Required: 1. Compute basic and diluted earnings per share for Witter House in 2024. 2. Compute basic and diluted earnings per share for Witter House in 2025. Note: Do not round intermediate calculations. Except for per share amounts, enter your answers in millions (i.e., 10,000,000 should be entered as 10). Round "Earnings per share" answer to 2 decimal places. Round "Denominator" answers to 2 decimal places. > Answer is complete but not entirely correct. Numerator Denominator Earnings per share

Required: 1. Compute basic and diluted earnings per share for Witter House in 2024. 2. Compute basic and diluted earnings per share for Witter House in 2025. Note: Do not round intermediate calculations. Except for per share amounts, enter your answers in millions (i.e., 10,000,000 should be entered as 10). Round "Earnings per share" answer to 2 decimal places. Round "Denominator" answers to 2 decimal places. > Answer is complete but not entirely correct. Numerator Denominator Earnings per share

Chapter6: Fixed-income Securities: Characteristics And Valuation

Section: Chapter Questions

Problem 14P

Related questions

Question

Sagar

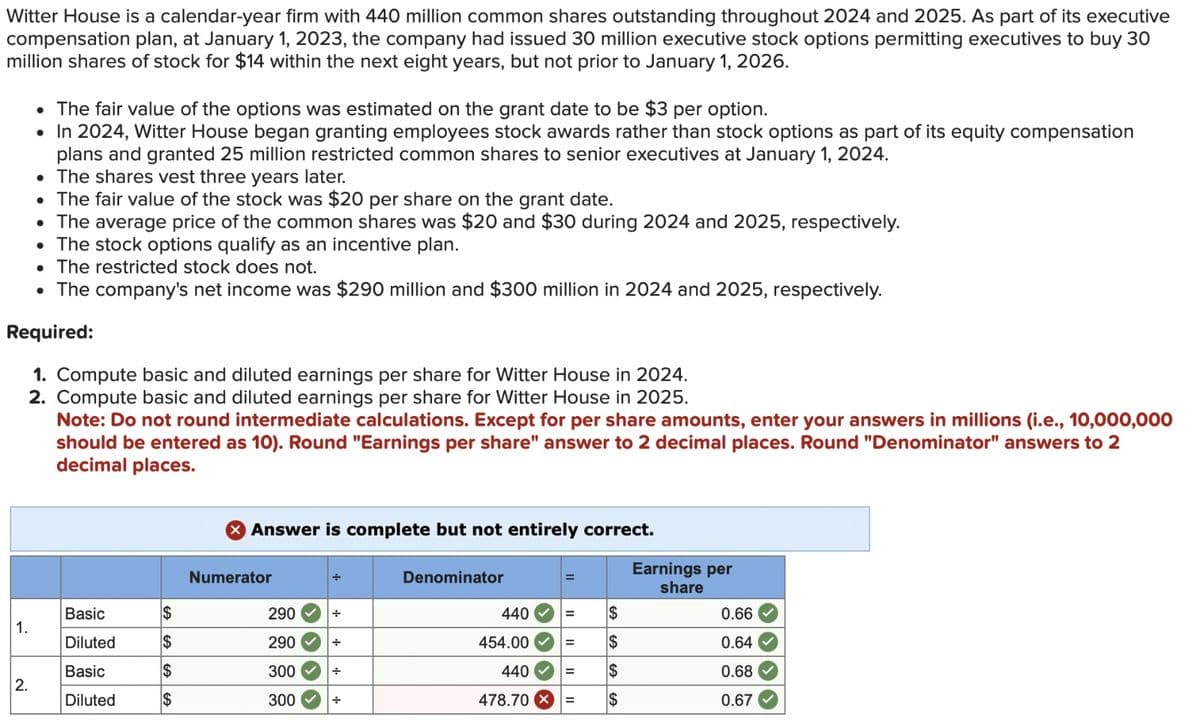

Transcribed Image Text:Witter House is a calendar-year firm with 440 million common shares outstanding throughout 2024 and 2025. As part of its executive

compensation plan, at January 1, 2023, the company had issued 30 million executive stock options permitting executives to buy 30

million shares of stock for $14 within the next eight years, but not prior to January 1, 2026.

• The fair value of the options was estimated on the grant date to be $3 per option.

•

In 2024, Witter House began granting employees stock awards rather than stock options as part of its equity compensation

plans and granted 25 million restricted common shares to senior executives at January 1, 2024.

⚫ The shares vest three years later.

• The fair value of the stock was $20 per share on the grant date.

• The average price of the common shares was $20 and $30 during 2024 and 2025, respectively.

• The stock options qualify as an incentive plan.

• The restricted stock does not.

• The company's net income was $290 million and $300 million in 2024 and 2025, respectively.

Required:

1. Compute basic and diluted earnings per share for Witter House in 2024.

2. Compute basic and diluted earnings per share for Witter House in 2025.

Note: Do not round intermediate calculations. Except for per share amounts, enter your answers in millions (i.e., 10,000,000

should be entered as 10). Round "Earnings per share" answer to 2 decimal places. Round "Denominator" answers to 2

decimal places.

> Answer is complete but not entirely correct.

Numerator

Basic

$

290

÷

1.

Diluted

$

290

Basic

$

300

2.

Diluted

$

300

+

Denominator

Earnings per

share

440

$

0.66

454.00

|=

$

0.64

440

= $

0.68

478.70 x =

69

$

0.67

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning