Redbird Company is considering a project with an initial investment of $300,000 in new equipment that will yield annual net cash flows of $57,626 each year over its seven-year life. The company's minimum required rate of return is 12%. (Click here to see present value and future value tables) A. What is the internal rate of return? B. Should Redbird accept the project based on IRR?

Redbird Company is considering a project with an initial investment of $300,000 in new equipment that will yield annual net cash flows of $57,626 each year over its seven-year life. The company's minimum required rate of return is 12%. (Click here to see present value and future value tables) A. What is the internal rate of return? B. Should Redbird accept the project based on IRR?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter2: Working With The Tax Law

Section: Chapter Questions

Problem 1RP

Related questions

Question

Transcribed Image Text:engageNOWv2 | Online teachin

+

/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false

Cancel Your.

Startup Opportuniti.

V How brands are co..

Assignment Practic.

A COVID-19 Student.

w C20-128PRO1-2016.

O Final Exam Review -.

G Professional Certific.

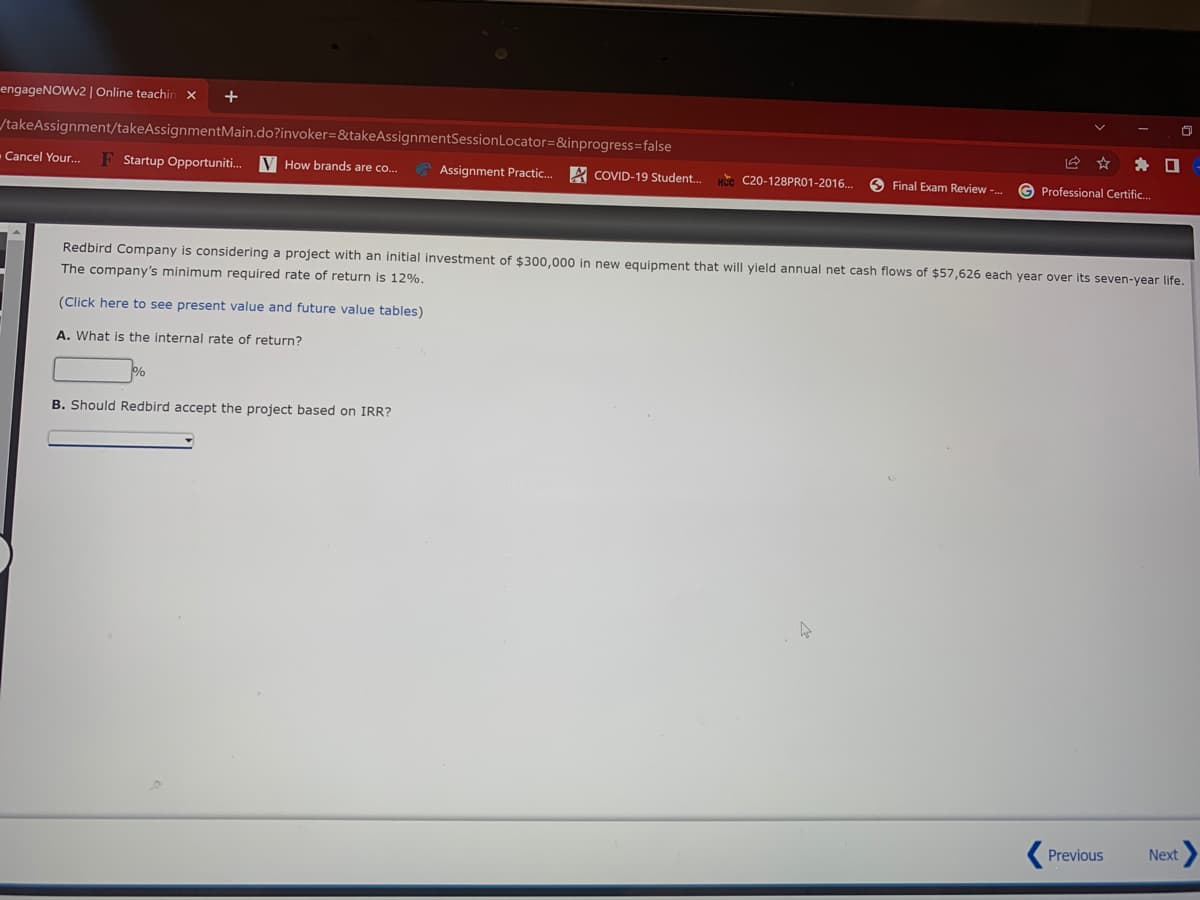

Redbird Company is considering a project with an initial investment of $300,000 in new equipment that will yield annual net cash flows of $57,626 each year over its seven-year life.

The company's minimum required rate of return is 12%.

(Click here to see present value and future value tables)

A. What is the internal rate of return?

B. Should Redbird accept the project based on IRR?

Previous

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you