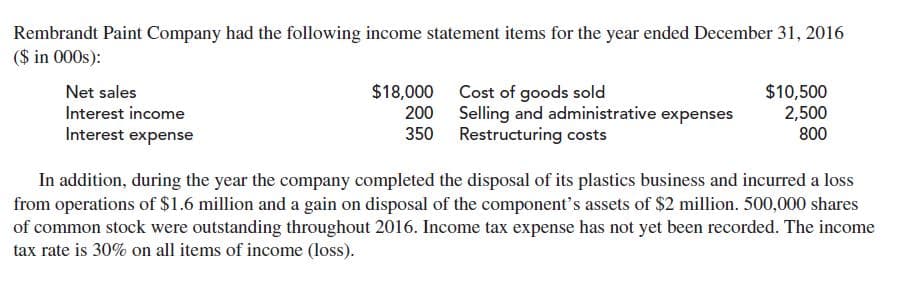

Rembrandt Paint Company had the following income statement items for the year ended December 31, 2016 ($ in 000s): $18,000 $10,500 2,500 Net sales Cost of goods sold Selling and administrative expenses Restructuring costs Interest income 200 Interest expense 350 800 In addition, during the year the company completed the disposal of its plastics business and incurred a loss from operations of $1.6 million and a gain on disposal of the component's assets of $2 million. 500,000 shares of common stock were outstanding throughout 2016. Income tax expense has not yet been recorded. The income tax rate is 30% on all items of income (loss).

Rembrandt Paint Company had the following income statement items for the year ended December 31, 2016 ($ in 000s): $18,000 $10,500 2,500 Net sales Cost of goods sold Selling and administrative expenses Restructuring costs Interest income 200 Interest expense 350 800 In addition, during the year the company completed the disposal of its plastics business and incurred a loss from operations of $1.6 million and a gain on disposal of the component's assets of $2 million. 500,000 shares of common stock were outstanding throughout 2016. Income tax expense has not yet been recorded. The income tax rate is 30% on all items of income (loss).

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 3RE: Shaquille Corporation began the current year with inventory of 50,000. During the year, its...

Related questions

Question

Required: Prepare a multiple-step income statement for 2016, including EPS disclosures.

Transcribed Image Text:Rembrandt Paint Company had the following income statement items for the year ended December 31, 2016

($ in 000s):

$18,000

$10,500

2,500

Net sales

Cost of goods sold

Selling and administrative expenses

Restructuring costs

Interest income

200

Interest expense

350

800

In addition, during the year the company completed the disposal of its plastics business and incurred a loss

from operations of $1.6 million and a gain on disposal of the component's assets of $2 million. 500,000 shares

of common stock were outstanding throughout 2016. Income tax expense has not yet been recorded. The income

tax rate is 30% on all items of income (loss).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning