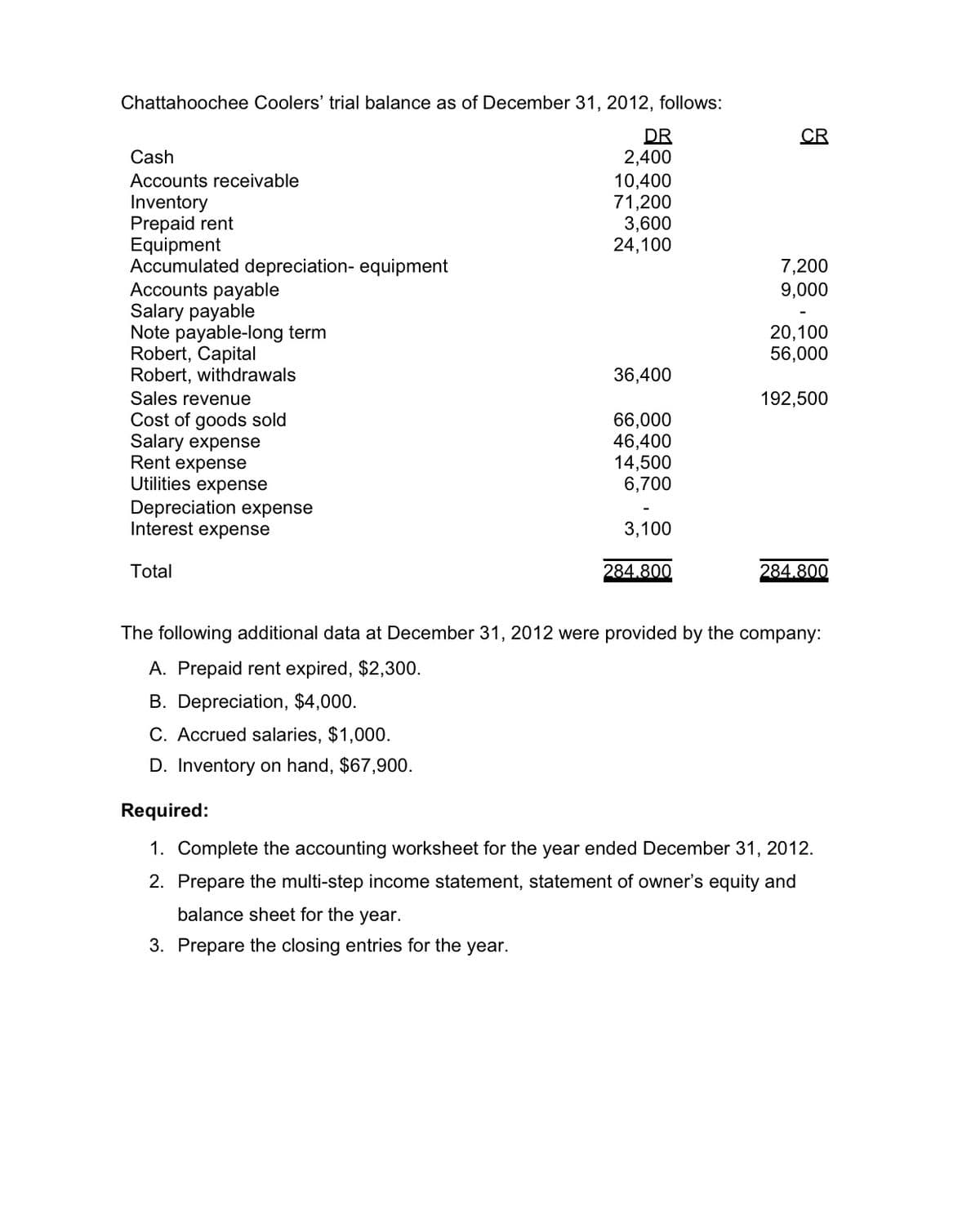

Required: 1. Complete the accounting worksheet for the year ended December 31, 2012. 2. Prepare the multi-step income statement, statement of owner's equity and balance sheet for the year. 3. Prepare the closing entries for the year.

Q: The following information was provided for Macy company. The purpose of presenting these account…

A: Income Statement for the year ended December 31, 2018. Sales…

Q: Using the above information prepare an October 31 balance sheet for Ernst Consulting.

A: ERNST Consulting Balance Sheet Assets Amount($) Liabilities Amount($) Current Assets Current…

Q: The general ledger of Jackrabbit Rentals at January 1, 2021, includes the following account…

A: 1. Record the transactions in the general journal.

Q: The following accounts appear in an adjusted trial balance of San Jose Consulting. Indicate whether…

A: Balance sheet is a financial statement that reports a company's assets, liabilities and…

Q: Can you please just do the income statement and balance sheet.

A: Income statement: The financial statement which reports revenues and expenses from business…

Q: REQUIRED: (Round up your answers to the nearest RM) (a) Prepare the necessary adjusting and…

A: 1. Income Statement - This Statement shows the income earned and loss incurred by the organization…

Q: 8. Prepare (a) a multi-step income statement, (b) a statement of owner's equity, and (c) a balance…

A: Statement of owner’s equity is a statement showing the shareholders’ equity at end of a period. The…

Q: The following selected accounts and their current balances appear in the ledger of Kanpur Co. for…

A: An income statement is a financial report that indicates the revenue and expenses of a business. It…

Q: Prepare an income statement for the current year ended September 3

A: Financial statement A financial statement is the complete record of financial transactions that…

Q: Required: 1. Prepare an income statement and statement of retained earnings for the year ended…

A: 1. Income statement Revenue earned $170,000 Less: Expenses Income tax expense -6000…

Q: What is the Income statement, statement of owners oquityAdjusted Trial Balance

A: Income Statement is a profit or loss account to the entity, it is one of financial statements that…

Q: On January 15, 2017, the accountant of Beshie Appliance Company prepared an income statement for the…

A: The question is related to Correct heading for the correct period.

Q: The following trial balance was extracted from the books of L. Kesego as at 31 Dec 2017. Use it to…

A: Income statement is a statement which shows all income and expenses of the business for the…

Q: state the assets, liabilities, and owners equity as of March 1 in equation similiar to that shown in…

A: Accounting equation is built on the foundation of Double-entry accounting system. As per Accounting…

Q: Preparing financial statements from the trial balance and calculating the debt ratio The trial…

A: Hey, since there are multiple requirements posted, we will answer first three requirements. If you…

Q: For each account on this company's balance sheet, show the change in the account during 2021 and…

A: Cash flows statement is that financial statement which shows all cash inflows and cash outflows of…

Q: One February 1, A&D opened for business. Prepare an income statement for the month of February and a…

A: The financial statements provide detailed financial information about the assets, obligations,…

Q: Miles Corporation completed the following selected transactions during the current year. A (Click…

A: The relationship between three elements is explained by preparing the accounting equations. These…

Q: The balances for the accounts listed below appear in the Adjusted Trial Balance at the end of the…

A: Financial Statements are prepared by the management for reporting purposes. These are the essential…

Q: Required: Prepare the entry to close the firm's Income Summary account as of its December 31…

A: Partnership is a form of business where two or more partners own and manage the business. Each…

Q: Prepare an income statement and statement of retained earnings for the year ended December 31, 2011.…

A:

Q: Required: 1. Prepare the journal entries to record the transactions. 2. Prepare the statement of…

A: Retained earnings: The amount of earnings remaining after making payment to shareholders is known as…

Q: Required: (a) Enter each transaction above into the ledger accounts. (b) Prepare an Income Statement…

A: Adjustments for prepaid and outstanding expenses are made at the end of the year, and then final…

Q: Prepare a balance sheet for Thompson Computer Services for the current year ended March 31. Thompson…

A: The balance sheet is a statement prepared to ascertain the true position of assets and liabilities…

Q: (a) Prepare journal entries with explanations to record the transactions above. (6 marks) (b)…

A: Number of shares issued- 700,000 Issue price -$1 Number of application received -700,000 (fully…

Q: 4. Prepare journal entries for the year. Adjusting entries should also be prepared, if necessary, at…

A: Ledger Account A company's ledger account is a journal in which it keeps track of all transactions…

Q: 1. Prepare the journal entries to record the transactions. 2. Prepare the statement of retained…

A: Shareholders equity is also known as capital for the corporates. It is the fund invested by the…

Q: Use the Trial Balance Information for Douglas Distinctive Services to complete an Income Statement,…

A: The question requires preparation of Income Statement, Statement of Owner's Equity and Balance Sheet…

Q: The following accounts appear in an adjusted trial balance of Blaine Auto Service Company. Indicate…

A: A current asset is cash and other assets or resources commonly identified as those which are…

Q: Open suitably coded ledger account and enter balances for assets and liabilities on 1st january and…

A: Accounts Payable Date Particulars Amount Date Particulars Amount Jan-31 To Balance b/d 7200…

Q: E1B. Premium Realty Company's income statement accounts at the end of its fiscal year follow.…

A: Closing Entry: These are the journal entries which are passed at the end of accounting period. It…

Q: A. What is the balance in the Unearned Consulting Fees account on the 31st of January, after the…

A: Hi student Since there are multiple subparts, we will answer only first three subparts.

Q: Required: Use the information in the adjusted trial balance to prepare (a) the income statement for…

A: Financial statements are those statements which are prepared at the end of the period. It includes…

Q: Review the account balances for Gorman Group for their fiscal year-end as of Oct 31 below. What is…

A: Net income is calculated as excess of revenues over expenses.

Q: Using the following (scrambled) accounts, prepare a balance sheet for ABC, a retail company, for the…

A: The balance sheet is one of the financial statements of the business, which represents the financial…

Q: The balances for the accounts that follow appear in the Adjusted Trial Balance columns of the…

A: Trial Balance: Trial balance is a statement in which the closing balance of all ledger accounts are…

Q: Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required…

A: The question is based on the concept of Financial Accounting.

Q: What is the Income statement, statement of owners equity, and balance sheet It is the last step…

A: Income Statement: It reports financial performance in terms of profit or loss for a specific period.…

Q: 2. Prepare the Income statement for the year ended December 31st, 2007 3. Prepare the Statement of…

A:

Q: Pope's Garage had the following accounts and amounts in its financial statements on December 31,…

A: Current assets are assets that are expected to be utilized over a period of one year.

Q: The following information is available for the Higgins Travel Agency. After closing entries are…

A: While posting closing entries: Incomes and Expenses are transferred to Income summary account.…

Q: (A) prepare a multiple step income statement for the year ended December 31, 2018. (B) Prepare a…

A: Income Statement is a form of financial statement which shows all income and expenses of the…

Q: Select whether each of the following would appear on the income statement, statement of owner's…

A: The financial statements of the business includes income statement and balance sheet and statement…

Q: I need to create a balance sheet, income statement, and Retained Earnings Statement. Can you point…

A: Income statement: The financial statement which reports revenues and expenses from business…

Q: 1. Prepare the general journal for all transactions since begin the company and 5 additional items…

A: Debit the receiver and credit the giver. Debit what comes in and credit what goes out. Debit…

Q: Required a. Determine the balance in the Retained Earnings account as of January 31, Year 1. b.…

A: Revenue and expense are recorded from period to period however its balance at the year end is not…

Q: Prepare Statement of Owners Equity for the month of August 31, 2016. 7- Prepare Balance Sheet for…

A: Statement of owners equity is a statement which shows all changes in equity balance during the…

I need help with these questions and explanations.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

- Refer to the information for Cox Inc. above. What amount would Cox record as depreciation expense at December 31, 2020, if the double-declining-balance method were used? a. $187,200 b. $192,000 c. $195,200 d. $312, 000Company presents the following selected general ledger accountsshowing balances at October 1, 2017: CashFinished GoodsWork in ProcessRaw materialsPrepaid Insurance Accumulated Depreciation Accounts PayableBalances at October 31, 2017 include: Accrued payrollFinished goodsWork in ProcessRaw MaterialsP 40,000 592,000 164,000 128,0004,000 280,000 108,000P 12,000 608,000 188,000 120,000 A summary of transactions for the month of October follows: a. Cash salesb. Raw materials purchased on account c. Direct materials usedd. Direct Labore. Factory insurance expiredf. Depreciation for factory equipment g. Factory utility service on accounth. Accounts payable paidi. Factory payroll paidP420,000 168,000 156,00064,000 1,200 6,80012,000 196,000 88,000Required: Indirect materials used.Indirect laborTotal factory overhead Cost of goods manufaThe trial balance of Fuzzy Security Services Ltd. as of January 1, Year 9, had the following normal balances:Cash$93,380Petty Cash100Accounts receivable21,390Allowance for doubtful accounts2,485Supplies180Prepaid rent3,000Merchandise inventory (23 @ $280)6,440Equipment9,000Van27,000Accumulated depreciation14,900Salaries payable1,500Common stock50,000Retained earnings91,605During Year 9, Fuzzy Security Services experienced the following transactions:1. Paid the salaries payable from Year 8.2. Paid $9,000 on May 2, Year 9, for one year’s office rent in advance.3. Purchased $425 of supplies on account.4. Purchased 145 alarm systems at a cost of $290 each. Paid cash for the purchase.5. After numerous attempts to collect from customers, wrote off $2,060 of uncollectible accounts receivable.6. Sold 130 alarm systems for $580 each plus sales tax of 5 percent. All sales were on account. (Be sure to compute cost of goods sold using the FIFO cost flow method.)7. Billed $107,000 of monitoring…

- Samke Limited sells new equipment and repairs equipment for their regular customers. The following information was extracted from the accounting records for the financial year ended 30 June 2021 Extracted from the Pre-Adjustment Trial Balance at 30 June 2021: R Fixed deposit 160 000 nie in nie Asset Inventory: Trade goods 219 800 nie in nie Asset Debtors control 39 090 nie in nie Asset Machinery 224 000 Accumulated depreciation: Machinery 130 000 Long term borrowing: Finhouse 281 200 liability nie in nie Sales 1 680 000 Debtors allowances/bad debt 17 000 Cost of sales 1 050 000 Service fee income (in respect of repair services) 297 140 Rent income 105 000 Interest income 11 200 Salaries and wages 294 640 Audit fees 30 000 Directors fees 230 000 Consumable stores 51 100 Bank charges 5 240 Travel and entertainment - Directors 15 910 Adjustments and additional…The following accounts and their balances appear in an unadjusted trial balance of Lechon Company as of December 31, 2023: · Cash and cash equivalents- P400,000 · Trade and other receivables- P2,000,000 · Inventory- P500,000 · Subscription receivable- P375,000· Trade and other payables- P670,000 · Income tax payable- P196,500Additional information: · Trade and other receivables include long term advances to company officers amounting to P430,000. · The subscription receivable has the following call dates: June 30,2024- P200,000; December 31, 2024- P100,000; and June 30, 2025- P75,000. · Inventory of P 500,000 was determined by physical count. On December 31, 2023, goods costing P 125,000 are in transit from a supplier. Terms of purchase of said goods is FOB shipping point. The goods and the related invoice have not been received as of the year end. · Trade and other payables include dividends payable amounting to…Bayley Company has the following trial balance below at December 31, 2020. All accounts have normal balances. Account Balance Cash $460,000 Accounts receivable (net of the Allowance for Doubtful Accounts) 352,000 Inventory at the lower of FIFO cost and net realizable value 451,000 Trading Investments 230,000 Buildings (net of accumulated depreciation) 740,000 Equipment (net of accumulated depreciation) 240,000 Land held for Future Use 305,000 Goodwill 89,000 Notes Receivable (due 2025) 91,000 Prepaid Insurance 16,000 Accounts Payable 345,000 Guaranteed Investment Certificates 50,000 Notes Payable (due in 2021) 235,000 Bonds Payable at net carrying value (due February 1, 2021) 83,000 Rent Payable 55,000 Bonds Payable at net carrying value (due December 31, 2028) 746,000 Common shares, unlimited number of shares authorized 400,000 Contributed surplus 190,000 Retained…

- On January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances:Accounts Debit CreditCash $ 11,200Accounts Receivable 34,000Allowance for Uncollectible Accounts $ 1,800Inventory 152,000Land 67,300Buildings 120,000Accumulated Depreciation 9,600Accounts Payable 17,700Common Stock 200,000Retained Earnings 155,400Totals $384,500 $384,500During January 2021, the…On January 1, 2020, the records of ABC Company showed a debit balance of P650,000 in its Accounts Receivable account. The following summary transactions that occurred during 2020 were also shown under the said account: Debits:Charge sales, P6,300,000Shareholders’ subscriptions, P200,000Deposit on contract, P120,000Claims against common carrier for shipping damages, P100,000IOUs from employees, P10,000Cash advances to affiliates, P150,000Advances to a supplier, P30,000Credits:Collections from customers, P5,300,000Write-off, P35,000Merchandise returns, P45,000Allowances to customers for shipping damages, P25,000Collections on carrier claims, P40,000Collections on subscriptions, P50,000Required:a. Determine the correct amount of accounts receivable.b. Compute the amount to be presented as “trade and other receivables” under current assets.The trial balance of Pacilio Security Services, Incorporated as of January 1, Year 9, had the following normal balances Cash $ 93,380Petty cash 100Accounts receivable 21,390Allowance for doubtful accounts 2,485Supplies 180Prepaid rent 3,000Merchandise inventory (23 @ $280) 6,440Equipment 9,000Van 27,000Accumulated depreciation 14,900Salaries payable 1,500Common stock 50,000Retained earnings 91,605 During Year 9, Pacilio Security Services experienced the following transactions: Paid the salaries payable from Year 8 Paid $9,000 on May 2, Year 9, for one year’s office rent in advance Purchased $425 of supplies on account Purchased 145 alarm systems at a cost of $290 each. Paid cash for the purchase After numerous attempts to collect from customers, wrote off $2,060 of uncollectible accounts receivable Sold 130 alarm systems for $580 each plus sales tax of 5 percent. All sales were on account Record cost of good sold for the sales transaction…

- 1. The following accounts and their balances appear in an unadjusted trial balance of Achiever Company as of December 31, 2020: Cash and Cash Equivalents - 400,000; Trade and other receivables - 2,000,000; Subscription receivable - 375,000; Inventory -500,000; Trade and other payables - 670,000; Income tax payable - 196,500. Additional information: a) Trade and other receivables include long term advances to company officers amounting to P430,000. b) The subscription receivable has the following call dates: June 30, 2021, P200,000; December 31, 2021, P100,000; and June 30, 2022, P75,000. c) Trade and other payables include dividends payable amounting to P170,000, of which P70,000 is payable in cash and P100,000 is distributable in Achiever's own shares. What is the total current assets at December 31, 2020? * 2. The financial records of DISGRASYA Inc. were destroyed by fire at the end of 2020. Selected information gathered are the following: Inventory on January 1 was P92,000 and…1.The following accounts and their balances appear in an unadjusted trial balance of Achiever Company as of December 31, 2020: Cash and Cash Equivalents - 400,000; Trade and other receivables - 2,000,000; Subscription receivable - 375,000; Inventory -500,000; Trade and other payables - 670,000; Income tax payable - 196,500. Additional information: a) Trade and other receivables include long term advances to company officers amounting to P430,000. b) The subscription receivable has the following call dates: June 30, 2021, P200,000; December 31, 2021, P100,000; and June 30, 2022, P75,000. c) Trade and other payables include dividends payable amounting to P170,000, of which P70,000 is payable in cash and P100,000 is distributable in Achiever's own shares. What is the total current assets at December 31, 2020? 2.Using the information of Achiever Company, what is the total current liabilities at December 31, 2020? Thank you so muchThe following is a portion of the current assets section of the balance sheets of Avanti's, Inc., at December 31, 2020 and 2019: 12/31/20 12/31/19 Accounts receivable, less allowance for baddebts of $9,750 and $15,336, respectively $179,866 $225,851 Required:a. If $11,849 of accounts receivable were written off during 2020, what was the amount of bad debts expense recognized for the year? (Hint: Use a T-account model of the Allowance account, plug in the three amounts that you know, and solve for the unknown.) b. The December 31, 2020, Allowance account balance includes $3,034 for a past due account that is not likely to be collected. This account has not been written off.(1) If it had been written off, will there be any effect of the write-off on the working capital at December 31, 2020? Yes No (2) If it had been written off, will there be any effect of the write-off on net income and ROI for the year ended December 31, 2020? Yes No c. The…