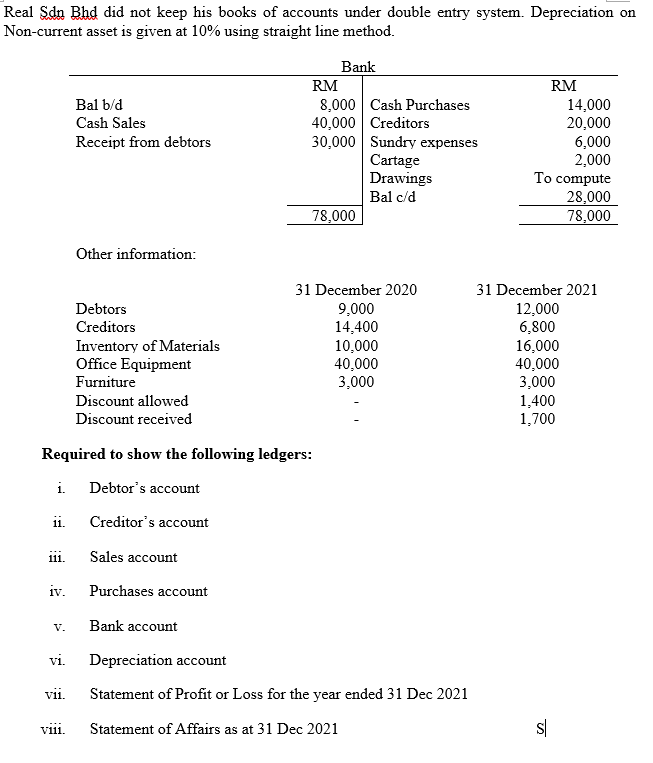

Real Sdn Bhd did not keep his books of accounts under double entry system. Depreciation on Non-current asset is given at 10% using straight line method. Bank RM RM 8,000 Cash Purchases 40,000 Creditors 30,000 Sundry expenses Cartage Drawings 14,000 20,000 6,000 2,000 To compute 28,000 78,000 Bal b/d Cash Sales Receipt from debtors Bal c/d 78,000 Other information: 31 December 2020 31 December 2021 Debtors 9,000 14,400 10,000 40,000 3,000 12,000 6,800 16,000 40,000 3,000 1,400 1,700 Creditors Inventory of Materials Office Equipment Furniture Discount allowed Discount received

Real Sdn Bhd did not keep his books of accounts under double entry system. Depreciation on Non-current asset is given at 10% using straight line method. Bank RM RM 8,000 Cash Purchases 40,000 Creditors 30,000 Sundry expenses Cartage Drawings 14,000 20,000 6,000 2,000 To compute 28,000 78,000 Bal b/d Cash Sales Receipt from debtors Bal c/d 78,000 Other information: 31 December 2020 31 December 2021 Debtors 9,000 14,400 10,000 40,000 3,000 12,000 6,800 16,000 40,000 3,000 1,400 1,700 Creditors Inventory of Materials Office Equipment Furniture Discount allowed Discount received

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 4MC: Marmol Corporation uses the allowance method for bad debts. During 2019, Marmol charged 50,000 to...

Related questions

Question

Please answer i, ii, iii. Thanks

Transcribed Image Text:Real Sdn Bhd did not keep his books of accounts under double entry system. Depreciation on

Non-current asset is given at 10% using straight line method.

Bank

RM

RM

8,000 Cash Purchases

40,000 Creditors

30,000 Sundry expenses

Cartage

Drawings

Bal c/d

14,000

20,000

6,000

2,000

To compute

28,000

78,000

Bal b/d

Cash Sales

Receipt from debtors

78,000

Other information:

31 December 2020

31 December 2021

Debtors

9,000

14,400

10,000

40,000

3,000

12,000

6,800

16,000

40,000

3,000

1,400

1,700

Creditors

Inventory of Materials

Office Equipment

Furniture

Discount allowed

Discount received

Required to show the following ledgers:

i.

Debtor's account

ii.

Creditor's account

1ii.

Sales account

iv.

Purchases account

V.

Bank account

vi.

Depreciation account

vii.

Statement of Profit or Loss for the year ended 31 Dec 2021

vii.

Statement of Affairs as at 31 Dec 2021

s|

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning