* Reflects revenue and expense activity only related to the computer furniture segment. t Revenue: (123 desks × $1,240) + (57 chairs × $490) = $152,520 + $27,930 = $180,450 ‡ Cost of goods sold: (123 desks × $740) + (57 chairs × $240) + $29,700 = $134,400 Santana Rey believes that sales will increase each month for the next three months (April, 49 desks, 31 chairs; May, 53 desks, 34 chairs; June, 57 desks, 37 chairs) if selling prices are reduced to $1,130 for desks and $440 for chairs and advertising expenses are increased by 10% and remain at that level for all three months. The products' variable cost will remain at $740 for desks and $240 for chairs. The sales staff will continue to earn a 10% commission, the fixed manufacturing costs per month will remain at $9,900 and other fixed expenses will remain at $5,900 per month. Required: 1. Prepare budgeted income statements for the computer furniture segment for each of the months of April, May, and June that show the expected results from implementing the proposed changes. Use a three-column format, with one column for each month. 2. Recommend whether Santana should implement the proposed changes. Hint. Compare quarterly income for the proposed April- May-June period to the quarterly income for the January-February-March period. Complete this question by entering your answers in the tabs below.

* Reflects revenue and expense activity only related to the computer furniture segment. t Revenue: (123 desks × $1,240) + (57 chairs × $490) = $152,520 + $27,930 = $180,450 ‡ Cost of goods sold: (123 desks × $740) + (57 chairs × $240) + $29,700 = $134,400 Santana Rey believes that sales will increase each month for the next three months (April, 49 desks, 31 chairs; May, 53 desks, 34 chairs; June, 57 desks, 37 chairs) if selling prices are reduced to $1,130 for desks and $440 for chairs and advertising expenses are increased by 10% and remain at that level for all three months. The products' variable cost will remain at $740 for desks and $240 for chairs. The sales staff will continue to earn a 10% commission, the fixed manufacturing costs per month will remain at $9,900 and other fixed expenses will remain at $5,900 per month. Required: 1. Prepare budgeted income statements for the computer furniture segment for each of the months of April, May, and June that show the expected results from implementing the proposed changes. Use a three-column format, with one column for each month. 2. Recommend whether Santana should implement the proposed changes. Hint. Compare quarterly income for the proposed April- May-June period to the quarterly income for the January-February-March period. Complete this question by entering your answers in the tabs below.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 35P

Related questions

Question

please answer all with working please answer all with everything like explanation , computation , formulation with steps please answer in text not image thanks no copy paste need complete and correct answer

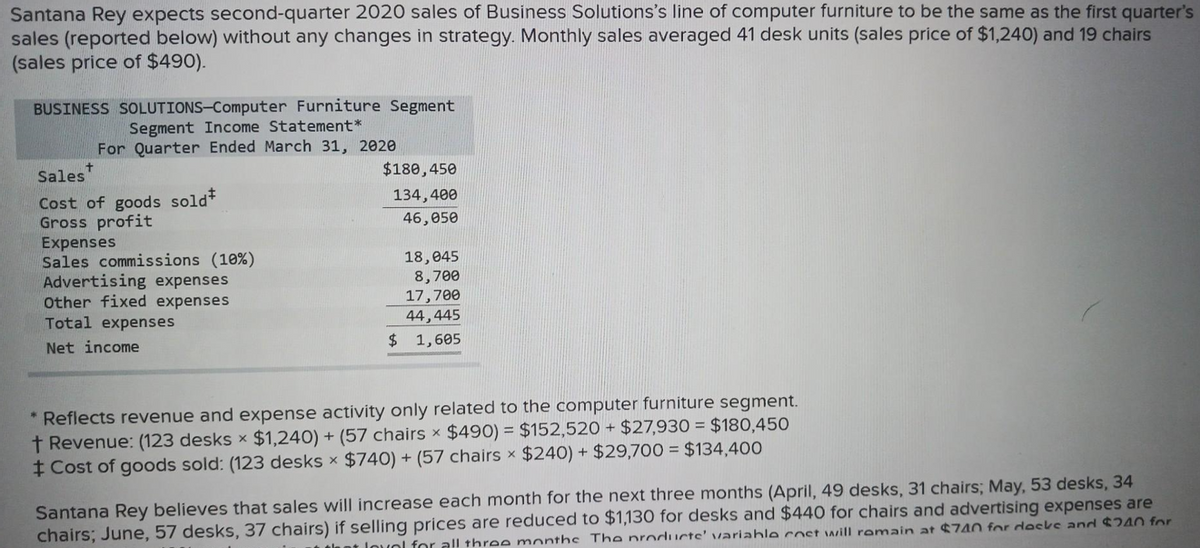

Transcribed Image Text:Santana Rey expects second-quarter 2020 sales of Business Solutions's line of computer furniture to be the same as the first quarter's

sales (reported below) without any changes in strategy. Monthly sales averaged 41 desk units (sales price of $1,240) and 19 chairs

(sales price of $490).

BUSINESS SOLUTIONS-Computer Furniture Segment

Segment Income Statement*

For Quarter Ended March 31, 2020

Sales*

Cost of goods sold*

Gross profit

Expenses

Sales commissions (10%)

Advertising expenses

Other fixed expenses

Total expenses

Net income

$180,450

134,400

46,050

18,045

8,700

17,700

44,445

$ 1,605

* Reflects revenue and expense activity only related to the computer furniture segment.

t Revenue: (123 desks x $1,240) + (57 chairs x $490) = $152,520 + $27,930 = $180,450

‡ Cost of goods sold: (123 desks x $740) + (57 chairs × $240) + $29,700 = $134,400

Santana Rey believes that sales will increase each month for the next three months (April, 49 desks, 31 chairs; May, 53 desks, 34

chairs; June, 57 desks, 37 chairs) if selling prices are reduced to $1,130 for desks and $440 for chairs and advertising expenses are

lovol for all three months. The producte' variable cost will remain at $740 for docks and $240 for

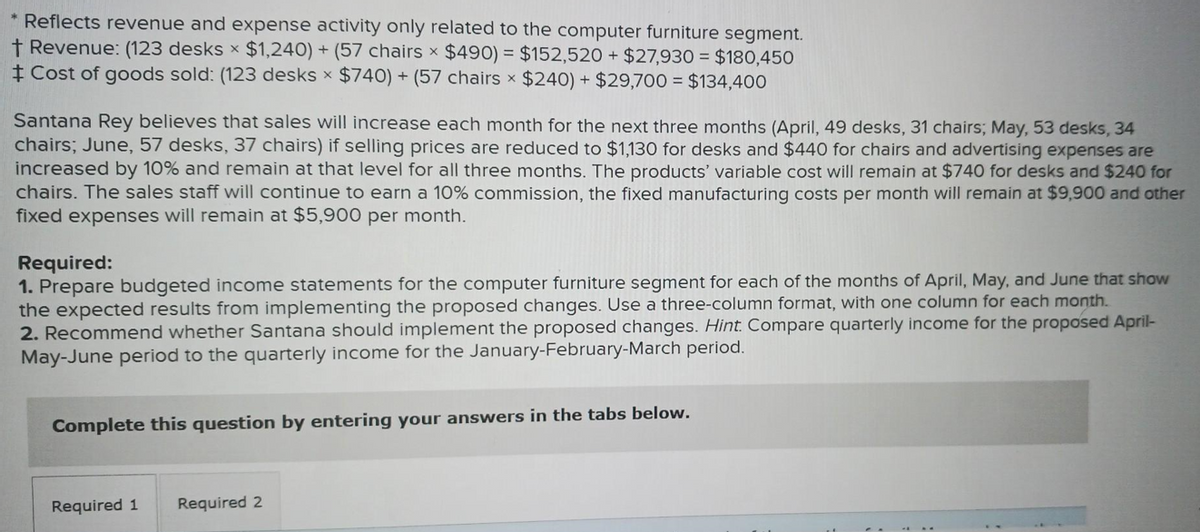

Transcribed Image Text:* Reflects revenue and expense activity only related to the computer furniture segment.

t Revenue: (123 desks x $1,240) + (57 chairs x $490) = $152,520 + $27,930 = $180,450

+ Cost of goods sold: (123 desks × $740) + (57 chairs × $240) + $29,700 = $134,400

Santana Rey believes that sales will increase each month for the next three months (April, 49 desks, 31 chairs; May, 53 desks, 34

chairs; June, 57 desks, 37 chairs) if selling prices are reduced to $1,130 for desks and $440 for chairs and advertising expenses are

increased by 10% and remain at that level for all three months. The products' variable cost will remain at $740 for desks and $240 for

chairs. The sales staff will continue to earn a 10% commission, the fixed manufacturing costs per month will remain at $9,900 and other

fixed expenses will remain at $5,900 per month.

Required:

1. Prepare budgeted income statements for the computer furniture segment for each of the months of April, May, and June that show

the expected results from implementing the proposed changes. Use a three-column format, with one column for each month.

2. Recommend whether Santana should implement the proposed changes. Hint. Compare quarterly income for the proposed April-

May-June period to the quarterly income for the January-February-March period.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning