Required: 1. Compute the predetermined overhead rate. 2. Compute the hourly billing rate for Debbie and Tara.

Required: 1. Compute the predetermined overhead rate. 2. Compute the hourly billing rate for Debbie and Tara.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter17: Activity Resource Usage Model And Tactical Decision Making

Section: Chapter Questions

Problem 6E: Elliott, Inc., has four salaried clerks to process purchase orders. Each clerk is paid a salary of...

Related questions

Question

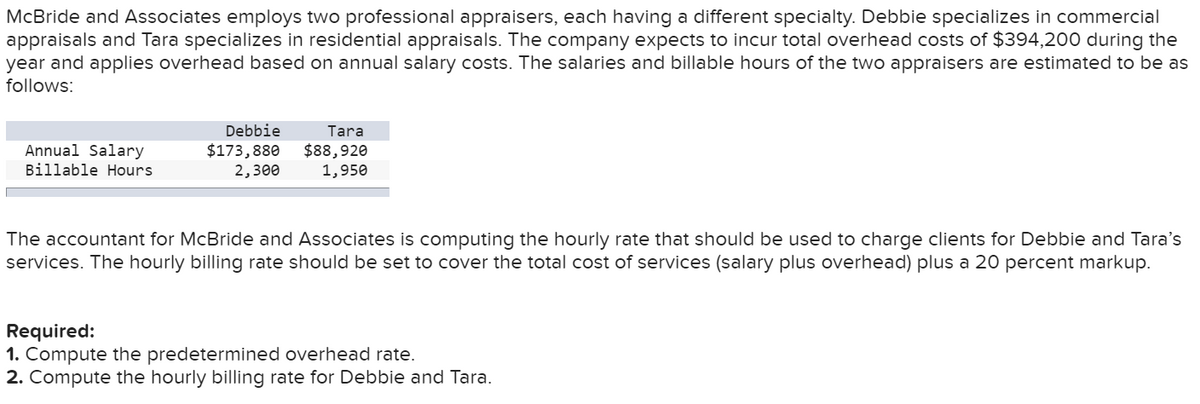

Transcribed Image Text:McBride and Associates employs two professional appraisers, each having a different specialty. Debbie specializes in commercial

appraisals and Tara specializes in residential appraisals. The company expects to incur total overhead costs of $394,200 during the

year and applies overhead based on annual salary costs. The salaries and billable hours of the two appraisers are estimated to be as

follows:

Debbie

$173,880

2,300

Tara

Annual Salary

$88,920

1,950

Billable Hours

The accountant for McBride and Associates is computing the hourly rate that should be used to charge clients for Debbie and Tara's

services. The hourly billing rate should be set to cover the total cost of services (salary plus overhead) plus a 20 percent markup.

Required:

1. Compute the predetermined overhead rate.

2. Compute the hourly billing rate for Debbie and Tara.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College