Required: 1. Compute the number and total cost of the units available for sale during the year. 2. Compute the amounts assigned to ending inventory and the cost of goods sold using (a) FIFO, (b) LIFO, and (c) weighted average.

Required: 1. Compute the number and total cost of the units available for sale during the year. 2. Compute the amounts assigned to ending inventory and the cost of goods sold using (a) FIFO, (b) LIFO, and (c) weighted average.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Inventories

Section: Chapter Questions

Problem 6.5BE: Periodic inventory using FIFO, UFO, and weighted average cost methods The units of an item available...

Related questions

Question

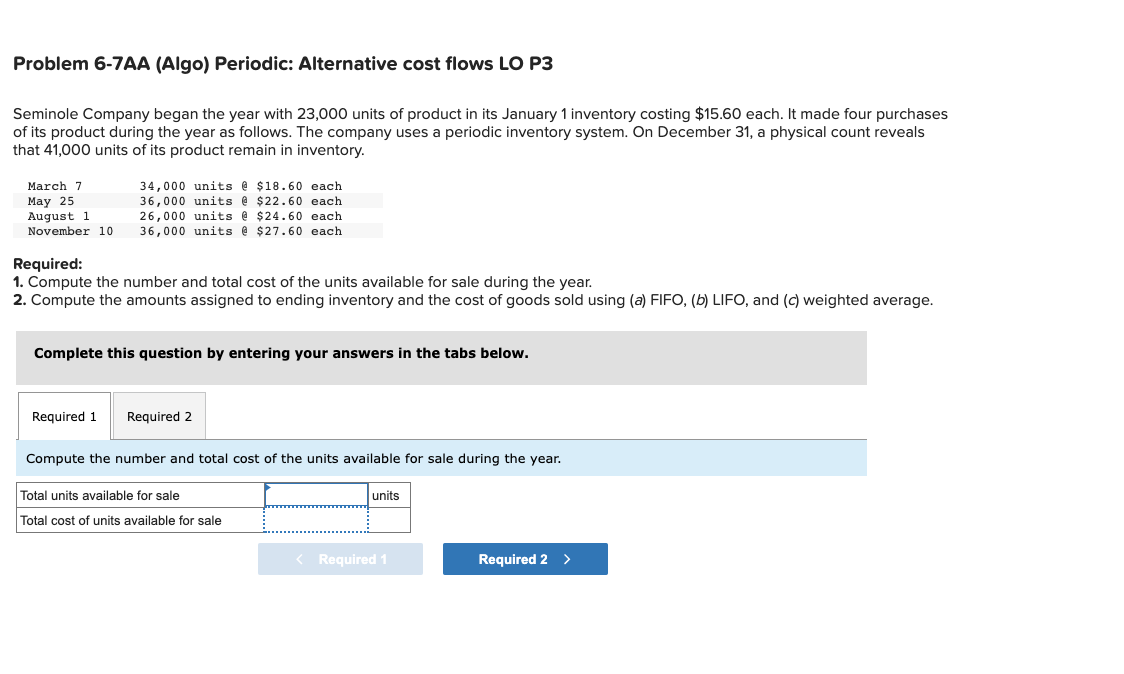

Transcribed Image Text:Problem 6-7AA (Algo) Periodic: Alternative cost flows LO P3

Seminole Company began the year with 23,000 units of product in its January 1 inventory costing $15.60 each. It made four purchases

of its product during the year as follows. The company uses a periodic inventory system. On December 31, a physical count reveals

that 41,000 units of its product remain in inventory.

March 7

May 25

August 1

November 10

34,000 units @ $18.60 each

36,000 units @ $22.60 each

26,000 units @ $24.60 each

36,000 units @ $27.60 each.

Required:

1. Compute the number and total cost of the units available for sale during the year.

2. Compute the amounts assigned to ending inventory and the cost of goods sold using (a) FIFO, (b) LIFO, and (c) weighted average.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Compute the number and total cost of the units available for sale during the year.

Total units available for sale

Total cost of units available for sale

units

< Required 1

Required 2 >

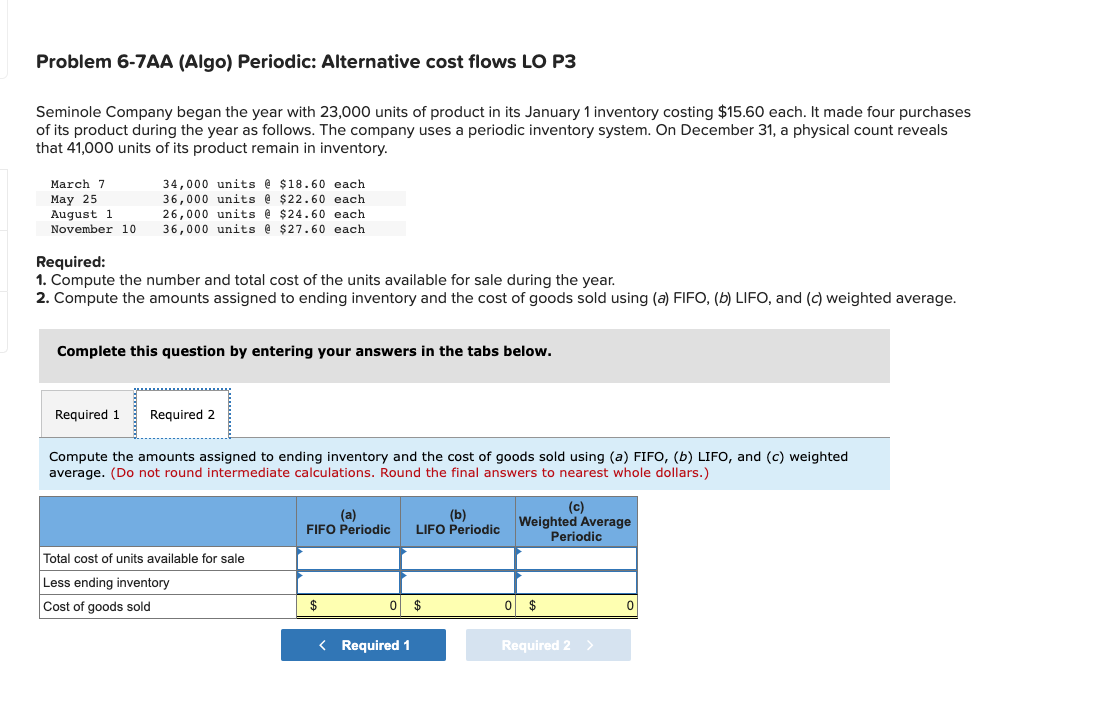

Transcribed Image Text:Problem 6-7AA (Algo) Periodic: Alternative cost flows LO P3

Seminole Company began the year with 23,000 units of product in its January 1 inventory costing $15.60 each. It made four purchases

of its product during the year as follows. The company uses a periodic inventory system. On December 31, a physical count reveals

that 41,000 units of its product remain in inventory.

March 7

May 25

August 1

November 10

34,000 units @ $18.60 each.

36,000 units @ $22.60 each.

26,000 units @ $24.60 each

36,000 units @ $27.60 each.

Required:

1. Compute the number and total cost of the units available for sale during the year.

2. Compute the amounts assigned to ending inventory and the cost of goods sold using (a) FIFO, (b) LIFO, and (c) weighted average.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Compute the amounts assigned to ending inventory and the cost of goods sold using (a) FIFO, (b) LIFO, and (c) weighted

average. (Do not round intermediate calculations. Round the final answers to nearest whole dollars.)

Total cost of units available for sale

Less ending inventory

Cost of goods sold

(a)

(b)

FIFO Periodic LIFO Periodic

$

0 $

< Required 1

(c)

Weighted Average

Periodic

0 $

Required 2

>

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning