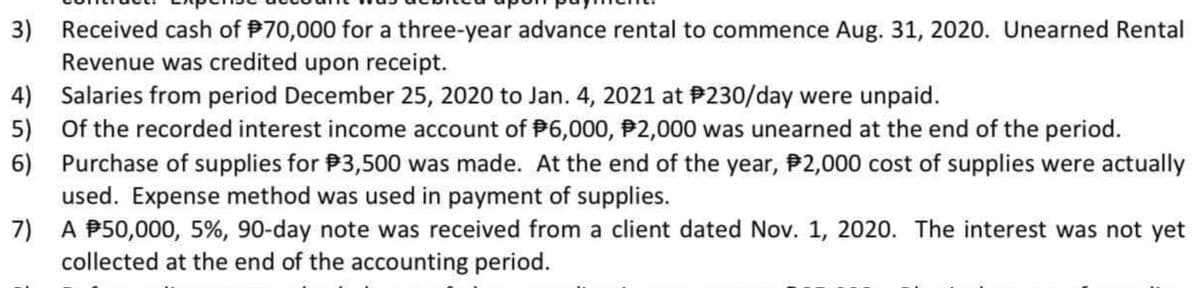

Received cash of P70,000 for a three-year advance rental to commence Aug. 31, 2020. Unearned Rental Revenue was credited upon receipt. Salaries from period December 25, 2020 to Jan. 4, 2021 at P230/day were unpaid. Of the recorded interest income account of P6,000, P2,000 was unearned at the end of the period. Purchase of supplies for P3,500 was made. At the end of the year, P2,000 cost of supplies were actually used. Expense method was used in payment of supplies. A P50,000, 5%, 90-day note was received from a client dated Nov. 1, 2020. The interest was not yet collected at the end of the accounting period.

Received cash of P70,000 for a three-year advance rental to commence Aug. 31, 2020. Unearned Rental Revenue was credited upon receipt. Salaries from period December 25, 2020 to Jan. 4, 2021 at P230/day were unpaid. Of the recorded interest income account of P6,000, P2,000 was unearned at the end of the period. Purchase of supplies for P3,500 was made. At the end of the year, P2,000 cost of supplies were actually used. Expense method was used in payment of supplies. A P50,000, 5%, 90-day note was received from a client dated Nov. 1, 2020. The interest was not yet collected at the end of the accounting period.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter3: Review Of A Company's Accounting System

Section: Chapter Questions

Problem 11E: Worksheet for Service Company Whitaker Consulting Company has prepared a trial balance on the...

Related questions

Question

Please prepare the

Transcribed Image Text:3)

Received cash of P70,000 for a three-year advance rental to commence Aug. 31, 2020. Unearned Rental

Revenue was credited upon receipt.

4) Salaries from period December 25, 2020 to Jan. 4, 2021 at P230/day were unpaid.

5) Of the recorded interest income account of P6,000, P2,000 was unearned at the end of the period.

6)

Purchase of supplies for P3,500 was made. At the end of the year, P2,000 cost of supplies were actually

used. Expense method was used in payment of supplies.

A P50,000, 5%, 90-day note was received from a client dated Nov. 1, 2020. The interest was not yet

7)

collected at the end of the accounting period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning