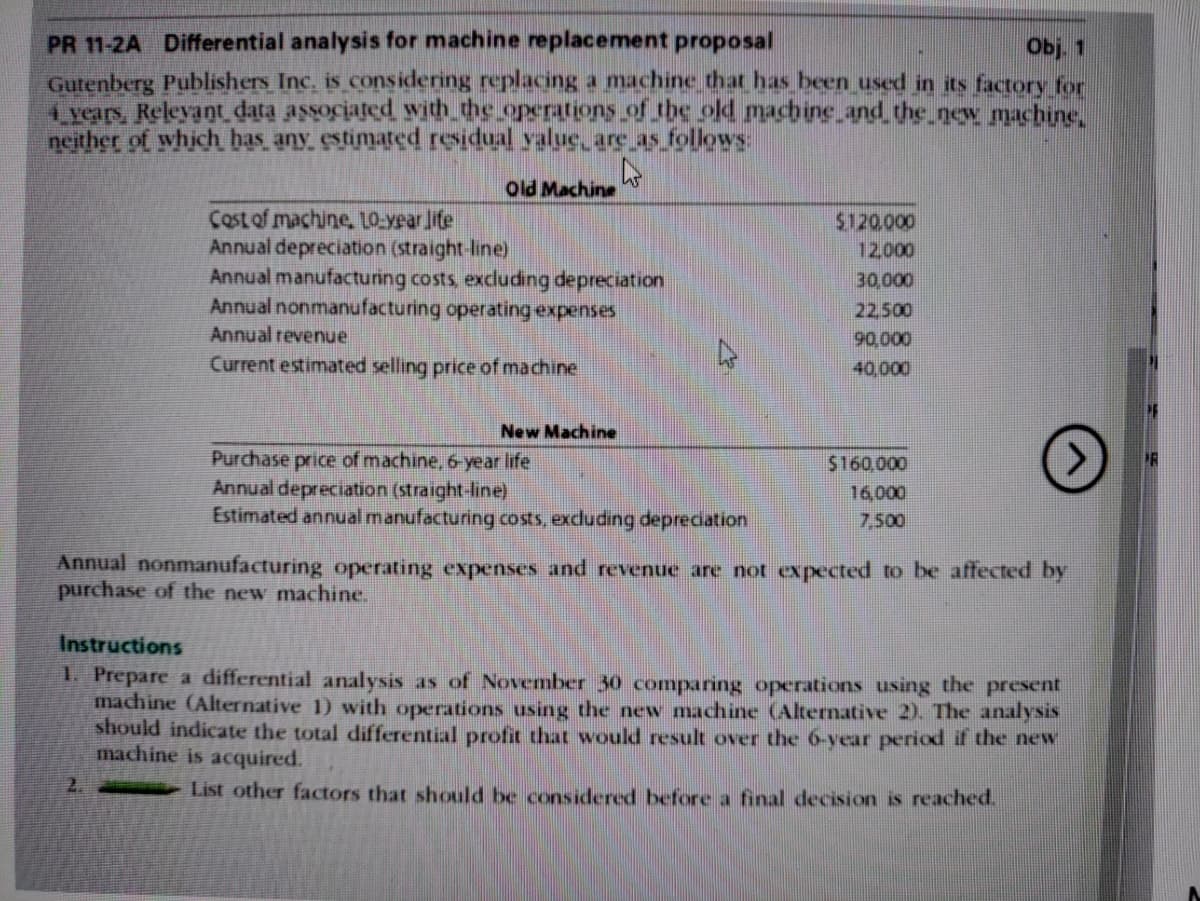

Obj. 1 PR 11-2A Differential analysis for machine replacement proposal Gutenberg Publishers Inc. is considering replacing a machine that has been used in its factory for 4 years, Relevant data associated with the operations of the old machine and the new machine. neither of which has any estimated residual value are as follows: W Old Machine Cost of machine, 10-year life Annual depreciation (straight-line) Annual manufacturing costs, excluding depreciation Annual nonmanufacturing operating expenses Annual revenue Current estimated selling price of machine 2. New Machine Purchase price of machine, 6-year life Annual depreciation (straight-line) Estimated annual manufacturing costs, excluding depreciation $120,000 12,000 30,000 22,500 90,000 40,000 $160,000 16,000 7,500 Annual nonmanufacturing operating expenses and revenue are not expected to be affected by purchase of the new machine. > Instructions 1. Prepare a differential analysis as of November 30 comparing operations using the present machine (Alternative 1) with operations using the new machine (Alternative 2). The analysis should indicate the total differential profit that would result over the 6-year period if the new machine is acquired. List other factors that should be considered before a final decision is reached.

Obj. 1 PR 11-2A Differential analysis for machine replacement proposal Gutenberg Publishers Inc. is considering replacing a machine that has been used in its factory for 4 years, Relevant data associated with the operations of the old machine and the new machine. neither of which has any estimated residual value are as follows: W Old Machine Cost of machine, 10-year life Annual depreciation (straight-line) Annual manufacturing costs, excluding depreciation Annual nonmanufacturing operating expenses Annual revenue Current estimated selling price of machine 2. New Machine Purchase price of machine, 6-year life Annual depreciation (straight-line) Estimated annual manufacturing costs, excluding depreciation $120,000 12,000 30,000 22,500 90,000 40,000 $160,000 16,000 7,500 Annual nonmanufacturing operating expenses and revenue are not expected to be affected by purchase of the new machine. > Instructions 1. Prepare a differential analysis as of November 30 comparing operations using the present machine (Alternative 1) with operations using the new machine (Alternative 2). The analysis should indicate the total differential profit that would result over the 6-year period if the new machine is acquired. List other factors that should be considered before a final decision is reached.

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter9: Fixed Assets And Intangible Assets

Section: Chapter Questions

Problem 9.3CP: Effect of depreciation on net income Tuttle Construction Co. specializes in building replicas of...

Related questions

Question

Please help with the blank yellow fields.

Transcribed Image Text:PR 11-2A Differential analysis for machine replacement proposal

Obj. 1

Gutenberg Publishers Inc. is considering replacing a machine that has been used in its factory for

4 years, Relevant data associated with the operations of the old machine and the new machine,

neither of which has any estimated residual value, are as follows:

W

Old Machine

Cost of machine, 10-year life

Annual depreciation (straight-line)

Annual manufacturing costs, excluding depreciation

Annual nonmanufacturing operating expenses

Annual revenue

Current estimated selling price of machine

2.

New Machine

Purchase price of machine, 6-year life

Annual depreciation (straight-line)

Estimated annual manufacturing costs, excluding depreciation

$120.000

12,000

30,000

22,500

90,000

40,000

$160,000

16,000

7,500

Annual nonmanufacturing operating expenses and revenue are not expected to be affected by

purchase of the new machine.

Instructions

1. Prepare a differential analysis as of November 30 comparing operations using the present

machine (Alternative 1) with operations using the new machine (Alternative 2). The analysis

should indicate the total differential profit that would result over the 6-year period if the new

machine is acquired.

List other factors that should be considered before a final decision is reached.

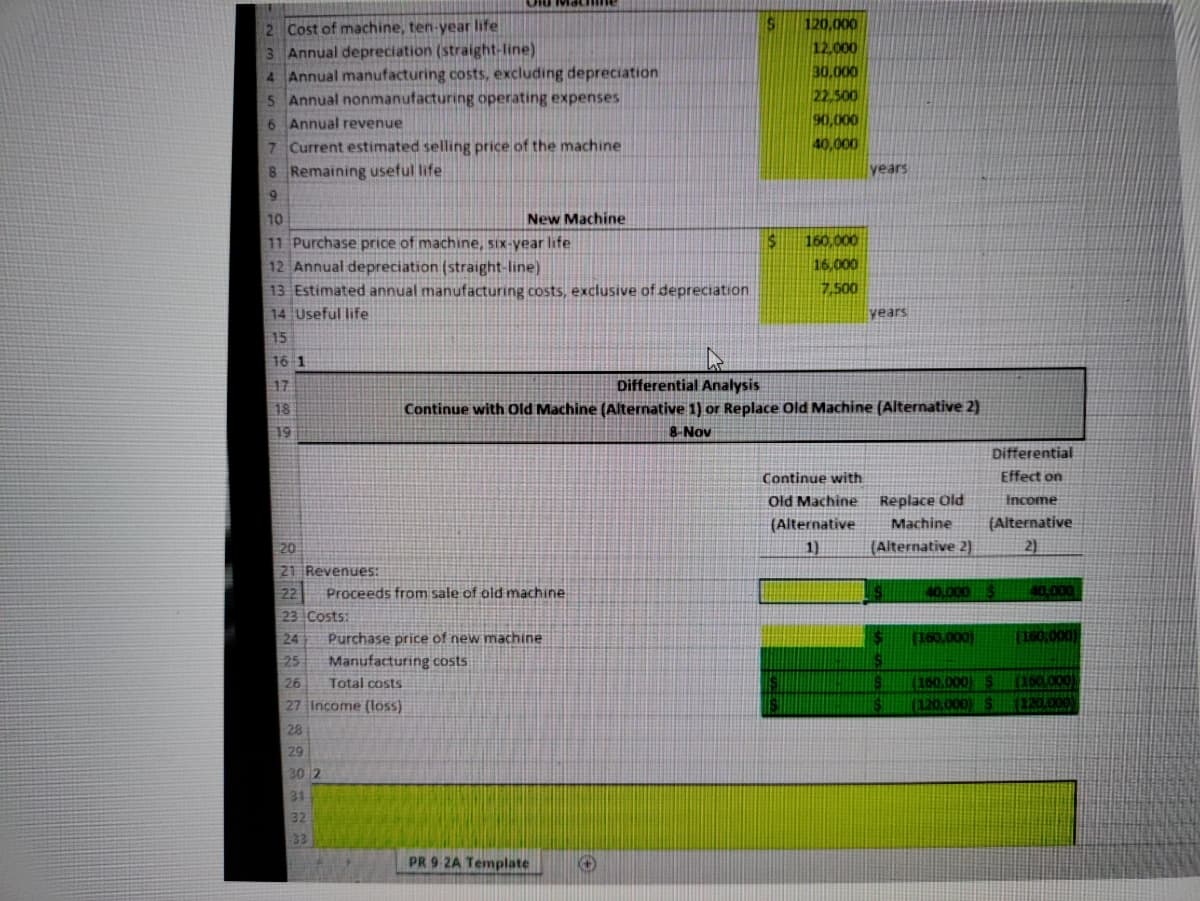

Transcribed Image Text:2 Cost of machine, ten-year life

3 Annual depreciation (straight-line)

4 Annual manufacturing costs, excluding depreciation

5 Annual nonmanufacturing operating expenses

6 Annual revenue

7

Current estimated selling price of the machine

8 Remaining useful life

9

10

11 Purchase price of machine, six-year life

12 Annual depreciation (straight-line)

13 Estimated annual manufacturing costs, exclusive of depreciation

14 Useful life

15

1618

16-1

17

18

19

852372 S53SS383

20

21 Revenues:

23 Costs:

24

26

28

27 Income (loss)

29

30 2

New Machine

31

Proceeds from sale of old machine

Purchase price of new machine

Manufacturing costs

Total costs

PR 9-2A Template

S

Ⓒ

$

120,000

12,000

30,000

4

Differential Analysis

Continue with Old Machine (Alternative 1) or Replace Old Machine (Alternative 2)

8-Nov

22,500

90,000

40,000

$

160,000

16,000

7,500

Continue with

Old Machine

(Alternative

1)

years

years

Replace Old

Machine

(Alternative 2)

$

$

S

$

Differential

Effect on

Income

(Alternative

2)

40.000 $

[160,000)

(160.000) $

(120,000) $

40,000

(160,000)

(160,000)

(120.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning