Reaner Coffee Beans Inc. produces two coffee bean products: "Specialty" and "House." The "House" product is sold to a few major vendors in bulk. The "Specialty" product is sold direct to individual consumers. The "Specialty" product includes a designer box in which the beans are hand packed into a red velvet drawstring bag, A leaflet with dessert recipes is also included. The "House" product simply packages the beans into a basic coffee bag Renner leo, currently uses a plant-wide rate to allocate overhead costs based on direct labor hours. Overhead is estimated to be $460,000 for the year, while direct labor hours are estimated to be 80,000 hour. The "Specialty" product requires $5 in direct materials per unit and I direct labor A total of 20,000 units of the "Specialty" product were manufactured during the year. The "House" product requires $1.50 in direct materials per unit and .5 direct labor hours. 120,000 units of the "House" product were produced during the year. The direct labor rate is $10 per hour. Renner Inc. is considering switching to an activity-based costing system to apply overhead costs to its products. Three activity pools have been identified as follow Cost Driver of orders of packing hours direct labor hrs Activity Center Ordering Packing General Factory Required (a) (b) (c) (d) Trac Cora $100,000 60,000 300,000 Annual Tracoactions Total 1000 Specialty 700 4000 3750 80000 20000 Home 300 250 60000 Compute the plant-wide overhead rate and apply overhead to each product. Compute the overhead rate for each activity center. Assume ABC is used, compute the amount of overhead cost that should be applied to the "Specialty" and "House" products. Compute the total unit cost of the "Specialty" and "House" using

Reaner Coffee Beans Inc. produces two coffee bean products: "Specialty" and "House." The "House" product is sold to a few major vendors in bulk. The "Specialty" product is sold direct to individual consumers. The "Specialty" product includes a designer box in which the beans are hand packed into a red velvet drawstring bag, A leaflet with dessert recipes is also included. The "House" product simply packages the beans into a basic coffee bag Renner leo, currently uses a plant-wide rate to allocate overhead costs based on direct labor hours. Overhead is estimated to be $460,000 for the year, while direct labor hours are estimated to be 80,000 hour. The "Specialty" product requires $5 in direct materials per unit and I direct labor A total of 20,000 units of the "Specialty" product were manufactured during the year. The "House" product requires $1.50 in direct materials per unit and .5 direct labor hours. 120,000 units of the "House" product were produced during the year. The direct labor rate is $10 per hour. Renner Inc. is considering switching to an activity-based costing system to apply overhead costs to its products. Three activity pools have been identified as follow Cost Driver of orders of packing hours direct labor hrs Activity Center Ordering Packing General Factory Required (a) (b) (c) (d) Trac Cora $100,000 60,000 300,000 Annual Tracoactions Total 1000 Specialty 700 4000 3750 80000 20000 Home 300 250 60000 Compute the plant-wide overhead rate and apply overhead to each product. Compute the overhead rate for each activity center. Assume ABC is used, compute the amount of overhead cost that should be applied to the "Specialty" and "House" products. Compute the total unit cost of the "Specialty" and "House" using

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter6: Process Cost Accounting—additional Procedures; Accounting For Joint Products And By-products

Section: Chapter Questions

Problem 11P: Otto Inc. specializes in chicken farming. Chickens are raised, packaged, and sold mostly to grocery...

Related questions

Question

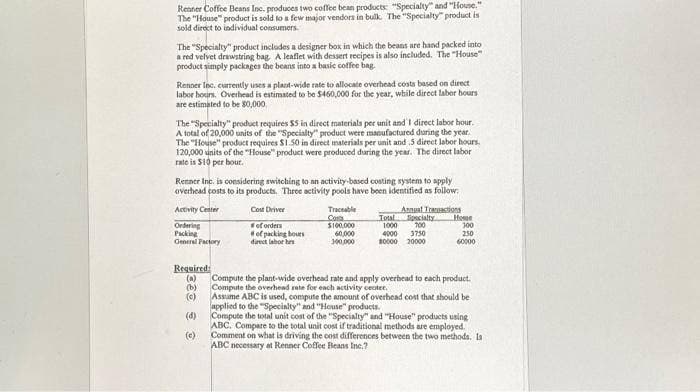

Transcribed Image Text:Renner Coffee Beans Inc. produces two coffee bean products: "Specialty" and "House."

The "House" product is sold to a few major vendors in bulk. The "Specialty product is

sold direct to individual consumers.

The "Specialty" product includes a designer box in which the beans are hand packed into

a red velvet drawstring bag, A leaflet with dessert recipes is also included. The "House"

product simply packages the beans into a basic coffee bag.

Renner lec, currently uses a plant-wide rate to allocate overhead costs based on direct

labor hours, Overhead is estimated to be $460,000 for the year, while direct labor hours

are estimated to be 80,000,

The Specialty" product requires $5 in direct materials per unit and I direct labor hour.

A total of 20,000 units of the "Specialty" product were manufactured during the year.

The "House" product requires $1.50 in direct materials per unit and .5 direct labor hours.

120,000 units of the "House" product were produced during the year. The direct labor

rate is $10 per hour.

Renner Inc. is considering switching to an activity-based costing system to apply

overhead costs to its products. Three activity pools have been identified as follow.

Activity Center

Cost Driver

of orders

of packing hours

direct labores

Ordering

Packing

General Factory

Required:

(a)

(b)

(c)

(d)

(c)

Traceable

Conta

$100,000

60,000

300,000

Total

1000

4000

80000

Annual Tramoactions

Specialty

700

3750

20000

Home

300

250

60000

Compute the plant-wide overhead rate and apply overhead to each product.

Compute the overhead rate for each activity center.

Assume ABC is used, compute the amount of overhead cost that should be

applied to the "Specialty" and "House" products.

Compute the total unit cost of the "Specialty" and "House" products using

ABC. Compare to the total unit cost if traditional methods are employed.

Comment on what is driving the cost differences between the two methods. la

ABC necessary at Renner Coffee Beans Inc.?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning