Quality Clothing, Inc., produces skorts and jumper uniforms for school children. In the process of cutting out the clothn pieces for each product, a certain amount ofse cloth is produced. Quality has been selling this cloth scrap to Jorge's Scrap Warehouse for $3.15 per pound. Last year, the company sold 39,000 Ib. of scrap, which w be enough to make 9,750 teddy bears that the management of Quality is now interested in producing. Their processes would need some reprogramming, particularly the cutting and stitching processes, but it would require no additional worker training. However, new packaging would be needed. The total variable cost to produce t teddy bears $3.80. Fixed costs would increase by $94,000 per year for the lease of the packaging equipment and Quality estimates it could produce and sell 9,750 te bears per year. Finished teddy bears could be sold for $18.00 each. Calculate the effect on operating income. Round your answers to the nearest dollar. Sell at Split-Off 122,850 V Process Further $ 42,450 x Should Quality continue to sell the scrap cloth or should Quality process the scrap into teddy bears to sell? Sell the Scrap

Quality Clothing, Inc., produces skorts and jumper uniforms for school children. In the process of cutting out the clothn pieces for each product, a certain amount ofse cloth is produced. Quality has been selling this cloth scrap to Jorge's Scrap Warehouse for $3.15 per pound. Last year, the company sold 39,000 Ib. of scrap, which w be enough to make 9,750 teddy bears that the management of Quality is now interested in producing. Their processes would need some reprogramming, particularly the cutting and stitching processes, but it would require no additional worker training. However, new packaging would be needed. The total variable cost to produce t teddy bears $3.80. Fixed costs would increase by $94,000 per year for the lease of the packaging equipment and Quality estimates it could produce and sell 9,750 te bears per year. Finished teddy bears could be sold for $18.00 each. Calculate the effect on operating income. Round your answers to the nearest dollar. Sell at Split-Off 122,850 V Process Further $ 42,450 x Should Quality continue to sell the scrap cloth or should Quality process the scrap into teddy bears to sell? Sell the Scrap

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 11PA: Quality Clothing, Inc., produces skorts and jumper uniforms for schoolchildren. In the process of...

Related questions

Question

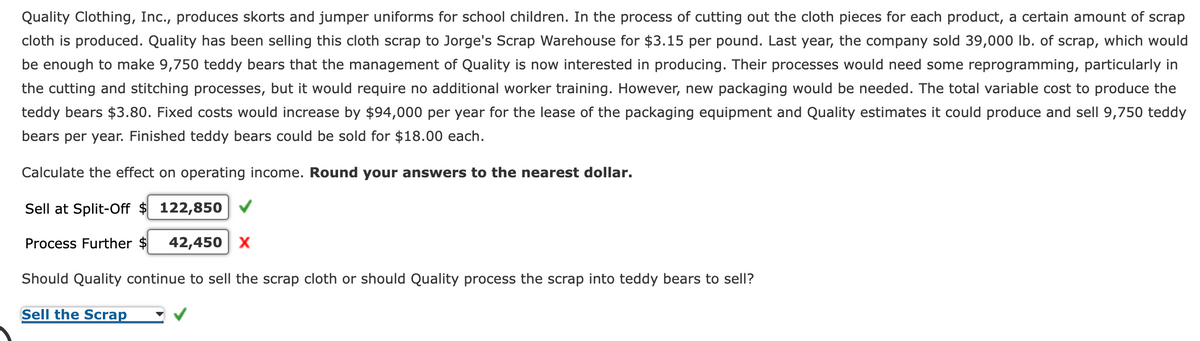

Transcribed Image Text:Quality Clothing, Inc., produces skorts and jumper uniforms for school children. In the process of cutting out the cloth pieces for each product, a certain amount of scrap

cloth is produced. Quality has been selling this cloth scrap to Jorge's Scrap Warehouse for $3.15 per pound. Last year, the company sold 39,000 lb. of scrap, which would

be enough to make 9,750 teddy bears that the management of Quality is now interested in producing. Their processes would need some reprogramming, particularly in

the cutting and stitching processes,

but it would require no additional worker training. However, new packaging would be needed. The total variable cost to produce the

teddy bears $3.80. Fixed costs would increase by $94,000 per year for the lease of the packaging equipment and Quality estimates it could produce and sell 9,750 teddy

bears per year. Finished teddy bears could be sold for $18.00 each.

Calculate the effect on operating income. Round your answers to the nearest dollar.

Sell at Split-Off $ 122,850

Process Further $

42,450 X

Should Quality continue to sell the scrap cloth or should Quality process the scrap into teddy bears to sell?

Sell the Scrap

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,