Refer to the income statements for The Gap, Inc., presented below. a. Prepare common-size income statements for fiscal years 2014 (ending January 31, 2015) and 2013 (ending February 1, 2014). Round answers to one decimal place (i.e., 0.2568 = 25.7%). The Gap, Inc. Common-Size Income Statements Fiscal year ended Jan. 31, 2015 Feb. 1, 2014 Net sales $16,435 0% $16,148 0 % Cost of goods sold & occupancy expenses 10,146 Gross profit 0 % 9,855 0% 6,289 0 % 6,293 0 % Operating expenses 4,206 0% 4,144 0 % Operating income 2,083 0% 2,149 0 % Interest expense 75 0 % 61 0% Interest income (5) 0 % (5) 0% Income before income taxes 2,013 0 % 2,093 0% Income taxes 751 0% 813 0% Net earnings $1,262 0 % $1,280 0 %

Refer to the income statements for The Gap, Inc., presented below. a. Prepare common-size income statements for fiscal years 2014 (ending January 31, 2015) and 2013 (ending February 1, 2014). Round answers to one decimal place (i.e., 0.2568 = 25.7%). The Gap, Inc. Common-Size Income Statements Fiscal year ended Jan. 31, 2015 Feb. 1, 2014 Net sales $16,435 0% $16,148 0 % Cost of goods sold & occupancy expenses 10,146 Gross profit 0 % 9,855 0% 6,289 0 % 6,293 0 % Operating expenses 4,206 0% 4,144 0 % Operating income 2,083 0% 2,149 0 % Interest expense 75 0 % 61 0% Interest income (5) 0 % (5) 0% Income before income taxes 2,013 0 % 2,093 0% Income taxes 751 0% 813 0% Net earnings $1,262 0 % $1,280 0 %

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 39E: Cuneo Companys income statements for the last 3 years are as follows: Refer to the information for...

Related questions

Question

question a

Transcribed Image Text:Common-Size and Forecast Income Statements

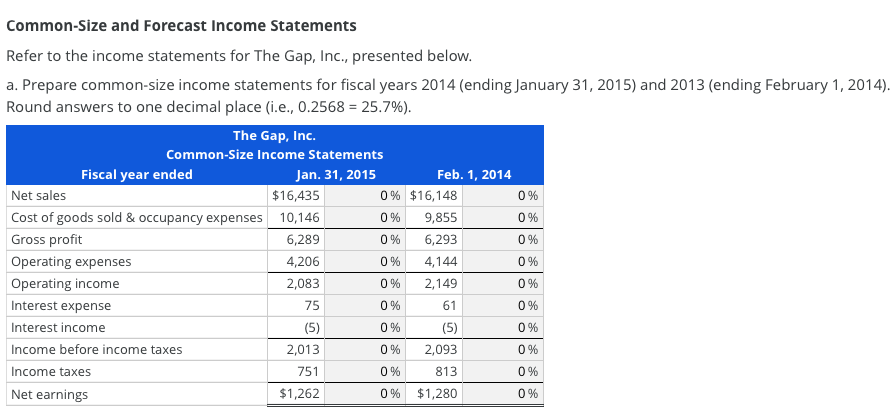

Refer to the income statements for The Gap, Inc., presented below.

a. Prepare common-size income statements for fiscal years 2014 (ending January 31, 2015) and 2013 (ending February 1, 2014).

Round answers to one decimal place (i.e., 0.2568 = 25.7%).

The Gap, Inc.

Common-Size Income Statements

Fiscal year ended

Jan. 31, 2015

Feb. 1, 2014

Net sales

$16,435

0 % $16,148

0%

Cost of goods sold & occupancy expenses 10,146

0 %

9,855

0%

Gross profit

6,289

0 %

6,293

Operating expenses

4,206

0%

4,144

0%

Operating income

2,083

0%

2,149

0%

Interest expense

75

0 %

61

0 %

Interest income

(5)

0%

(5)

0%

Income before income taxes

2,013

0 %

2,093

0%

Income taxes

751

0 %

813

0%

Net earnings

$1,262

0 %

$1,280

0%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning