Statement of Income and Retained Earnings For the Year Ended December 31, 2016 Net sales $1,950,000 Operating expenses: Cost of sales Selling and administrative expenses Depreciation $1,150,000 505,000 53,000 $1,708,000 $242,000 Operating income Other (income) expense: Interest expense Equity in net income of Hall Inc. Loss on sale of equipment Amortization of patent $15,000 (13,000) 5,000 4,000 $ 11,000 $231,000 Income before income taxes Income taxes: Current Deferred $ 79,000 11,000 90.000 Provision for income taxes

Statement of Income and Retained Earnings For the Year Ended December 31, 2016 Net sales $1,950,000 Operating expenses: Cost of sales Selling and administrative expenses Depreciation $1,150,000 505,000 53,000 $1,708,000 $242,000 Operating income Other (income) expense: Interest expense Equity in net income of Hall Inc. Loss on sale of equipment Amortization of patent $15,000 (13,000) 5,000 4,000 $ 11,000 $231,000 Income before income taxes Income taxes: Current Deferred $ 79,000 11,000 90.000 Provision for income taxes

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 24P: Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of...

Related questions

Question

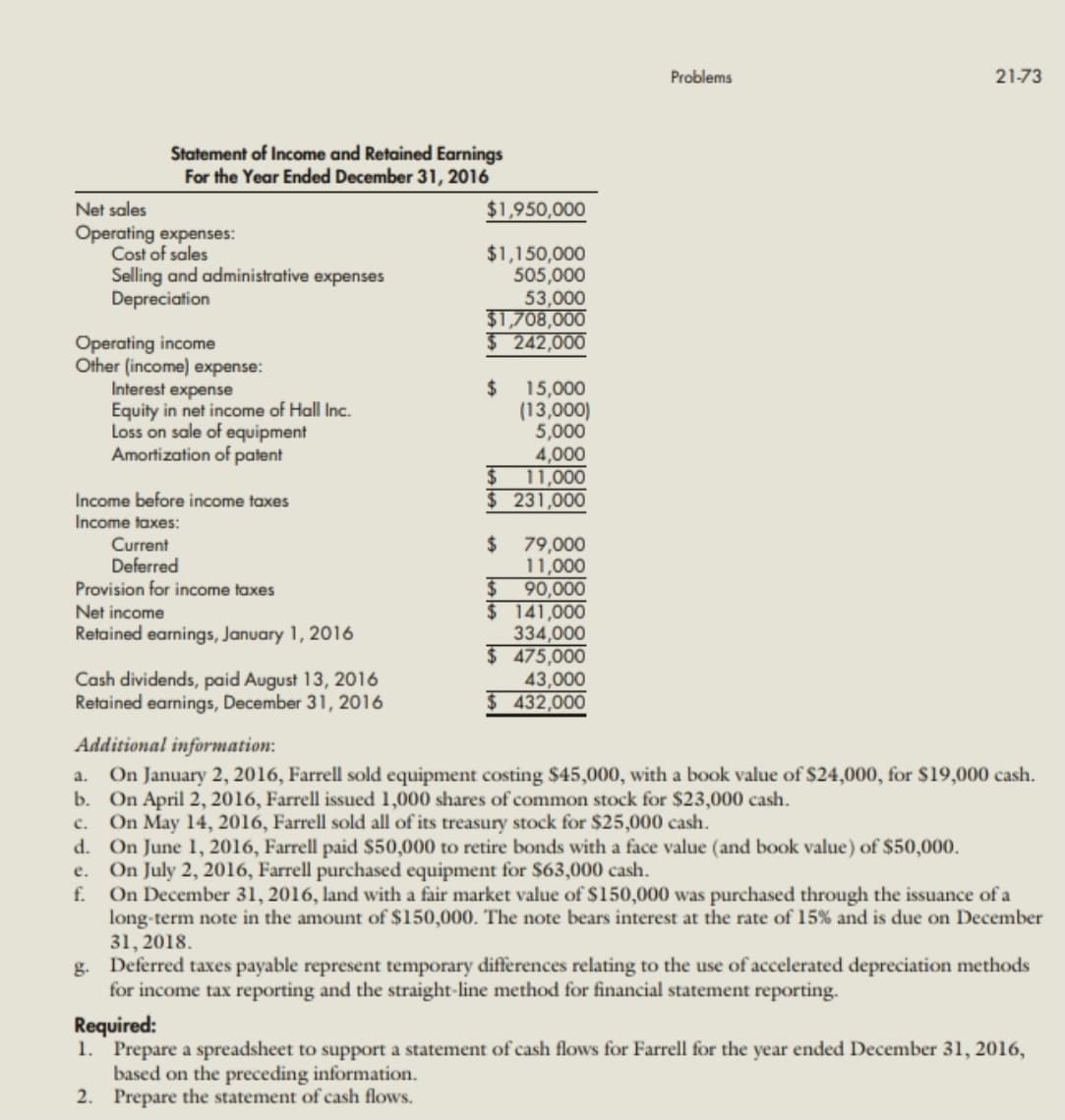

Transcribed Image Text:Problems

21-73

Statement of Income and Retained Earnings

For the Year Ended December 31, 2016

Net sales

$1,950,000

Operating expenses:

Cost of sales

Selling and administrative expenses

Depreciation

$1,150,000

505,000

53,000

$1,708,000

$242,000

Operating income

Other (income) expense:

Interest expense

Equity in net income of Hall Inc.

Loss on sale of equipment

Amortization of patent

24

15,000

(13,000)

5,000

4,000

$ 11,000

$ 231,000

Income before income taxes

Income taxes:

Current

Deferred

Provision for income taxes

%24

79,000

11,000

$ 90,000

$ 141,000

334,000

$ 475,000

43,000

$ 432,000

Net income

Retained earnings, January 1, 2016

Cash dividends, paid August 13, 2016

Retained earnings, December 31, 2016

Additional information:

On January 2, 2016, Farrell sold equipment costing $45,000, with a book value of $24,000, for S19,000 cash.

b. On April 2, 2016, Farrell issued 1,000 shares of common stock for $23,000 cash.

On May 14, 2016, Farrell sold all of its treasury stock for $25,000 cash.

d. On June 1, 2016, Farrell paid $50,000 to retire bonds with a face value (and book value) of $50,000.

On July 2, 2016, Farrell purchased equipment for $63,000 cash.

f.

a.

c.

е.

On December 31, 2016, land with a fair market value of $150,000 was purchased through the issuance of a

long-term note in the amount of $150,000. The note bears interest at the rate of 15% and is due on December

31, 2018.

g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods

for income tax reporting and the straight-line method for financial statement reporting.

Required:

1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2016,

based on the preceding information.

2. Prepare the statement of cash flows.

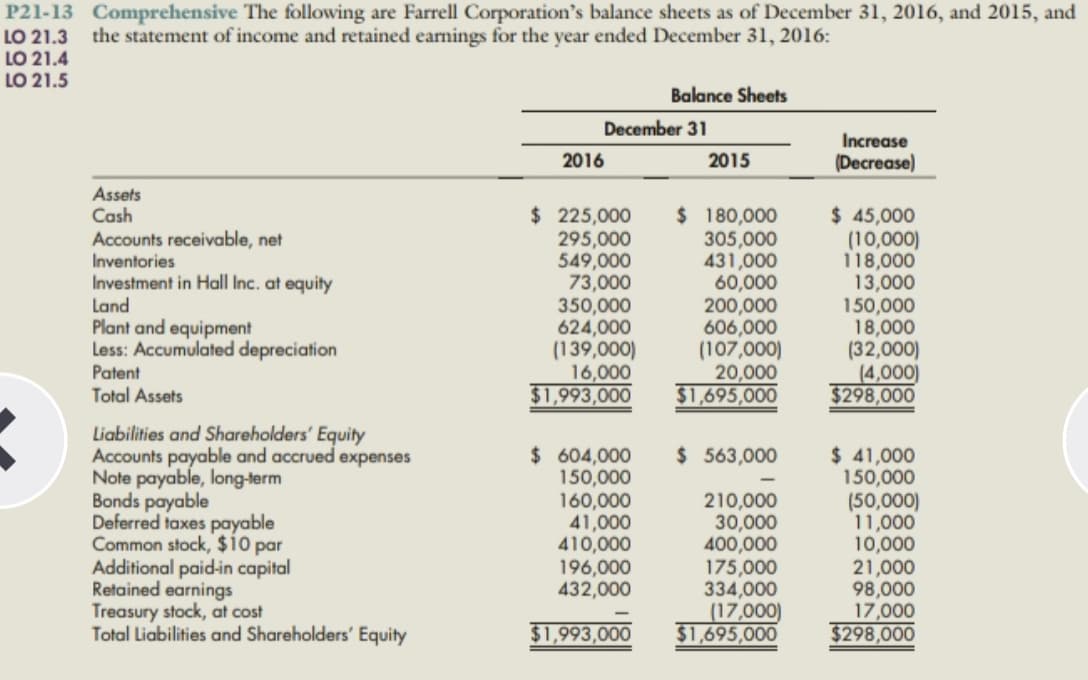

Transcribed Image Text:P21-13 Comprehensive The following are Farrell Corporation's balance sheets as of December 31, 2016, and 2015, and

the statement of income and retained earnings for the year ended December 31, 2016:

LO 21.3

LO 21.4

LO 21.5

Balance Sheets

December 31

Increase

(Decrease)

2016

2015

Assets

Cash

Accounts receivable, net

Inventories

Investment in Hall Inc. at equity

Land

Plant and equipment

Less: Accumulated depreciation

Patent

Total Assets

$225,000

295,000

549,000

73,000

350,000

624,000

(139,000)

16,000

$1,993,000

$ 180,000

305,000

431,000

60,000

200,000

606,000

(107,000)

20,000

$1,695,000

$ 45,000

(10,000)

118,000

13,000

150,000

18,000

(32,000)

(4,000)

$298,000

Liabilities and Shareholders' Equity

Accounts payable and accrued expenses

Note payable, long-term

Bonds payable

Deferred taxes payable

Common stock, $10 par

Additional paid-in capital

Retained earnings

Treasury stock, at cost

Total Liabilities and Shareholders' Equity

$ 563,000

$ 604,000

150,000

160,000

41,000

410,000

196,000

432,000

210,000

30,000

400,000

175,000

334,000

(17,000)

$1,695,000

$ 41,000

150,000

(50,000)

11,000

10,000

21,000

98,000

17,000

$298,000

$1,993,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning