Sydney Retailing (buyer) and Troy Wholesalers (seller) enter into the following transactions. May 11 Sydney accepts delivery of $29,000 of merchandise it purchases for resale from Troy: invoice dated May 11, terms 3/10, FOB shipping point. The goods cost Troy $19,430. Sydney pays $570 cash to Express Shipping for delivery charges c merchandise. ay 17 Sydney returns $2.300 of the $29.999 of goods to Troy, who receives them the same day and restores them to its inven

Sydney Retailing (buyer) and Troy Wholesalers (seller) enter into the following transactions. May 11 Sydney accepts delivery of $29,000 of merchandise it purchases for resale from Troy: invoice dated May 11, terms 3/10, FOB shipping point. The goods cost Troy $19,430. Sydney pays $570 cash to Express Shipping for delivery charges c merchandise. ay 17 Sydney returns $2.300 of the $29.999 of goods to Troy, who receives them the same day and restores them to its inven

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter10: Cash Receipts And Cash Payments

Section: Chapter Questions

Problem 5PB: The following transactions were completed by Nelsons Hardware, a retailer, during September. Terms...

Related questions

Question

Please do not give image format

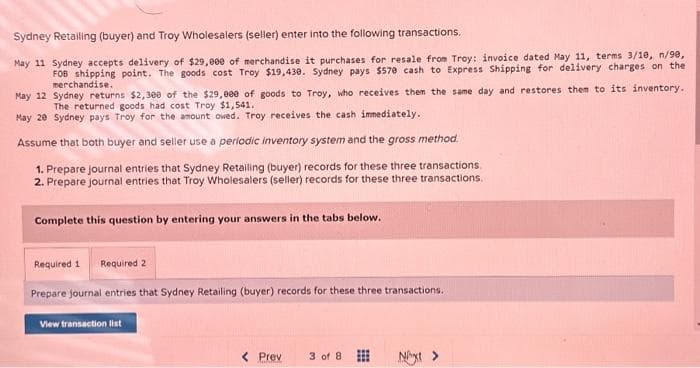

Transcribed Image Text:Sydney Retailing (buyer) and Troy Wholesalers (seller) enter into the following transactions.

May 11 Sydney accepts delivery of $29,000 of merchandise it purchases for resale from Troy: invoice dated May 11, terms 3/10, n/90,

FOB shipping point. The goods cost Troy $19,430. Sydney pays $570 cash to Express Shipping for delivery charges on the

merchandise.

May 12

Sydney returns $2,300 of the $29,000 of goods to Troy, who receives them the same day and restores them to its inventory.

The returned goods had cost Troy $1,541.

May 20 Sydney pays Troy for the amount owed. Troy receives the cash immediately.

Assume that both buyer and seller use a periodic inventory system and the gross method.

1. Prepare journal entries that Sydney Retailing (buyer) records for these three transactions.

2. Prepare journal entries that Troy Wholesalers (seller) records for these three transactions.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Prepare journal entries that Sydney Retailing (buyer) records for these three transactions.

View transaction list

< Prev

3 of 8

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,