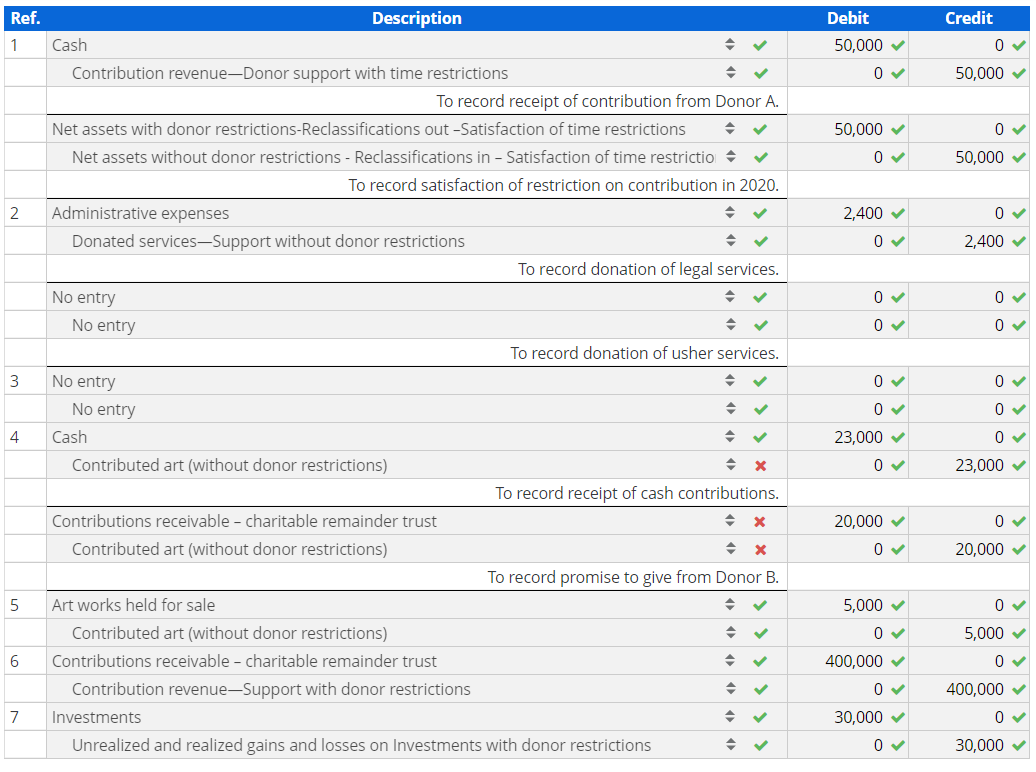

Recording journal entries for nonprofits Prepare journal entries to record the following transactions. 1. Donor A gave the nonprofit a cash gift of $50,000 in June 2019, telling the nonprofit the gift could not be used until 2020. (Identify the affected net asset classification(s) in the journal entries made both in June 2019 and at the start of 2020.) 2. Attorney Howard Gorman volunteered his services to Taconic Singers, a nonprofit. He spent 12 hours preparing contracts for the services of professional singers and 8 hours serving as an usher before performances. Gorman normally gets $200 an hour for legal services, and Taconic normally pays $8 an hour when it hires ushers. 3. Donor B sent a letter to a nonprofit, saying she would donate $20,000 in cash to the nonprofit, to be used for any purpose the nonprofit's trustees desired, provided the nonprofit raised an equal amount of cash from other donors. 4. Regarding the previous transaction, the nonprofit raised $23,000 in cash from other donors and then notified Donor B of its success in meeting her condition for the gift. 5. Donor C donates to a local museum a work of art having a fair value of $5,000, with the understanding that the museum will sell it at auction and use the funds for its general activities. 6. Donor D advises a university that he has established an irrevocable charitable remainder trust, administered by his attorney, whereby his wife will receive income from the trust as long as she lives. At her death, the remaining trust assets will be distributed to the university as a permanent endowment. The university's actuary estimates the fair value of the university's beneficial interest to be $400,000. 7. As of December 31, 2019, the fair value of investments held in perpetuity by a nonprofit had increased by $30,000. If a transaction doesn't require a journal entry select No entry as your answer and leave the Debit and Credit answer boxes blank (zero).

Recording journal entries for nonprofits Prepare journal entries to record the following transactions. 1. Donor A gave the nonprofit a cash gift of $50,000 in June 2019, telling the nonprofit the gift could not be used until 2020. (Identify the affected net asset classification(s) in the journal entries made both in June 2019 and at the start of 2020.) 2. Attorney Howard Gorman volunteered his services to Taconic Singers, a nonprofit. He spent 12 hours preparing contracts for the services of professional singers and 8 hours serving as an usher before performances. Gorman normally gets $200 an hour for legal services, and Taconic normally pays $8 an hour when it hires ushers. 3. Donor B sent a letter to a nonprofit, saying she would donate $20,000 in cash to the nonprofit, to be used for any purpose the nonprofit's trustees desired, provided the nonprofit raised an equal amount of cash from other donors. 4. Regarding the previous transaction, the nonprofit raised $23,000 in cash from other donors and then notified Donor B of its success in meeting her condition for the gift. 5. Donor C donates to a local museum a work of art having a fair value of $5,000, with the understanding that the museum will sell it at auction and use the funds for its general activities. 6. Donor D advises a university that he has established an irrevocable charitable remainder trust, administered by his attorney, whereby his wife will receive income from the trust as long as she lives. At her death, the remaining trust assets will be distributed to the university as a permanent endowment. The university's actuary estimates the fair value of the university's beneficial interest to be $400,000. 7. As of December 31, 2019, the fair value of investments held in perpetuity by a nonprofit had increased by $30,000. If a transaction doesn't require a journal entry select No entry as your answer and leave the Debit and Credit answer boxes blank (zero).

Chapter10: Deductions And Losses: Certain Itemized Deductions

Section: Chapter Questions

Problem 35P: On December 27, 2019, Roberta purchased four tickets to a charity ball sponsored by the city of San...

Related questions

Question

Transcribed Image Text:Ref.

Description

Debit

Credit

1

Cash

50,000

Contribution revenue-Donor support with time restrictions

50,000 v

To record receipt of contribution from Donor A.

Net assets with donor restrictions-Reclassifications out -Satisfaction of time restrictions

50,000 v

Net assets without donor restrictions - Reclassifications in - Satisfaction of time restrictio

50,000 v

To record satisfaction of restriction on contribution in 2020.

2

Administrative expenses

2,400 v

Donated services-Support without donor restrictions

2,400 v

To record donation of legal services.

No entry

No entry

To record donation of usher services.

3

No entry

No entry

4

Cash

23,000 v

Contributed art (without donor restrictions)

23,000 v

To record receipt of cash contributions.

Contributions receivable - charitable remainder trust

20,000 v

Contributed art (without donor restrictions)

20,000 v

To record promise to give from Donor B.

Art works held for sale

5,000 v

Contributed art (without donor restrictions)

5,000 v

6

Contributions receivable - charitable remainder trust

400,000 v

Contribution revenue-Support with donor restrictions

400,000 v

7

Investments

30,000 v

Unrealized and realized gains and losses on Investments with donor restrictions

30,000 v

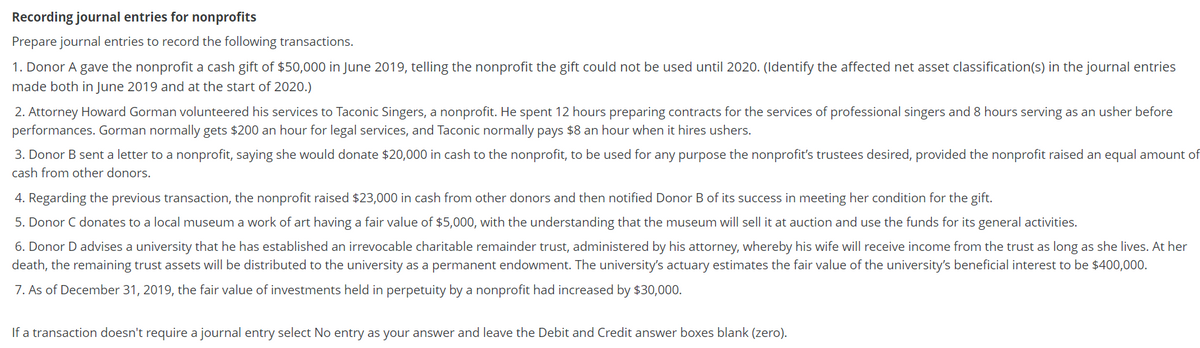

Transcribed Image Text:Recording journal entries for nonprofits

Prepare journal entries to record the following transactions.

1. Donor A gave the nonprofit a cash gift of $50,000 in June 2019, telling the nonprofit the gift could not be used until 2020. (Identify the affected net asset classification(s) in the journal entries

made both in June 2019 and at the start of 2020.)

2. Attorney Howard Gorman volunteered his services to Taconic Singers, a nonprofit. He spent 12 hours preparing contracts for the services of professional singers and 8 hours serving as an usher before

performances. Gorman normally gets $200 an hour for legal services, and Taconic normally pays $8 an hour when it hires ushers.

3. Donor B sent a letter to a nonprofit, saying she would donate $20,000 in cash to the nonprofit, to be used for any purpose the nonprofit's trustees desired, provided the nonprofit raised an equal amount of

cash from other donors.

4. Regarding the previous transaction, the nonprofit raised $23,000 in cash from other donors and then notified Donor B of its success in meeting her condition for the gift.

5. Donor C donates to a local museum a work of art having a fair value of $5,000, with the understanding that the museum will sell it at auction and use the funds for its general activities.

6. Donor D advises a university that he has established an irrevocable charitable remainder trust, administered by his attorney, whereby his wife will receive income from the trust as long as she lives. At her

death, the remaining trust assets will be distributed to the university as a permanent endowment. The university's actuary estimates the fair value of the university's beneficial interest to be $400,000.

7. As of December 31, 2019, the fair value of investments held in perpetuity by a nonprofit had increased by $30,000.

If a transaction doesn't require a journal entry select No entry as your answer and leave the Debit and Credit answer boxes blank (zero).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT