Record the closing entry for revenue accounts.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter10: Property, Plant And Equipment: Acquisition And Subsequent Investments

Section: Chapter Questions

Problem 9P

Related questions

Question

Hh.83.

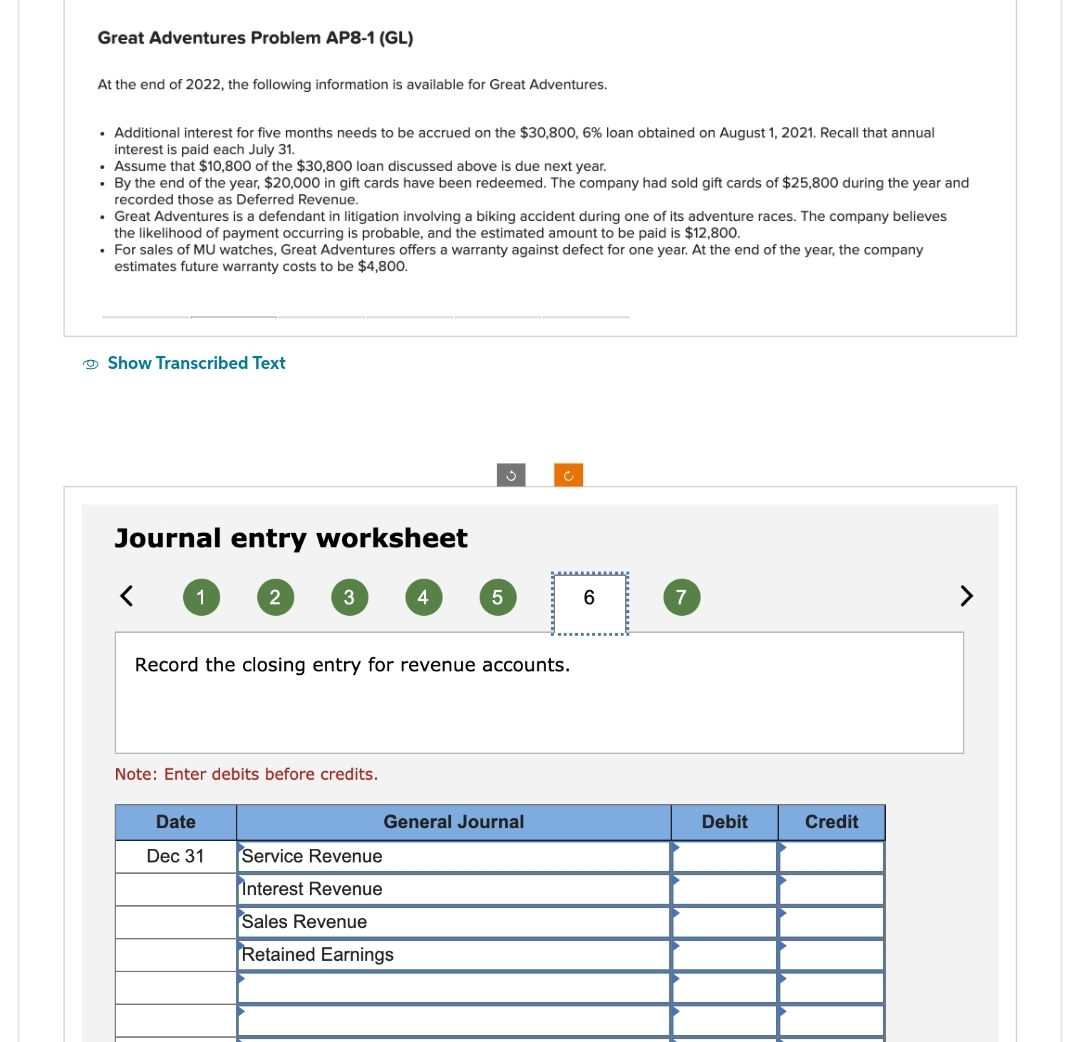

Transcribed Image Text:Great Adventures Problem AP8-1 (GL)

At the end of 2022, the following information is available for Great Adventures.

• Additional interest for five months needs to be accrued on the $30,800, 6% loan obtained on August 1, 2021. Recall that annual

interest is paid each July 31.

• Assume that $10,800 of the $30,800 loan discussed above is due next year.

. By the end of the year, $20,000 in gift cards have been redeemed. The company had sold gift cards of $25,800 during the year and

recorded those as Deferred Revenue.

• Great Adventures is a defendant in litigation involving a biking accident during one of its adventure races. The company believes

the likelihood of payment occurring is probable, and the estimated amount to be paid is $12,800.

• For sales of MU watches, Great Adventures offers a warranty against defect for one year. At the end of the year, the company

estimates future warranty costs to be $4,800.

Show Transcribed Text

Journal entry worksheet

1

2

3

Date

Dec 31

Note: Enter debits before credits.

4

Record the closing entry for revenue accounts.

5

Service Revenue

Interest Revenue

Sales Revenue

Retained Earnings

General Journal

C

6

7

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College