Required: (a) Enter each transaction above into the ledger accounts. (b) Prepare an Income Statement (extract) for the year ended 31 December 2021, and (c) the Balance Sheet (extract) as at that date.

Required: (a) Enter each transaction above into the ledger accounts. (b) Prepare an Income Statement (extract) for the year ended 31 December 2021, and (c) the Balance Sheet (extract) as at that date.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter1: Introduction To Accounting And Business

Section: Chapter Questions

Problem 4PB: Transactions; financial statements 2. Net income: 10,850 On April 1, 20Y8, Maria Adams established...

Related questions

Question

Please help me to solve this problem

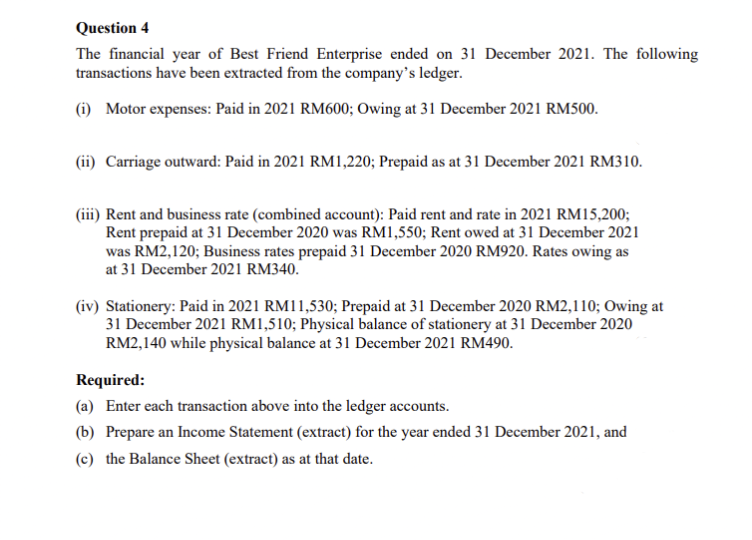

Transcribed Image Text:Question 4

The financial year of Best Friend Enterprise ended on 31 December 2021. The following

transactions have been extracted from the company's ledger.

(i) Motor expenses: Paid in 2021 RM600; Owing at 31 December 2021 RM500.

(ii) Carriage outward: Paid in 2021 RM1,220; Prepaid as at 31 December 2021 RM310.

(iii) Rent and business rate (combined account): Paid rent and rate in 2021 RM15,200;

Rent prepaid at 31 December 2020 was RM1,550; Rent owed at 31 December 2021

was RM2,120; Business rates prepaid 31 December 2020 RM920. Rates owing as

at 31 December 2021 RM340.

(iv) Stationery: Paid in 2021 RM11,530; Prepaid at 31 December 2020 RM2,110; Owing at

31 December 2021 RM1,510; Physical balance of stationery at 31 December 2020

RM2,140 while physical balance at 31 December 2021 RM490.

Required:

(a) Enter each transaction above into the ledger accounts.

(b) Prepare an Income Statement (extract) for the year ended 31 December 2021, and

(c) the Balance Sheet (extract) as at that date.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 14 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning