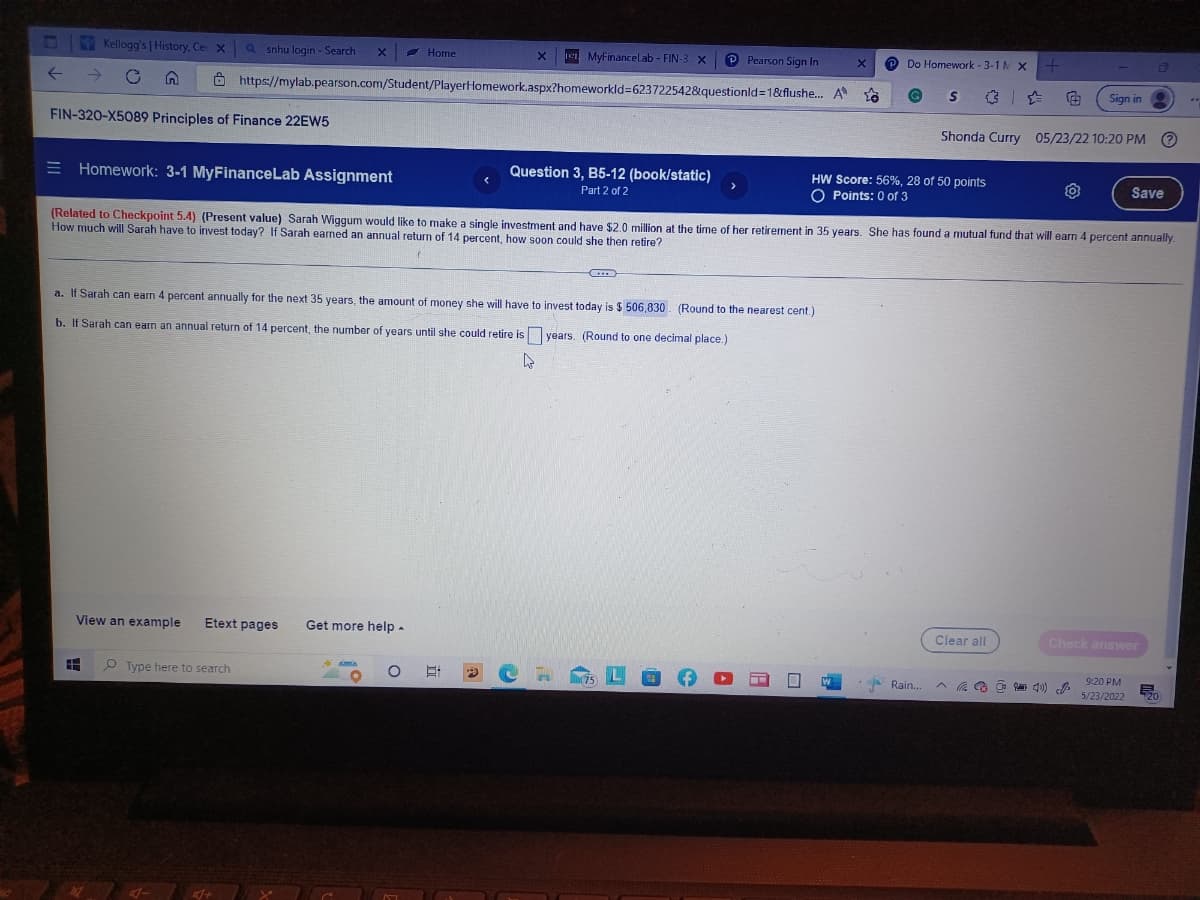

(Related to Checkpoint 5.4) (Present value) Sarah Wiggum would like to make a single investment and have $2.0 million at the time of her retirement in 35 years. She has found a mutual fund that will earn 4 percent annually. How much will Sarah have to invest today? If Sarah earned an annual return of 14 percent, how soon could she then retire? CIT a. If Sarah can earn 4 percent annually for the next 35 years, the amount of money she will have to invest today is $ 506,830 (Round to the nearest cent.) b. If Sarah can earn an annual return of 14 percent, the number of years until she could retire is years. (Round to one decimal place.) 4

(Related to Checkpoint 5.4) (Present value) Sarah Wiggum would like to make a single investment and have $2.0 million at the time of her retirement in 35 years. She has found a mutual fund that will earn 4 percent annually. How much will Sarah have to invest today? If Sarah earned an annual return of 14 percent, how soon could she then retire? CIT a. If Sarah can earn 4 percent annually for the next 35 years, the amount of money she will have to invest today is $ 506,830 (Round to the nearest cent.) b. If Sarah can earn an annual return of 14 percent, the number of years until she could retire is years. (Round to one decimal place.) 4

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 3.4C

Related questions

Question

Transcribed Image Text:UND

Home

X

MyFinanceLab - FIN-3 X

P Pearson Sign In

Do Homework-3-1 M X

+

Kellogg's | History, Cer X a snhu login - Search X

https://mylab.pearson.com/Student/PlayerHomework.aspx?homeworkld=6237225428questionid=1&flushe...

← → C

A

5.6

G

S

Sign in

FIN-320-X5089 Principles of Finance 22EW5

Shonda Curry 05/23/22 10:20 PM Ⓒ

Homework: 3-1 MyFinanceLab Assignment

Question 3, B5-12 (book/static)

Part 2 of 2

HW Score: 56%, 28 of 50 points

O Points: 0 of 3

Save

(Related to Checkpoint 5.4) (Present value) Sarah Wiggum would like to make a single investment and have $2.0 million at the time of her retirement in 35 years. She has found a mutual fund that will earn 4 percent annually.

How much will Sarah have to invest today? If Sarah earned an annual return of 14 percent, how soon could she then retire?

a. If Sarah can earn 4 percent annually for the next 35 years, the amount of money she will have to invest today is $ 506,830 (Round to the nearest cent.)

b. If Sarah can earn an annual return of 14 percent, the number of years until she could retire is

years. (Round to one decimal place.)

4

View an example Etext pages Get more help.

Clear all

Check answer

E

Type here to search

O

L

9

(75)

A

X

Rain...

(40)

D

9:20 PM

5/23/2022 20

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you