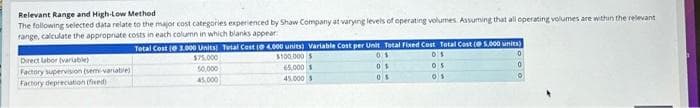

Relevant Range and High-Low Method The following selected data relate to the major cost categories experienced by Shaw Company at varying levels of operating volumes Assuming that all operating volumes are within the relevant range, calculate the appropriate costs in each column in which blanks appear Total Cost ( Direct labor (variable) Factory supervision (semi-variabile) Factory depreciation (fixed) 3.000 Units) Total Cost (@4.000 units) Variable Cost per Unit Total Fixed Cost Total Cost (@5,000 units) $75,000 $100,000 $ 05 50.000 45,000 65.000 45.000 $ 01 05 05 01 DOO

Relevant Range and High-Low Method The following selected data relate to the major cost categories experienced by Shaw Company at varying levels of operating volumes Assuming that all operating volumes are within the relevant range, calculate the appropriate costs in each column in which blanks appear Total Cost ( Direct labor (variable) Factory supervision (semi-variabile) Factory depreciation (fixed) 3.000 Units) Total Cost (@4.000 units) Variable Cost per Unit Total Fixed Cost Total Cost (@5,000 units) $75,000 $100,000 $ 05 50.000 45,000 65.000 45.000 $ 01 05 05 01 DOO

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter6: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 7E: High-low method Ziegler Inc. has decided to use the high-low method to estimate the total cost and...

Related questions

Question

200.

Transcribed Image Text:Relevant Range and High-Low Method

The following selected data relate to the major cost categories experienced by Shaw Company at varying levels of operating volumes Assuming that all operating volumes are within the relevant

range, calculate the appropriate costs in each column in which blanks appear

Direct labor (variable)

Factory supervision (sem -variabile)

Factory depreciation (fixed)

Total Cost ( 1.000 Units) Total Cest (@4000 units) Variable Cost per Unit Total Fixed Cost Total Cost (@5,000 units)

$75,000

50,000

45,000

$100,000 $

65.000 1

45.000 $

01

0$

05

05

05

01

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,