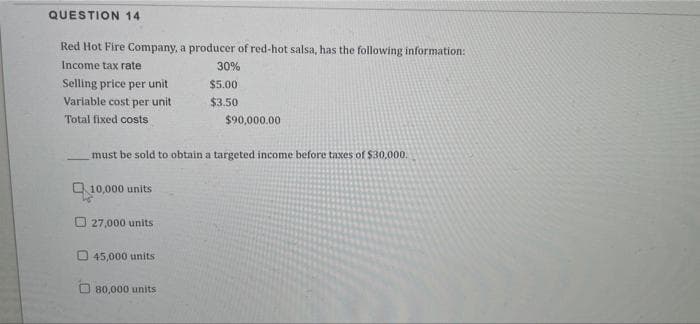

Red Hot Fire Company, a producer of red-hot salsa, has the following information: Income tax rate 30% Selling price per unit $5.00 Variable cost per unit $3.50 Total fixed costs $90,000.00 must be sold to obtain a targeted income before taxes of $30,000. Q10,000 units O 27,000 units O 45,000 units O 80099 units

Red Hot Fire Company, a producer of red-hot salsa, has the following information: Income tax rate 30% Selling price per unit $5.00 Variable cost per unit $3.50 Total fixed costs $90,000.00 must be sold to obtain a targeted income before taxes of $30,000. Q10,000 units O 27,000 units O 45,000 units O 80099 units

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter21: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 21.17EX

Related questions

Question

Transcribed Image Text:QUESTION 14

Red Hot Fire Company, a producer of red-hot salsa, has the following information:

Income tax rate

30%

Selling price per unit

Variable cost per unit

$5.00

$3.50

Total fixed costs

$90,000.00

must be sold to obtain a targeted income before taxes of $30,000.

O 10,000 units

O27,000 units

O 45,000 units

U 80,000 units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning