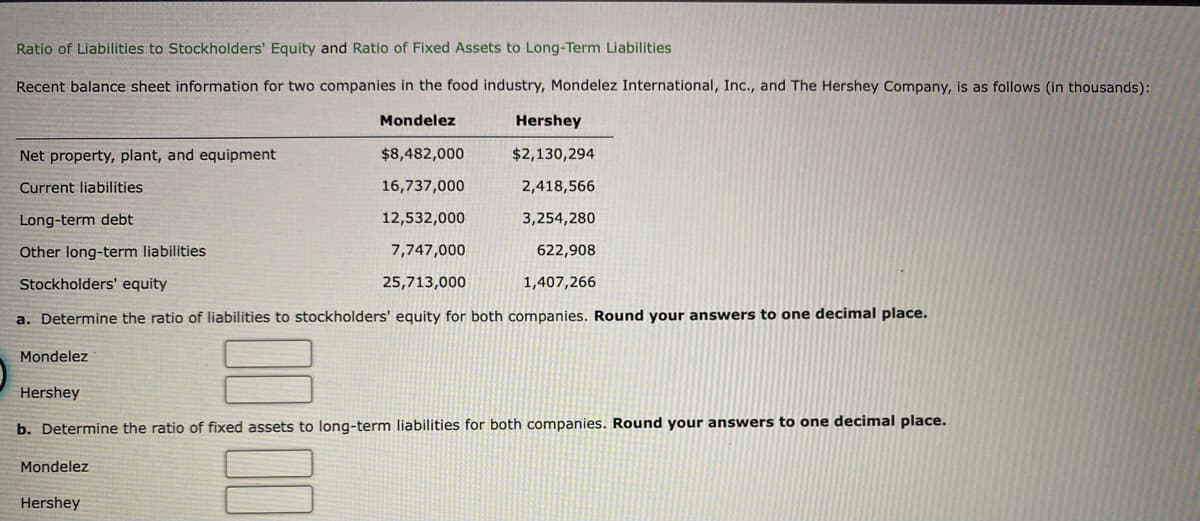

Recent balance sheet information for two companies in the food industry, Mondelez International, Inc., and The Hershey Company, is as follows (in thousands): Mondelez Hershey Net property, plant, and equipment $8,482,000 $2,130,294 Current liabilities 16,737,000 2,418,566 Long-term debt 12,532,000 3,254,280 Other long-term liabilities 7,747,000 622,908 Stockholders' equity 25,713,000 1,407,266 a. Determine the ratio of liabilities to stockholders' equity for both companies. Round your answers to one decimal place. Mondelez Hershey b. Determine the ratio of fixed assets to long-term liabilities for both companies. Round your answers to one decimal place. Mondelez

Recent balance sheet information for two companies in the food industry, Mondelez International, Inc., and The Hershey Company, is as follows (in thousands): Mondelez Hershey Net property, plant, and equipment $8,482,000 $2,130,294 Current liabilities 16,737,000 2,418,566 Long-term debt 12,532,000 3,254,280 Other long-term liabilities 7,747,000 622,908 Stockholders' equity 25,713,000 1,407,266 a. Determine the ratio of liabilities to stockholders' equity for both companies. Round your answers to one decimal place. Mondelez Hershey b. Determine the ratio of fixed assets to long-term liabilities for both companies. Round your answers to one decimal place. Mondelez

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 15E: Recent balance sheet information for two companies in the food industry, Mondelez International,...

Related questions

Question

Transcribed Image Text:Ratio of Liabilities to Stockholders' Equity and Ratio of Fixed Assets to Long-Term Liabilities

Recent balance sheet information for two companies in the food industry, Mondelez International, Inc., and The Hershey Company, is as follows (in thousands):

Mondelez

Hershey

Net property, plant, and equipment

$8,482,000

$2,130,294

Current liabilities

16,737,000

2,418,566

Long-term debt

12,532,000

3,254,280

Other long-term liabilities

7,747,000

622,908

Stockholders' equity

25,713,000

1,407,266

a. Determine the ratio of liabilities to stockholders' equity for both companies. Round your answers to one decimal place.

Mondelez

Hershey

b. Determine the ratio of fixed assets to long-term liabilities for both companies. Round your answers to one decimal place.

Mondelez

Hershey

Expert Solution

Required Formulas :

Ratio of Liabilities to Stockholder's Equity :

Total Liabilities / Company's Stockholder's Equity

Ratio of Fixed Assets to Long-term Liabilities :

Total Fixed Assets of the Company / Long term Liabilities of the Company

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning