than done. Which of the following illustrates the potential pitfalls of real option analysis? The managers involved with the analysis lose their ability to objectively assess the options due to an inflated sense of their ability to reduce risks inherent in the decision-making process. Due to a lack of subjectivity when formally modeling a real option, managers may have an incentive to choose variance values that diminish the likelihood of project approval. A prevailing tendency on the part of managers to operate in a highly conservative manner thereby resulting in the investment approval criteria not being met. A prevailing mindset on the part of management to place greater focus on smaller decisions than on larger ones.

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter25: Portfolio Theory And Asset Pricing Models

Section: Chapter Questions

Problem 4MC: You have been hired at the investment firm of Bowers Noon. One of its clients doesnt understand the...

Related questions

Question

Transcribed Image Text:Real options analysis is an investment analysis tool that looks at an investment or

activity as a series of sequential steps, and for each step, the investors have the

option of: 1) investing additional funds to grow or accelerate, 2) delaying, shrinking

the scale of, or abandoning an activity. However, analyzing and making decisions on

these options is often easier said than done. Which of the following illustrates the

potential pitfalls of real option analysis?

The managers involved with the analysis lose their ability to objectively assess

the options due to an inflated sense of their ability to reduce risks inherent in

the decision-making process.

Due to a lack of subjectivity when formally modeling a real option, managers

may have an incentive to choose variance values that diminish the likelihood of

project approval.

A prevailing tendency on the part of managers to operate in a highly

conservative manner thereby resulting in the investment approval criteria not

being met.

A prevailing mindset on the part of management to place greater focus on

smaller decisions than on larger ones.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning