Use the following information and the percent-of-sales method to answer this question. Below is the 2021 year-end balance sheet for Isaiah, Inc. Sales for 2021 were $1,600,000 and are expected to be $2,000,000 during 2022. In addition, we know that Isaiah Inc. plans to pay $90,000 in 2022 dividends and expects a projected net income of 4% of sales. (For consistency with the Answer selections provided, round your forecast percentages to two decimals.) How much is the projected current assets for 2022? Isaiah, Inc. Balance Sheet Assets Current assets Net fixed assets Total Liabilities and Owners' Equity Accounts payable Accrued expenses Notes payable Long-term debt December 31, 2021 Total liabilities Common stock (plus paid-in capital) Retained earnings Common equity Total O 1.260 M 1.500 M O 1.000 M 1.120 M $890,000 1,000,000 $1,890,000 $160,000 100,000 700,000 300,000 1,260,000 360,000 270,000 630,000 $1,890,000

Use the following information and the percent-of-sales method to answer this question. Below is the 2021 year-end balance sheet for Isaiah, Inc. Sales for 2021 were $1,600,000 and are expected to be $2,000,000 during 2022. In addition, we know that Isaiah Inc. plans to pay $90,000 in 2022 dividends and expects a projected net income of 4% of sales. (For consistency with the Answer selections provided, round your forecast percentages to two decimals.) How much is the projected current assets for 2022? Isaiah, Inc. Balance Sheet Assets Current assets Net fixed assets Total Liabilities and Owners' Equity Accounts payable Accrued expenses Notes payable Long-term debt December 31, 2021 Total liabilities Common stock (plus paid-in capital) Retained earnings Common equity Total O 1.260 M 1.500 M O 1.000 M 1.120 M $890,000 1,000,000 $1,890,000 $160,000 100,000 700,000 300,000 1,260,000 360,000 270,000 630,000 $1,890,000

Chapter4: Financial Planning And Forecasting

Section: Chapter Questions

Problem 7P

Related questions

Question

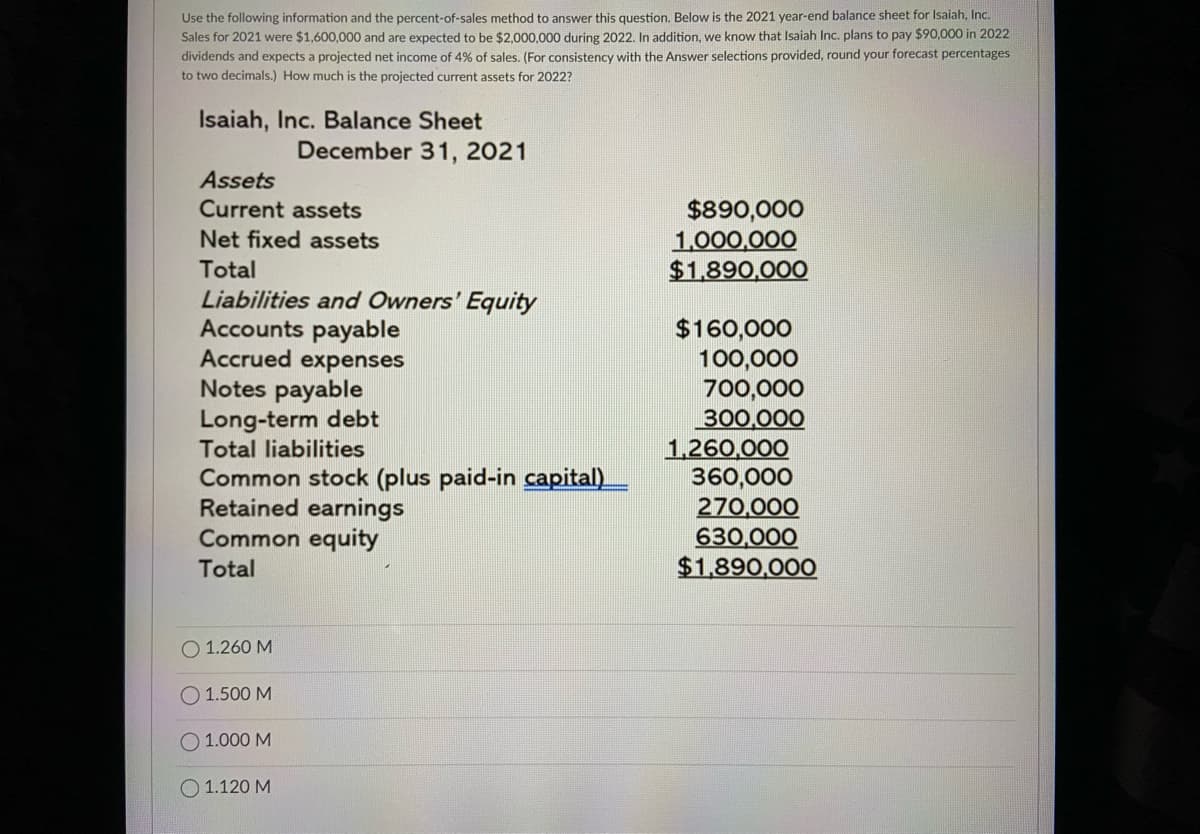

Transcribed Image Text:Use the following information and the percent-of-sales method to answer this question. Below is the 2021 year-end balance sheet for Isaiah, Inc.

Sales for 2021 were $1,600,000 and are expected to be $2,000,000 during 2022. In addition, we know that Isaiah Inc. plans to pay $90,000 in 2022

dividends and expects a projected net income of 4% of sales. (For consistency with the Answer selections provided, round your forecast percentages

to two decimals.) How much is the projected current assets for 2022?

Isaiah, Inc. Balance Sheet

Assets

Current assets

Net fixed assets

Total

Liabilities and Owners' Equity

Accounts payable

Accrued expenses

Notes payable

Long-term debt

Total liabilities

Common stock (plus paid-in capital)

Retained earnings

Common equity

Total

O 1.260 M

December 31, 2021

1.500 M

O 1.000 M

1.120 M

$890,000

1,000,000

$1,890,000

$160,000

100,000

700,000

300,000

1,260,000

360,000

270,000

630,000

$1,890,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning